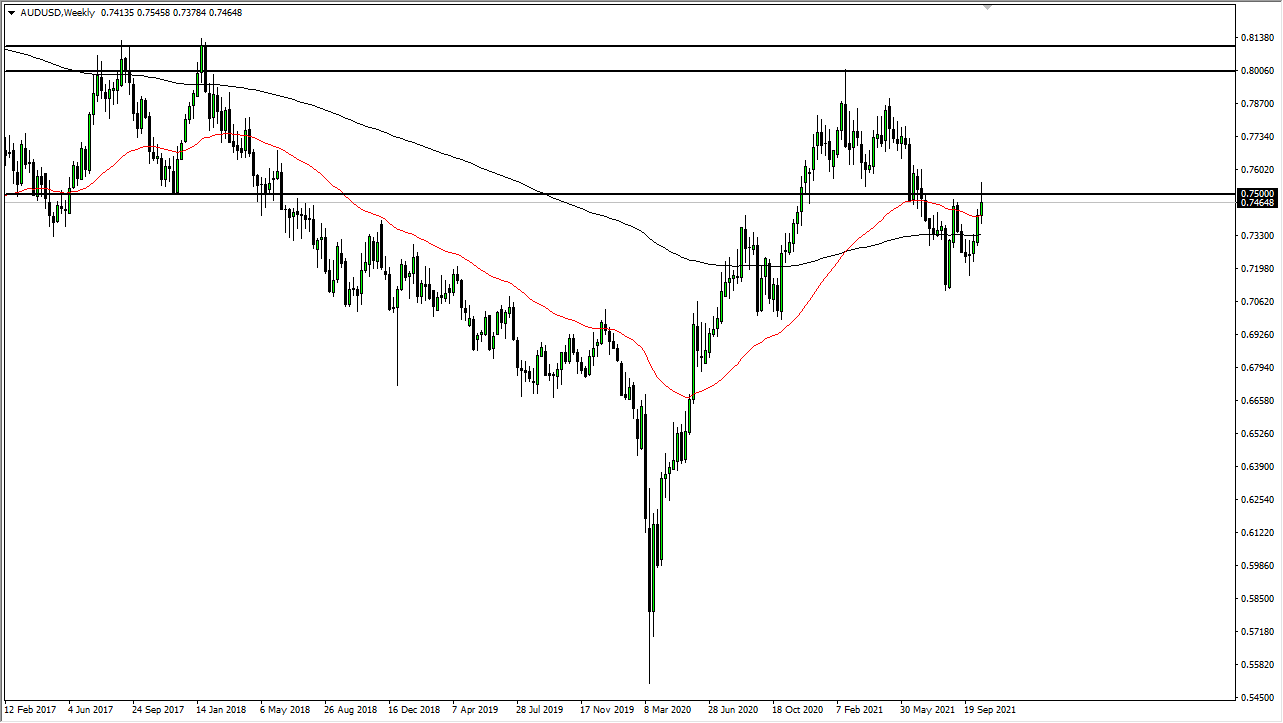

AUD/USD

The Australian dollar rallied for a better part of the week, piercing the 0.75 handle. However, the market pulled back from that area, and I think it is only a matter of time before we have to make some type of bigger decision. If we can break above the 0.76 level, then the Australian dollar is ready to go higher. However, it does look like it is primed for a little bit of a pullback in the short term. The 0.7375 handle underneath is the bottom of the weekly range, and if we break down below there, then the market is very likely to go looking towards the 0.73 level. Keep in mind that the Aussie dollar is highly correlated to risk appetite, so you will have to pay attention to it in general to get a feel as to where this market will go.

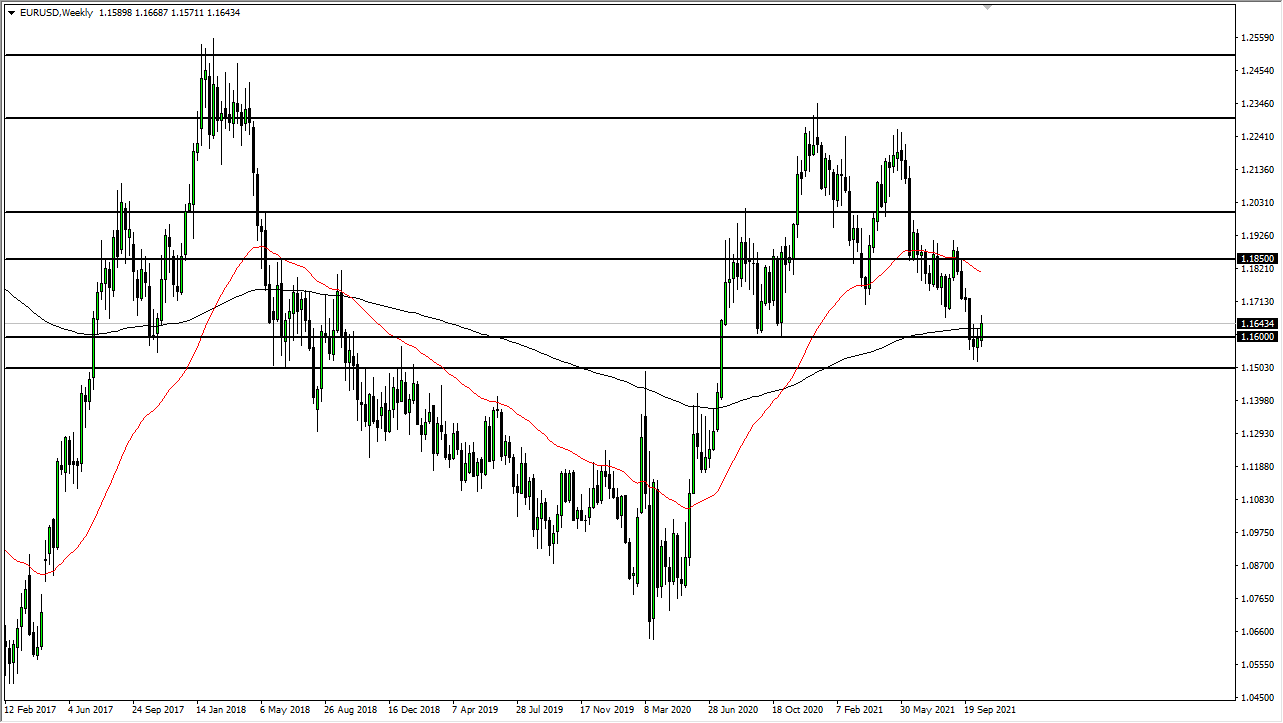

EUR/USD

The euro has broken to the upside, clearing the 1.1650 level. It has broken above the top of the previous two candlesticks, showing signs of a breakout, but at this point in time it looks like we are going to continue to see a bit of support just underneath at the 1.16 level. Look for choppy and perhaps slightly upward momentum for the week, but if we were to break down below the 1.15 level underneath, then I think it opens up the “trapdoor” for selling pressure.

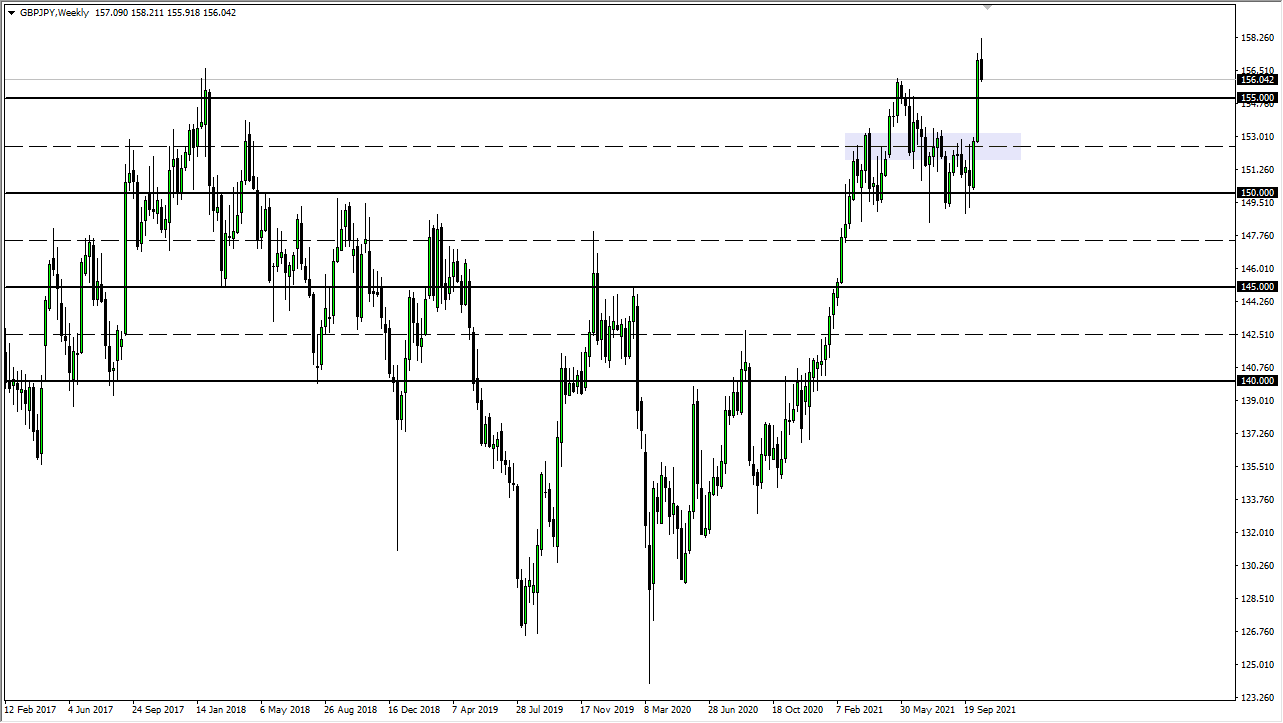

GBP/JPY

The British pound has given up early gains for the week to turn around and break down towards the ¥156 level. If we break down below there, then the ¥155 level should be supportive. We have clearly broken out to the upside and at this point I think as long as risk appetite does not get torn apart during the course of this week, then I think it is only a matter of time before the buyers will come back in and push this pair higher. If you want to get a feel as to where this market is going, maybe you need to pay attention to the USD/JPY pair, as it could give you a read as to what is going to happen with the yen.

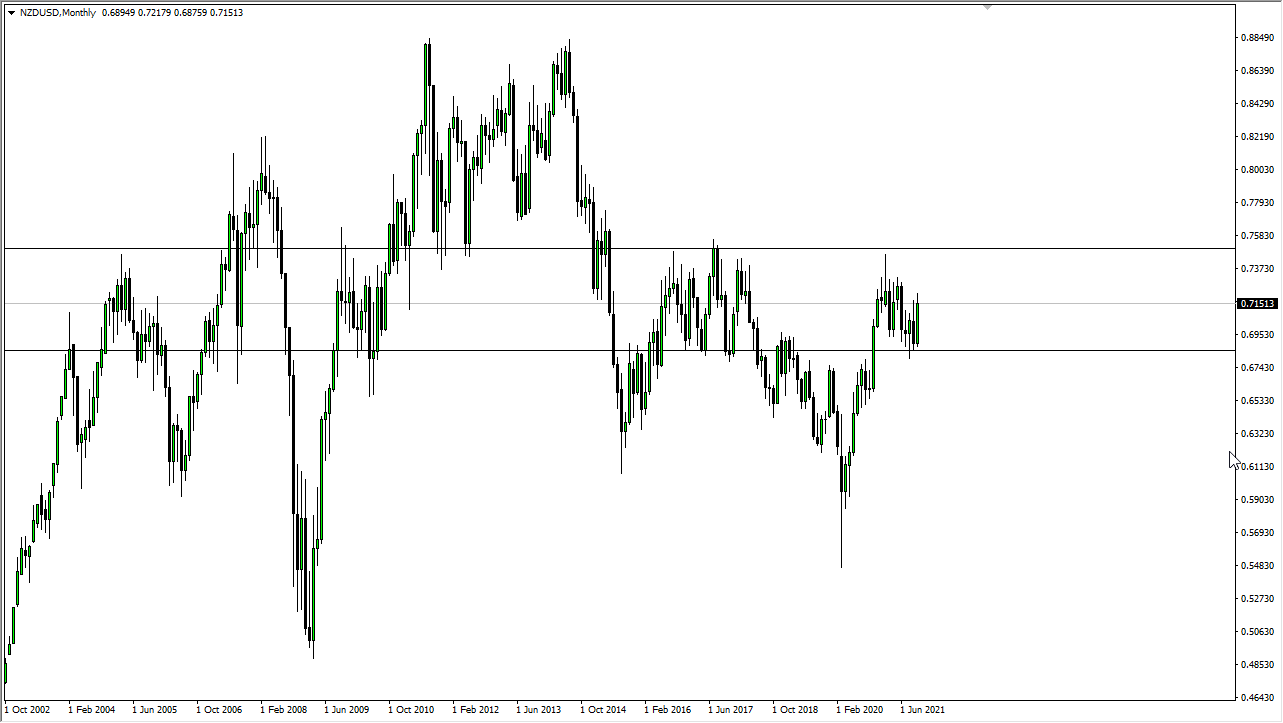

NZD/USD

The New Zealand dollar rallied significantly last week, and it now looks as if it is ready to go looking towards higher levels. Furthermore, you can make a strong argument for a bullish flag. With this, I think it is only a matter of time before short-term dips continue to offer buying opportunities. The 0.69 level underneath should offer plenty of support, just as the 0.75 level above should continue to offer resistance.