Despite mixed US retail sales figures, the USD/JPY remained stable around its gains of 114.40, nearly its highest level since October 2018. The US currency is still the strongest with expectations of imminent tightening of the policy of the US Federal Reserve, and the improvement in the country's economic performance supports those expectations. On the other hand, the Japanese yen is still facing pressure from investor sentiment towards the new Japanese government's policies.

In contrast, Japan's weak Services Index in August (-1.7% vs. -1.2% forecast) appears to be due to the easing of the official emergency. We expect better data starting in September and in the fourth quarter. This week's highlights include Japan's trade balance for September, the Consumer Price Index for September, where the key rate is likely to be above zero for the first time since August 2020, and the preliminary PMI for October. Also, a large supplementary budget is expected after the House elections on October 31.

Beijing is encouraging big banks to loosen restrictions and speed up mortgage lending. This is seen as one way to mitigate the influence of Evergrande and other property developers. Early Monday in Beijing, China will announce its third-quarter GDP. The combination of deliberate steel production cuts to meet emissions targets, bad weather, including floods, and the virus outbreak suggest weak growth. The median forecast (Bloomberg survey) expects quarterly growth of 0.4%, which would see the pace slow year-over-year to 5% from about 8% in the second quarter.

In the midst of a sharp inflation wave that covered the world and in the face of rising energy prices, the US CPI stabilized. It's still certainly high, but the year-over-year pace of increase held steady at 5.3%-5.4% for the four months through September, and the core rate, which peaked in June at 4.5%, is now stabilizing at 4%. The last annual rate of the CPI in the third quarter was less than 5%. The annual pace in the third quarter was about 10%.

Japan, the UK and Canada will release their September CPI figures this week. Japan was still deflationary in August. In fact, the key gauge has been below zero since last October. The base rate, which excludes only fresh food, rose to zero in August. It has been negative since August 2020.

However, height was a function of the energy effect. When food and energy were removed from the basket, consumer prices were 0.5% lower than they were a year ago. The continued rise in oil and gas prices and rising food prices, along with a weak yen, may help Japan overcome deflation. It makes Japanese government bonds look somewhat less attractive.

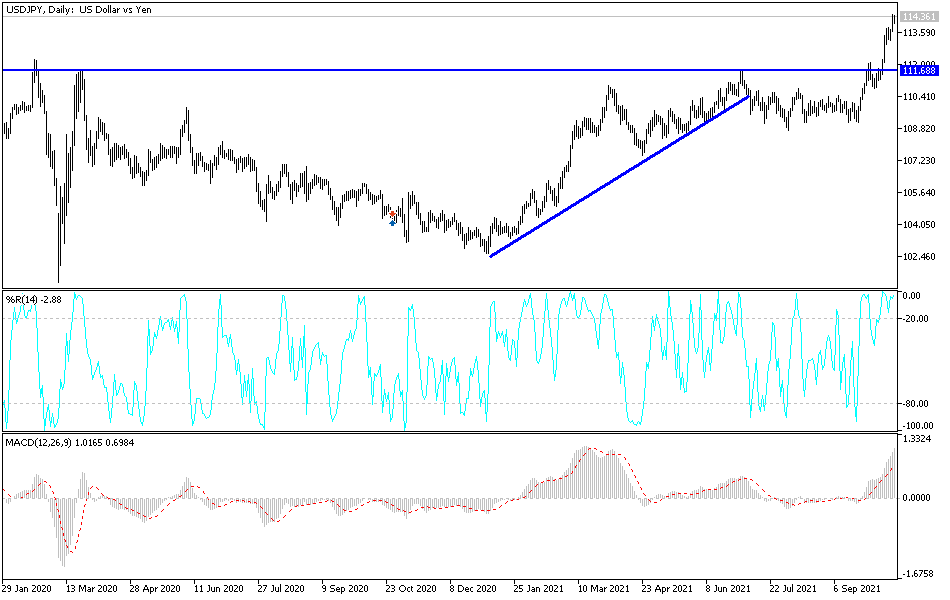

Technical analysis of the pair

In the near term, according to the performance on the hourly chart, it appears that the USD/JPY is trading within the formation of an ascending channel. The pair recently retreated after finding trend line resistance around 114.47. Therefore, the bears will target the profits of the extended pullback at around 113.97 or lower at 113.69. On the other hand, the bulls will look to ride the current bullish wave by targeting profits at around 114.47 or higher at 114.76.

In the long term, according to the performance on the daily chart, it appears that the USD/JPY is trading within the formation of a sharp ascending channel. The pair has now pushed towards the overbought levels of the 14-day RSI. This indicates a strong long-term bullish momentum in market sentiment. Therefore, the bulls will look to extend the current uptrend towards the 115.33 resistance or higher to the 116.50 resistance. On the other hand, the bears will target long-term profits at around the 113.204 support or lower at the 112.037 support.