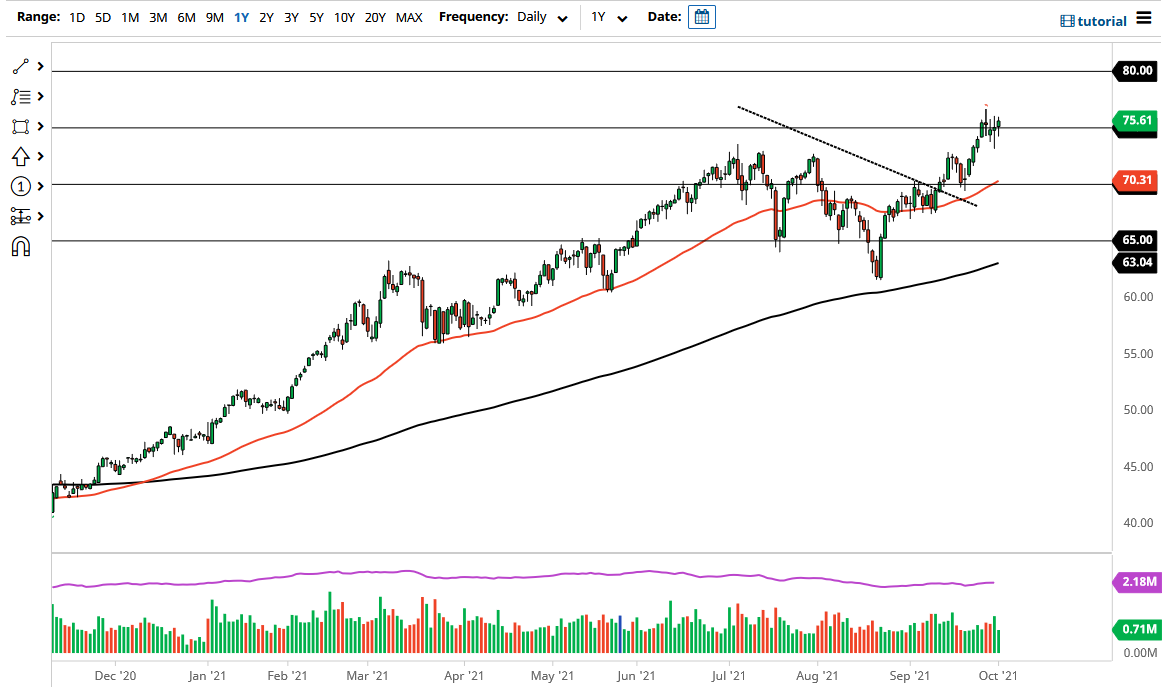

The West Texas Intermediate Crude Oil market initially pulled back on Friday but found support just below the $75 level to turn things back around. Ultimately, this is a market that I think will continue to go much higher, as we have formed a bullish flag at this point. If we can break above the recent highs, it opens up the possibility of a move towards the $80 level. That is a large, round, psychologically significant figure, and it is likely that we would see that area serve as a nice target.

As there seems to be a tight crude oil supply going into next year, it is very likely that we will see buyers on dips take advantage of value when it presents itself. At this point, the market is very likely to see plenty of upward momentum over the longer term, but it looks like we are simply digesting gains in the short term, so that we can continue to go higher. If we do pull back from here, the 50-day EMA comes into the picture as support, sitting just above the $70 level. In that scenario, I think there would be plenty of buyers to offer a bit of a “floor in the market.”

If we were to break down below that level, then it is likely that we could see a little bit more negativity, perhaps reaching down towards the $65 level. That seems to be very unlikely to happen though, especially as we have turned around over the last 72 hours to show signs of strength again. This is a market that continues to focus on the reopening trade and the fact that we had closed down most of the production of crude oil for an entire year.

If that is going to be the case, then it is likely that the market has a long way to go before we run out of momentum, but that does not necessarily mean that we will go straight up in the air. Because of this, it will probably take a certain amount of patience, but this is a one-way trade at the moment, and you have to forget about shorting this market anytime soon.