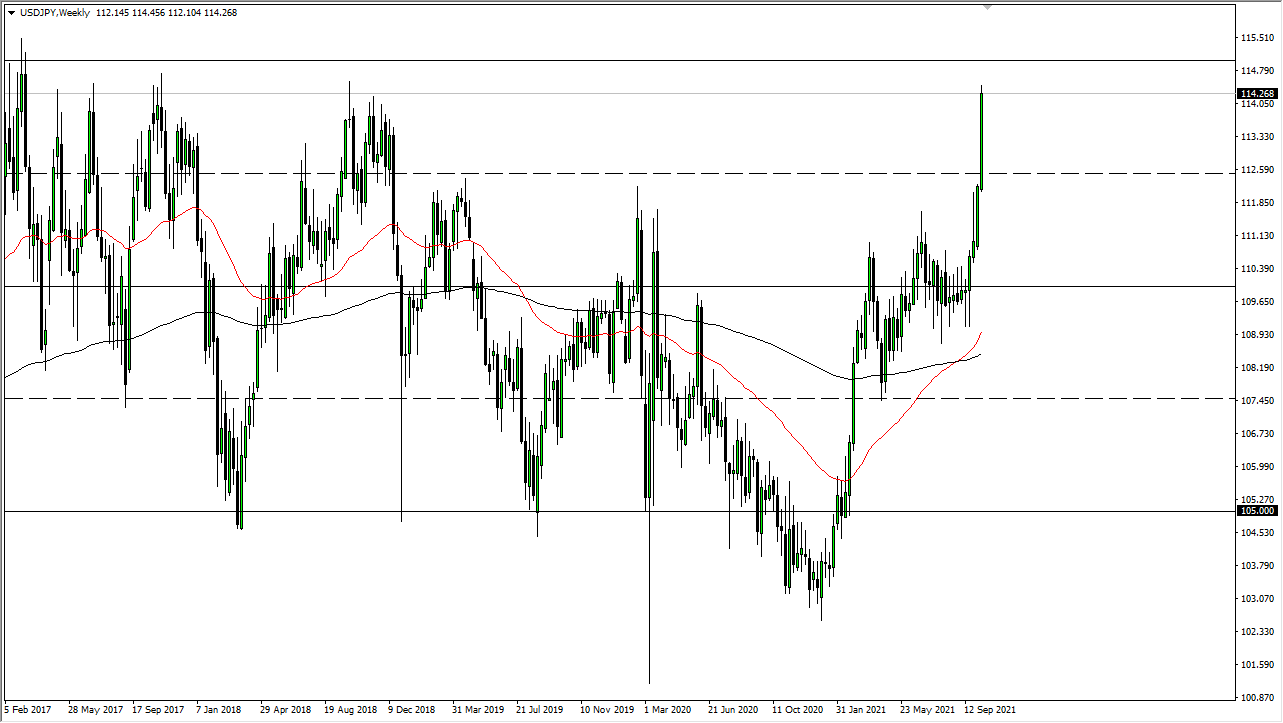

USD/JPY

The US dollar shot straight up in the air last week to break above the ¥114 level. This is a very bullish sign, but there is a lot of noise just above which continues to cause a bit of hesitation. If we were to break above the ¥115 level, then it would allow this market to become more or less a “buy-and-hold” market. However, I think we are much more likely to see a little bit of a pullback in order to find a bit of value. The ¥112.50 level should be an area where a lot of buyers will return. That being said, if we do break above the ¥115 level, then it is very likely that we could see an even bigger rush into this market. As things stand right now, I am looking at the Japanese yen's relative strength or weakness as in indicator to trade in other markets.

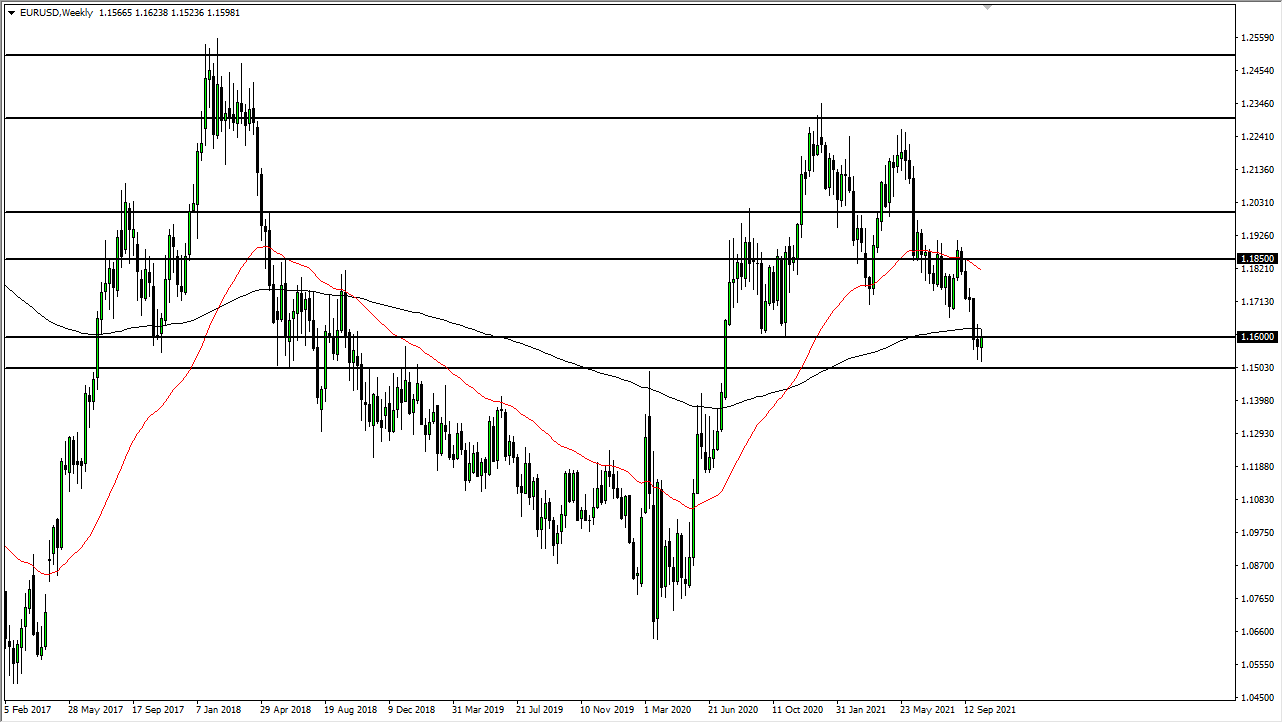

EUR/USD

The euro fluctuated last week just as it did the previous week, showing that the 1.16 level has been difficult. If we can break above the 1.16 level, then it is likely that we will test the 200-week EMA yet again. If we can break above the 1.1650 level, then the market is likely to go looking towards the 1.1750 level. On the other hand, if we turn around and break down below the 1.15 level, this is a market that could break down quite significantly. This coming week I anticipate that we will probably see a lot of choppy behavior, but we may finally get some type of impulsive candle that we can trade off.

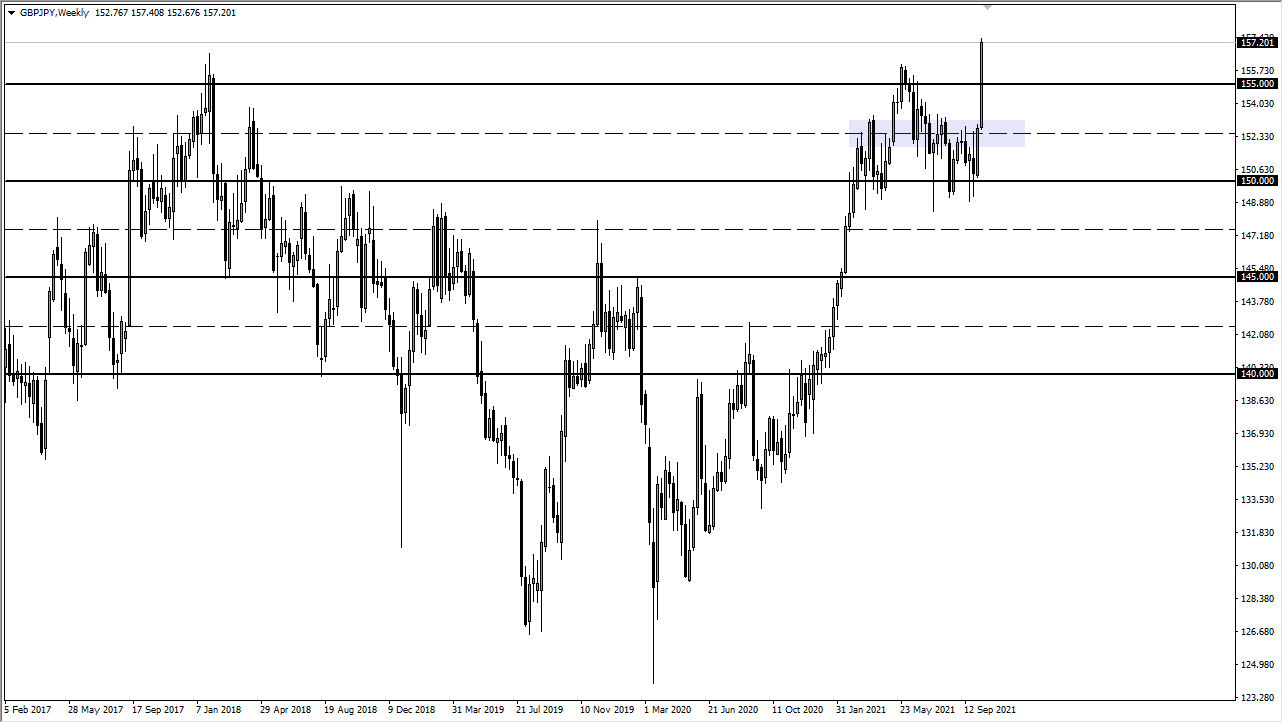

GBP/JPY

The British pound rallied rather significantly last week to finally break out above the most recent high. We are closing towards the top of the candlestick and have even taken out the ¥157 level. I anticipate that this market probably will pull back, but I would also anticipate a lot of support near the ¥155 level, so I will be looking for that move. If we continue to go higher, then it is very likely that we would go looking towards the ¥160 level given enough time. Either way, this is a market that has obviously stated its intention, and therefore you cannot be short this pair.

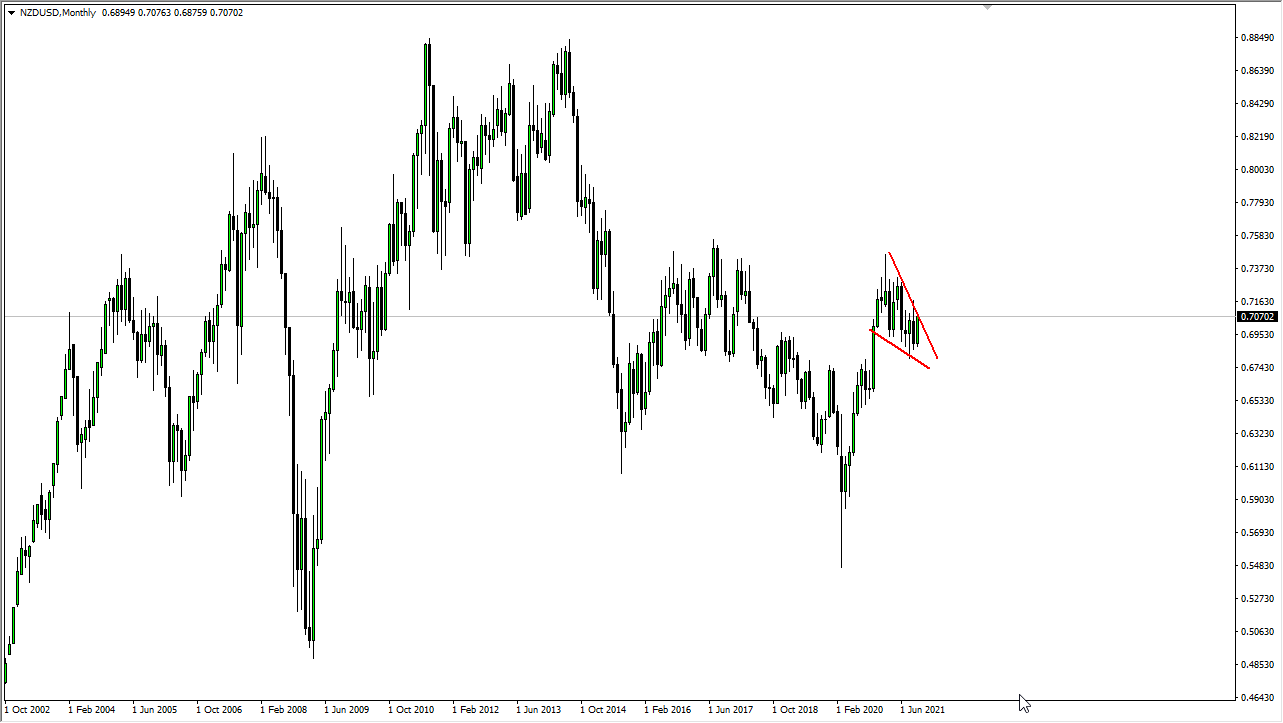

NZD/USD

The New Zealand dollar rallied significantly last week to break above the 0.70 level. The market is forming some type of bullish pennant, or perhaps even a falling wedge. Either way, the market is suggesting that it could break out to the upside. If we can break above the previous week high, then I think that the New Zealand dollar has a high likelihood of looking towards the 0.74 handle. To the downside, the 0.69 level continues offer support.