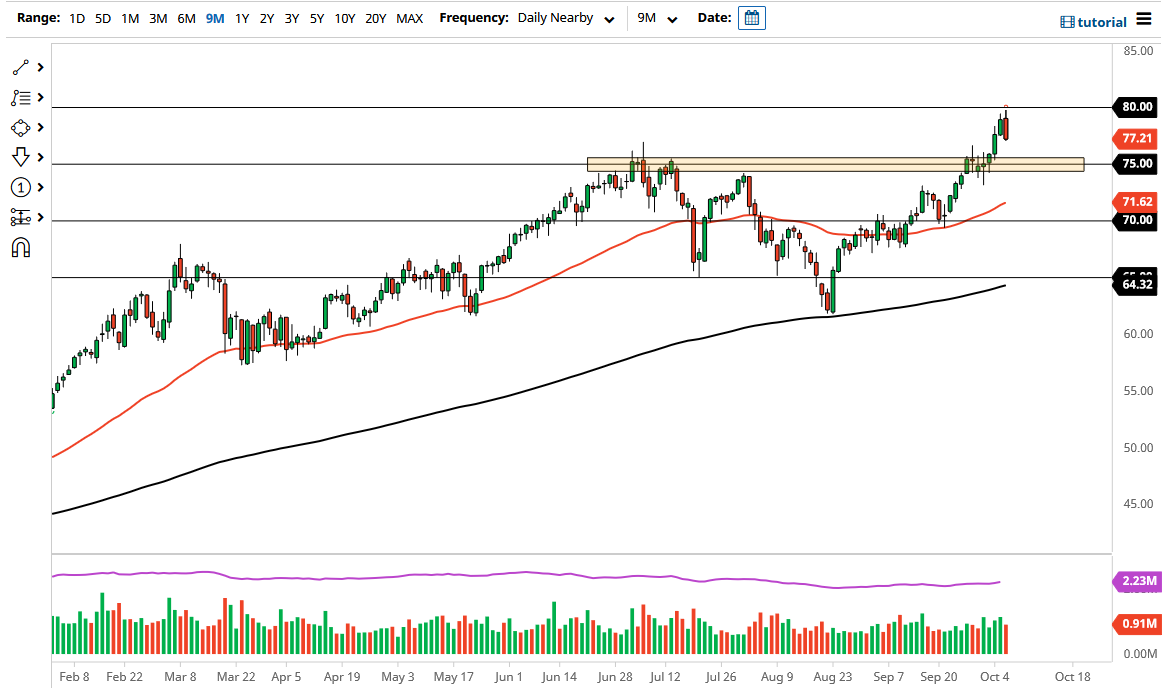

The West Texas Intermediate Crude Oil market initially tried to rally on Wednesday but gave back gains near the $80 level. The $80 level is a large, round, psychologically significant figure, and would attract a lot of attention. The fact that we have pulled back the way we have suggests that we are going to drop further. If we pull back towards the $75 level, then I think there is a lot of support just waiting to happen. After all, that is an area that had been significant resistance previously, and we hear a lot of noise in that general vicinity.

In fact, it is not until we break down below the lows from last week that I would be concerned about the uptrend, and even if we did break down below there, I think the 50-day EMA comes into the picture as support next. Quite frankly, unless the entire narrative changes, it is difficult to imagine that the market would simply fall apart. I think we are more likely than not going to see a pullback that attracts plenty of value hunters, as we have been in such a strong move to the upside. I think buying the dips will continue to be the way that most people play this market.

Having said that, keep in mind that Friday features the jobs number and that will throw around the US dollar. Furthermore, it will also have a significant amount of influence on the idea of how much demand there will be for crude oil. Right now, there seems to be a significant amount of demand for oil that simply is not there, as we have seen in places like the United Kingdom and the European Union. Granted, the WTI grade is US-based, but it does have a knock-on effect over here. Nonetheless, it is not anytime soon that I can imagine shorting this market, because at the very least we need to see the 50-day EMA broken. We are light years away from having that happen anytime soon. If we turn around and break above the $80 level, then it is likely that we could go looking towards the $85 level. I think it is going to be volatile but I am still looking for value.