Expectations of raising US interest rates have always been a strong profit factor for the US dollar in the Forex market. In terms of the performance of the USD/JPY, it was the reason for a strong upward push towards the resistance level of 112.08, its highest since February 2020. Immediately after the move with those gains, there may be profit-taking at any time, especially as the markets are awaiting the announcement of the US jobs numbers by the end of this week, which will have a strong reaction to the markets' expectations regarding the Fed's policy. Selloffs moved the currency pair towards the 110.83 level, where it has settled at the beginning of today's trading.

"Technically speaking, the dollar appears to be on the cusp of a major breakout, and a strong US jobs report could reinforce that trend," says Chris Turner, market analyst at ING.

Friday's US non-farm payrolls are more import than usual because the September economic outlook and policy notes from Fed officials made it clear that the "strong" number of jobs would be enough to announce plans to begin ending the 120 billion quantitative easing (QE) program dollars per month at the next November 3 meeting. “We estimate that total salaries rose by 400,000 (350,000 private) in September,” says Kevin Cummins, chief US economist at Natwest Markets.

US Federal Reserve Chairman Jerome Powell himself said at the press conference in September, "It won't take a knockout, a great, very strong employment report. It would take a reasonably good employment report to be ready to join the 'many' of the FOMC who already see fit to begin to wean the economy and financial markets off Fed support and interest rate suppression." .

“The outcome of the September FOMC meeting was hawkish,” said Athanasios Vamvakidis, FX analyst at BofA Global Research. Barring unexpected physical labor market weakness, our basic view is that the Fed will announce and implement tape taps in November.”

Next Friday's data is even more important because if the Fed starts ending its quantitative easing program in November, the process will likely be completed with a one-time hike by the middle of next year, and the evidence for this is that the US central bank may then feel less frustration about raising the interest rate from near zero. However, job growth in the US was strong, with more than two million jobs created or recovered from the coronavirus in the three months to the end of August. This could mean that a weak or outright weak number is slightly more likely in September than it would be in any other month.

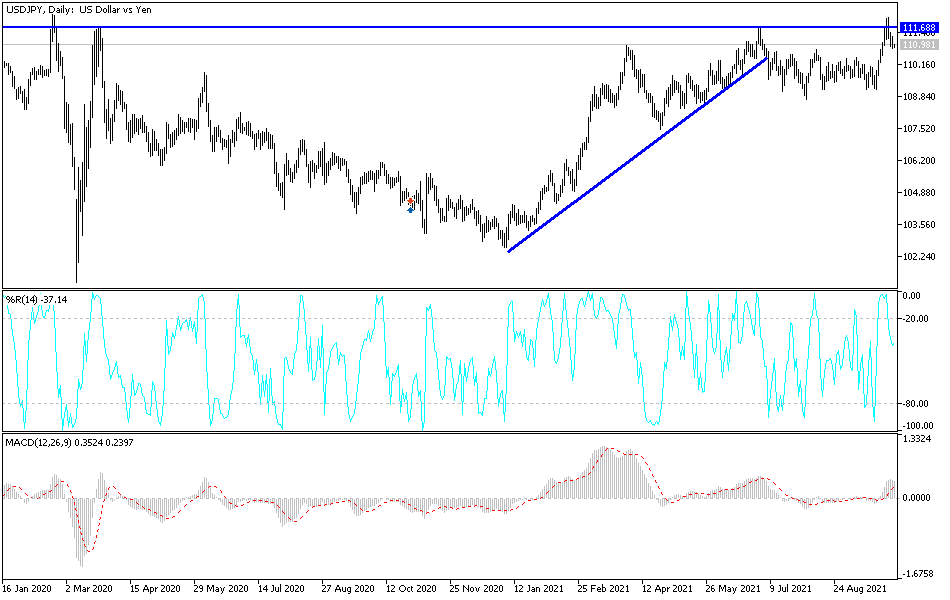

Technical analysis of the pair

The recent selloffs did not break the USD/JPY out of its ascending channel. As long as it is stable above the 110.00 psychological resistance, that motivates the bulls to dominate the performance and increases buying. The currency pair may maintain the bullish trend until the US jobs numbers are announced, which may increase the dollar's gains or expose it to more selling. The trading range for the USD/JPY pair in the coming days may be between 110.30 and 112.00. This top is psychologically important for the bulls to make sharp bullish breakouts in the coming days.

The USD/JPY's exit from its current ascending channel requires moving below the 109.65 support level.

The currency pair will be affected today by risk appetite and the announcement of the ISM Services PMI reading.