Recent profit-taking pushed the USD/JPY towards the 113.41 support level, with the pair settling near the 114.00 resistance as of this writing. The dollar's performance in the Forex market has been affected by US Federal Reserve Chairman Jerome Powell's suggestion in a panel discussion at the RBA Centennial Conference that the Fed is keen to scale back its quantitative easing program to ensure that the bank is "in a position to address the full range of reasonable outcomes" on inflation in the foreseeable future.

This was after Governor Waller said last Thursday that the Fed would need to do more than scale back its quantitative easing program in 2022 if inflation remains elevated at recent high levels in the new year, which they both acknowledged presents a risk.

“If monthly releases of inflation continue to rise through the remainder of this year, a more aggressive policy response than simply tapering in 2022 may be warranted,” Governor Christopher Waller said at the Stanford Institute for Economic Policy Research Partners meeting. "I expect inflation to be moderate, which means takeoff is still off for some time. However, as I mentioned earlier, if the upside risk to inflation, with inflation significantly above 2 percent through 2022, I would prefer to lift sooner than expected.”

The US dollar was sold heavily in October but may find better support in November if comments last week from two of the Fed's top policy makers portend the inclusion of inflation warnings in the bank's interest rate guidance next Wednesday.

Commenting on this, Richard Vranulovic, FX analyst at Westpac, said: "The ongoing re-pricing of the Fed's policy trajectory continues to push short-term yield margins in favor of the US dollar. It is possible that the dollar index declines are confined to the mid to low levels of the nineties of the last century.”

So far, the Fed has seen it hard to convince the market that a rate hike is still a long way from the possible mid-2022 end of quantitative easing, so a departure from this could lead to a revival of the dollar over the coming weeks.

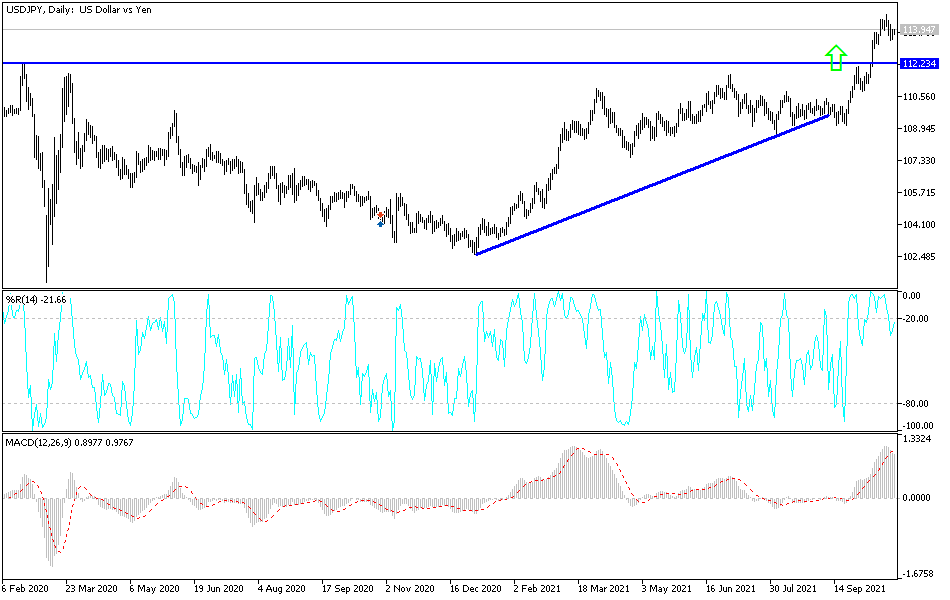

Technical analysis of the pair

Despite its recent performance, the general trend of the USD/JPY is still bullish. If the price moves to the resistance levels 114.60 and 115.20, it will be enough to push the technical indicators towards strong overbought levels that could bring in buyers, unless the dollar gets more momentum. On the downside, and according to the performance on the daily chart, the bears need to move the pair below the 112.20 support to change the bullish trend.

The USD/JPY currency pair will be affected by risk appetite as well as the reaction to the announcement of the US Consumer Confidence Index and US new home sales.