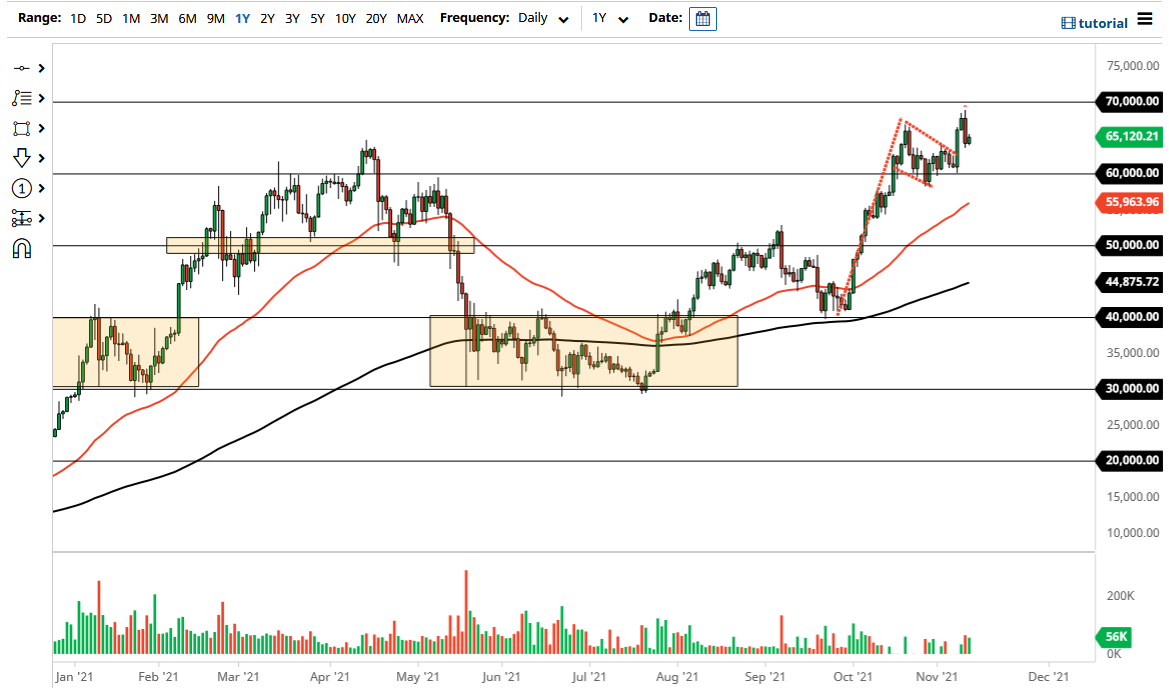

The Bitcoin market has rallied just a bit during the course of the trading session on Thursday to show signs of stability, right around the $65,000 level. This is an area that of course is somewhat important, but when you look at the Ethereum market, it is very likely that the most important attention is paid to the $10,000 level increments. The $5000 level in between each of them is somewhat important, but it is essentially minor support and resistance. It is because of this that I think the trend continues to go higher. After all, this is a simple pullback in what has been a very strong move to higher levels.

At this point, if we can break above the top of the candlestick for the trading session on Thursday, then I believe that we go looking towards the $70,000 level yet again. That is a large, round, psychologically significant figure that will attract a certain amount of attention, but as we have been in a bullish flag previously, we have to take the “measured move” going forward based upon that technical analysis. That suggests that we are going to see Bitcoin go looking towards $85,000 level. I do not think that is a real stretch of the imagination, as we continue to see so much bullish pressure in this market over the last year or so. Bitcoin continues to go much higher over the longer term, so I do not have any interest in trying to short this market.

The $60,000 level would make quite a bit of sense, but the 50 day EMA at the $55,000 level makes even more sense for a buying opportunity. Nonetheless, I think it is probably only a matter of time before we break out and go much higher. The ETF that has recently been started to hold physical Bitcoin will continue to be a driver of more money into this market, so at this point in time I think we will have plenty of reasons to anticipate higher pricing. This is especially true as inflation continues to be a concern, where people are trying to buy “things” in order to protect their wealth. Suddenly, Bitcoin is starting to be looked at favorably by the general public as well. If we ever see mass adoption of Bitcoin, that could drive things much higher.