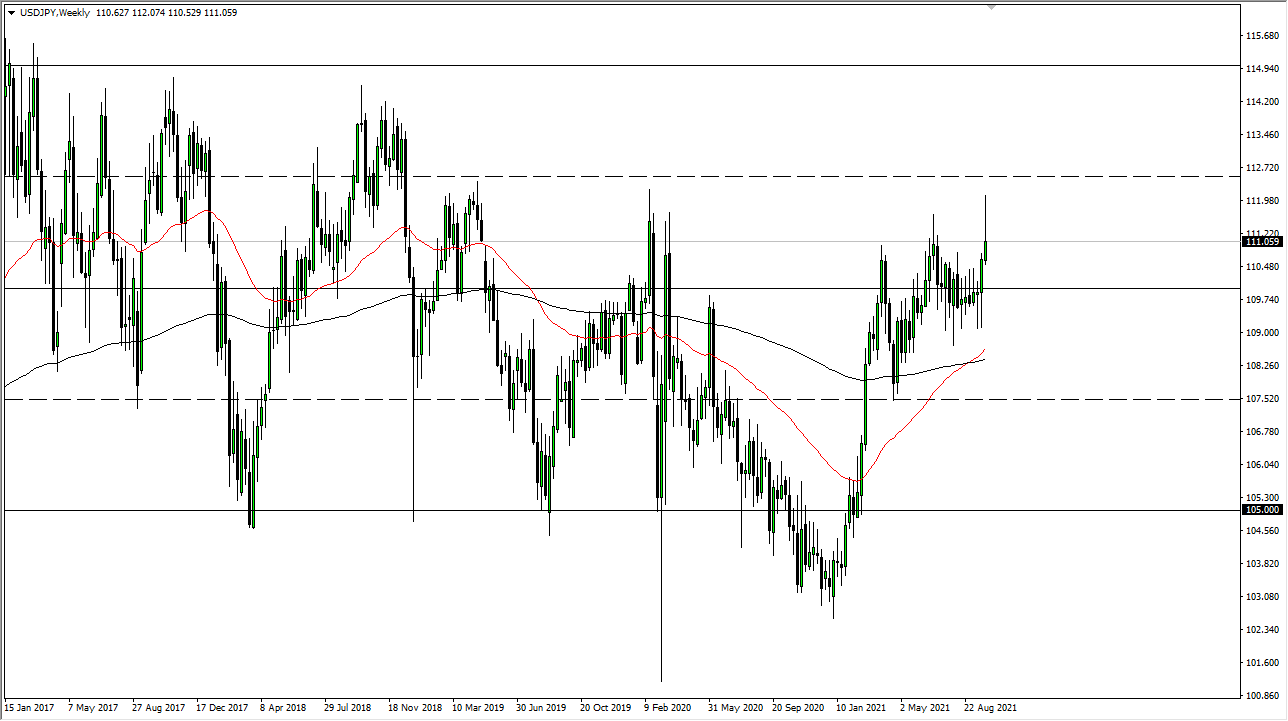

USD/JPY

The US dollar has been on an absolute tear against the Japanese yen over the last couple of weeks, and as a result of exhaustion was likely to come back into the picture eventually. That is exactly what we have seen, but there is still plenty of buying interest underneath that will support this market. I think that the ¥111 level is a natural place for this market to close from the previous week, and I think that the “bottom” is closer to the ¥110 level. I like the idea of buying dips going forward.

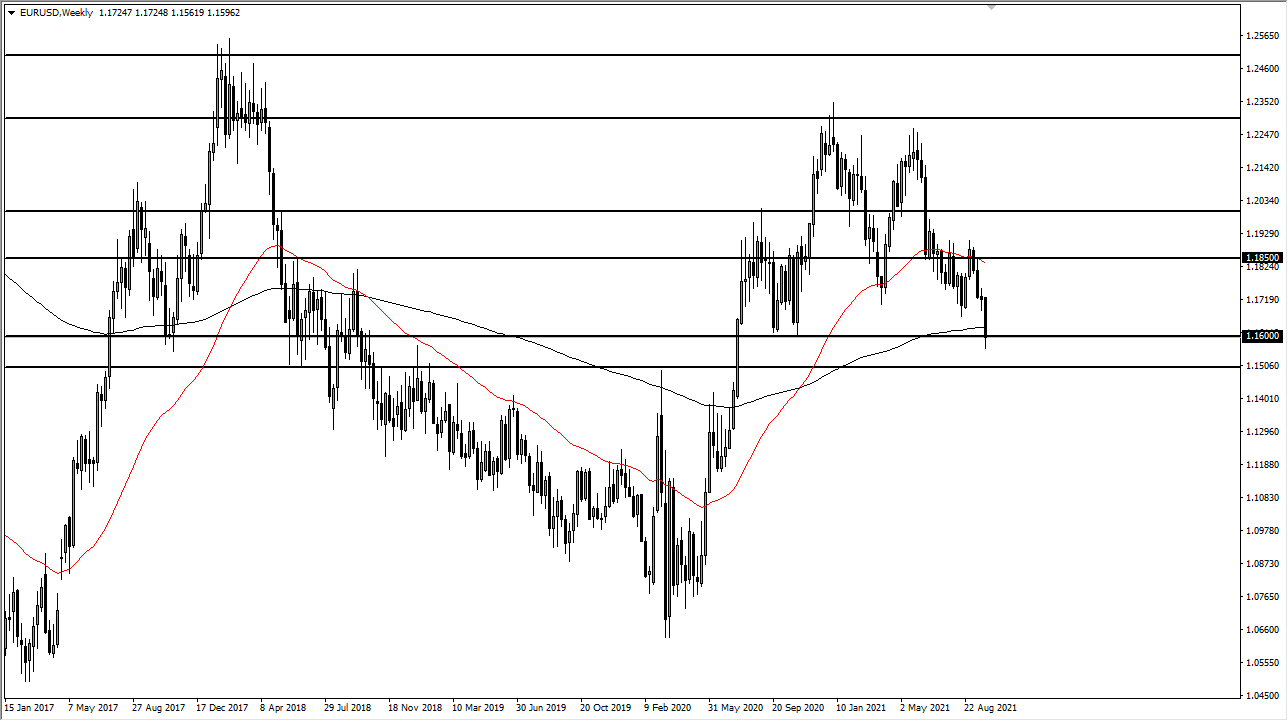

EUR/USD

The euro fell hard last week, as the bond yield differential between the United States and Germany finally got too wide. That being said, we are desperately trying to hang on to the 1.16 level, but with this type of impulsive candlestick it does make sense that we will continue going lower. I anticipate that fading rallies will continue to be the way the market moves more often than not, with perhaps the 1.17 level above being a bit of the ceiling in the short term. If we can break down below the 1.15 level, the bottom will more than likely fall out.

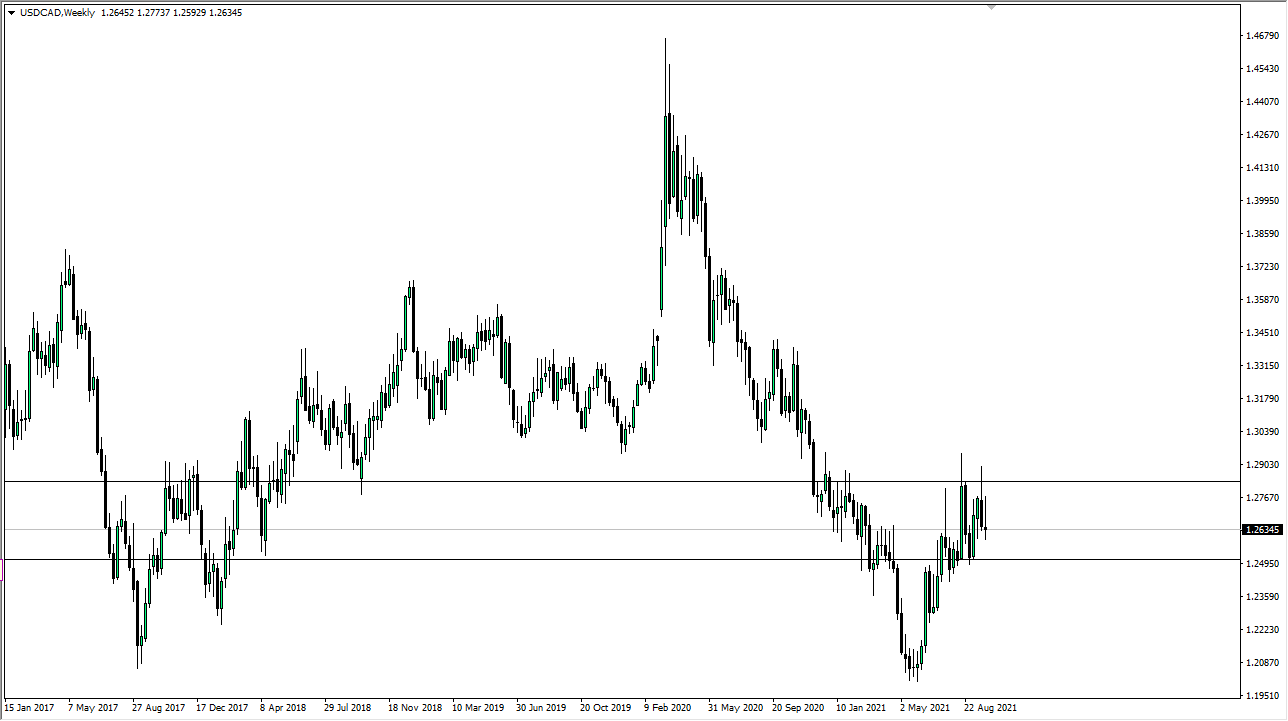

USD/CAD

The US dollar continues to bounce around between the 1.25 level and the 1.28 level against the Canadian dollar. The past week has told us that more likely than not we could see a little bit of a pullback, in what would be an anti-US dollar move. While we are seeing US dollar strength against other currencies, oil has been rising rather rapidly, and perhaps that might be one of the main drivers of where we go next. Nonetheless, I would look for value hunters near the 1.25 level even if we do break down significantly. Over the course of this next week, I fully anticipate that we will still be stuck in the same range.

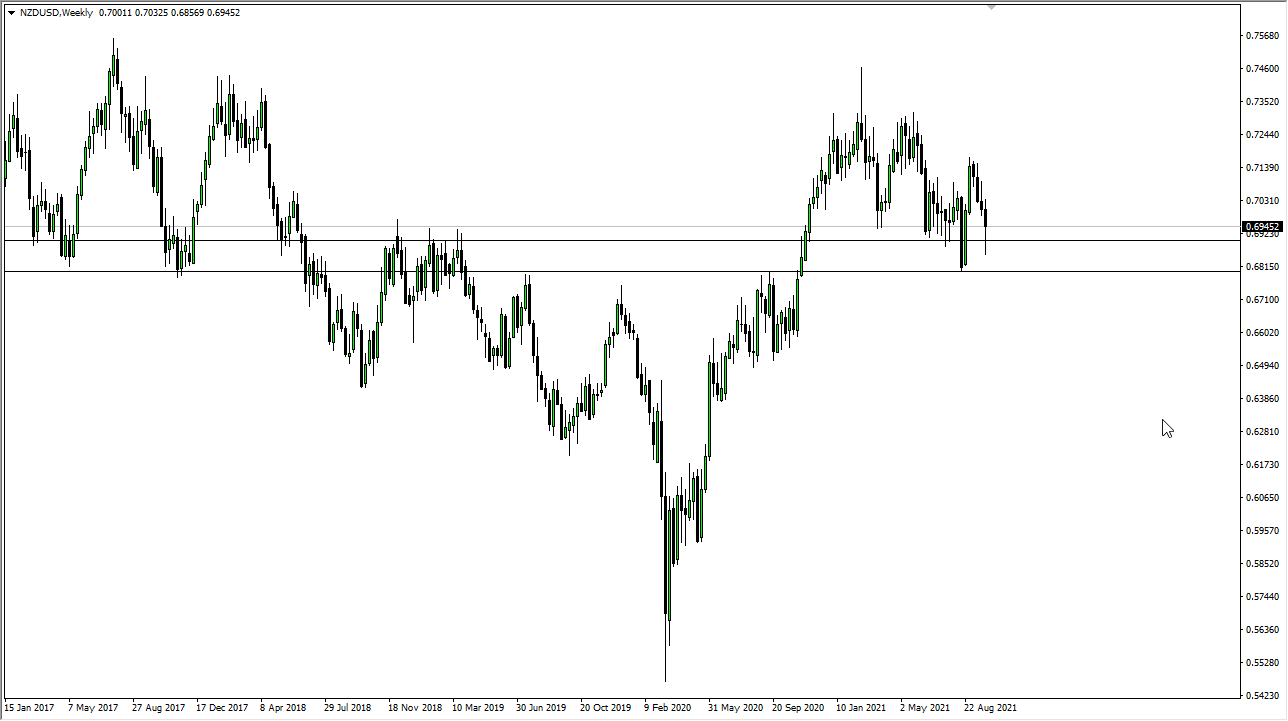

NZD/USD

The New Zealand dollar fell most of last week against the US dollar, but as you can see, we have recovered quite nicely. The question now is whether or not the support will hold. If we were to turn around and break down below the 0.68 level, it is likely that this market will fall apart quite drastically. However, if we end up turning around and breaking above the 0.70 level, that could be a bit of a turnaround. It will be interesting to see how this plays out, because this market is almost like a microcosm of what we see everywhere else: lots of choppy behavior without any real clarity.