The West Texas Intermediate Crude Oil market has pulled back a bit during the trading session on Tuesday, only to find buyers underneath and push to the upside. With that being the case, the market is very likely to continue seeing massive amounts of value underneath, as the supply issue continues to be a major problem.

With the world’s economies are reopening, it does make a certain amount of sense that there would be increased demand for crude oil, as it is the very lifeblood of an economy. Furthermore, the market will have to look at the fact that there is a significant amount of shortfall when it comes to the overall attitude, due to the fact that there had been almost no drilling for an entire year. Now that the pandemic is over and the lockdowns are stopping, it does make a certain amount of sense that crude oil would become much more expensive. Furthermore, there has been a severe lack of capital expenditure in this sector over the last couple of years, and that of course means that drilling has not kept up with the necessary stockpiles.

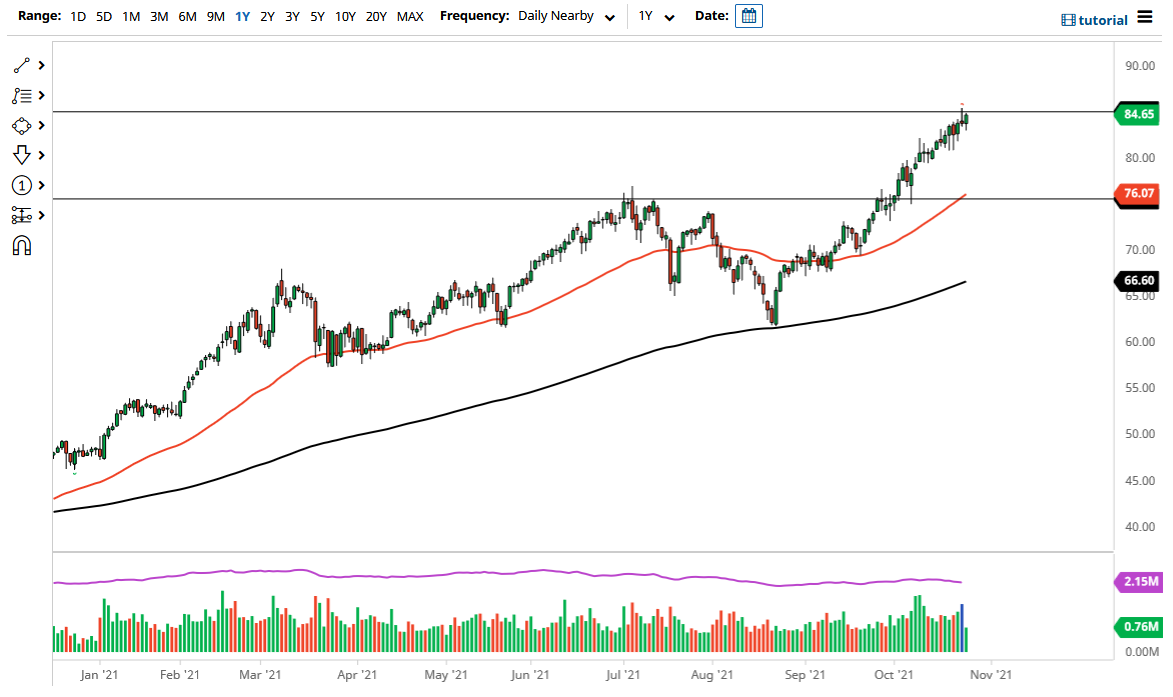

As we continue to go through the post pandemic world, the market is likely to continue seeing a bit of a currency headwind, as the US dollar has sold off as well. The crude oil market is sensitive to the US dollar due to the fact that it is priced in that very same currency. If the US dollar falls, it can be reason enough sometimes to send this market higher. Nonetheless, we are in an uptrend, and it is almost impossible to fight this type of move. The 50 day EMA currently sits at the $75 level, and that I believe is the “floor the market.” That is this uptrend going. I also recognize that there is support near the $82.50 level, the $80 level, and the $77.50 area. Because of this, I think this remains a “buy on the dips” type of market, but if we were to break above the top of the shooting star from the Monday session, which would indicate that the momentum has picked up even further and should continue to explode to the upside. At this point, I do believe that we break out higher, but I do not know if it is right away or if we need to pull back just a bit.