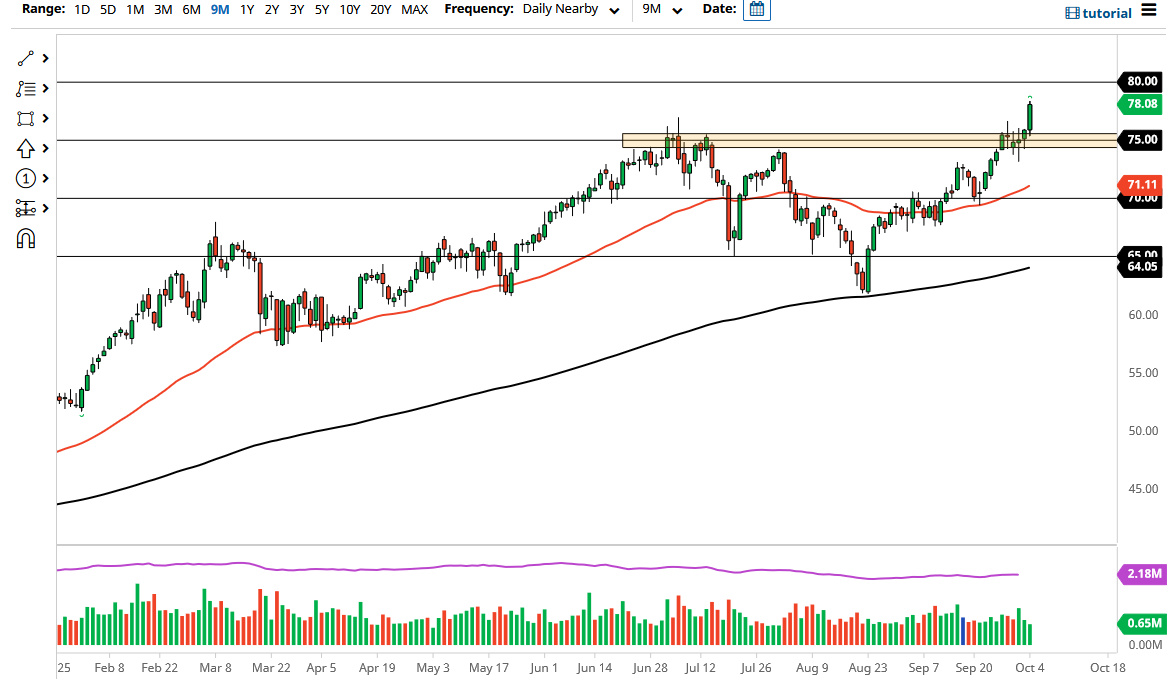

The West Texas Intermediate Crude Oil market rallied significantly on Monday to break above significant resistance. In fact, the market even reached towards the $70 level before pulling back ever so slightly. At this point, the market is likely to continue to see buyers on dips because it has been bullish and the supply remains relatively tight.

The strengthening US dollar over the last couple of months has had almost no effect on the crude oil market, so it certainly suggests that there is a real fundamental reason for this market to continue going higher. In fact, I believe that the $75 level will now offer significant support, and a potential short-term “floor in the market. There is a nice-looking hammer sitting right there as well, which led to the move higher that was formed on Thursday. The market almost certainly will continue to look at any pullback as a potential value play.

In fact, I have no interest in shorting this market anytime soon, because every time traders have thought that the oil trade was over, they got hammered. The markets will continue to see the recent action as a continuation of the bigger picture, as the world reopens. However, there are bigger underlying issues that need to be tackled. It is not simply the reopening trade that is driving oil higher - it is the fact that capacity just is not as strong as it was previously, and there has been a severe lack of investment. That being said, the United States looks like it is ready to start fracking soon, which could bring more supply into the market, but we have a significant lag between now and then. I think it is more likely that we will see buyers push this market towards the $80 level in the short term than break down. If we were to break down below that candlestick from Thursday, then it is possible that we would go looking towards the 50-day EMA in order to find value again. Either way, I have no interest in shorting this market because that has been a great way to lose money as of late. Continue to look for value and take advantage of it when it occurs. The candlestick during the Monday session certainly shows momentum building.