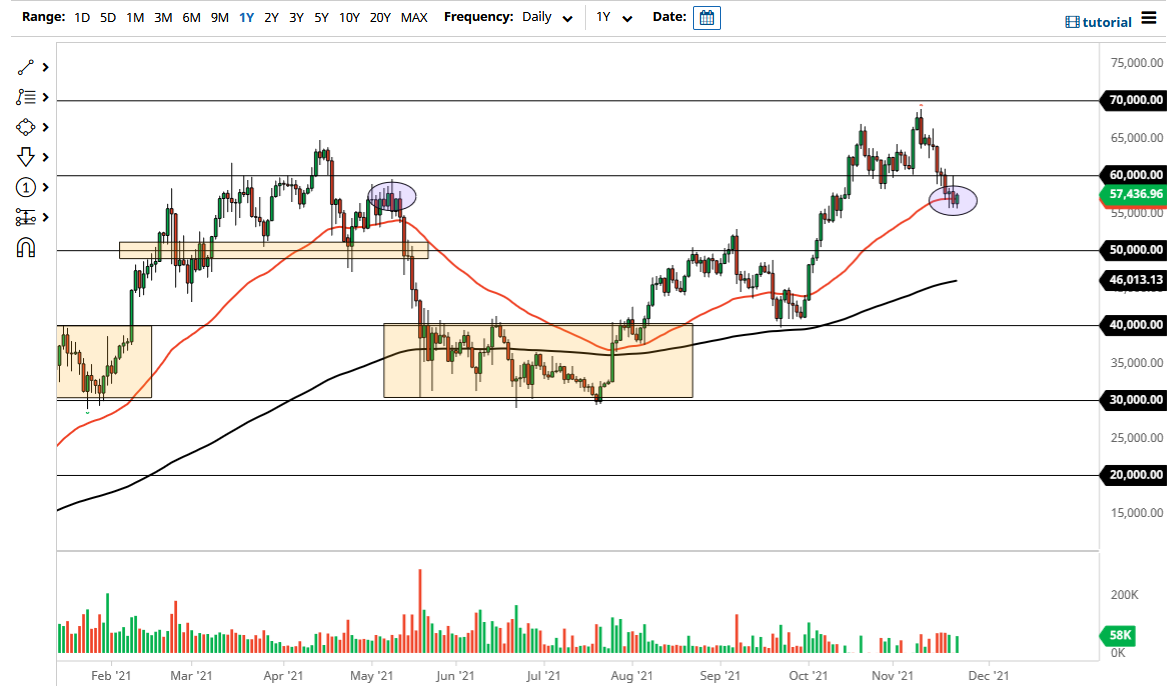

Bitcoin markets rallied just a bit on Tuesday to show a continuation of the overall consolidation that we have been in over the last couple of days. The $55,000 level underneath continues to offer a certain amount of support, so it does make sense that we continue to kill a bit of time in an area that would attract attention in general. The overall attitude of this market is still very bullish, but we have recently formed a bit of a “double top”, which of course would attract a certain amount of attention and itself.

The $70,000 level has offered resistance, so I think it makes sense that we will go looking towards that area as a potential longer-term target. The $60,000 level between here and there would be something that people will pay attention to, not only because it is a large, round, psychologically significant figure, but it is also an area that we tried to break above on Monday but failed. Underneath, we have a significant amount of support near the $55,000 level, as we have bounced from just above there for the last three days in a row.

If we were to break down below the $55,000 level, then it is likely that we could go looking towards the $50,000 level underneath. That was an area that that has previously been supportive, and it is a large, round, psychologically significant figure so I think a lot of attention would be paid to that region. The 200-day EMA is reaching towards the upside, and I think it is only a matter of time before it gets to that $50,000 level. In general, I suspect that once we get any pullback towards the $50,000 level, there will be a lot of money flowing back into crypto overall.

I would anticipate a lot of noisy behavior in the short term, so I would not jump into this market with both feet, as it more than likely will continue to be very noisy, so you simply put a little bit of a position on and add to your position as it continues to work out in your favor. This way, you can avoid sudden losses in a market that tends to move quite suddenly.