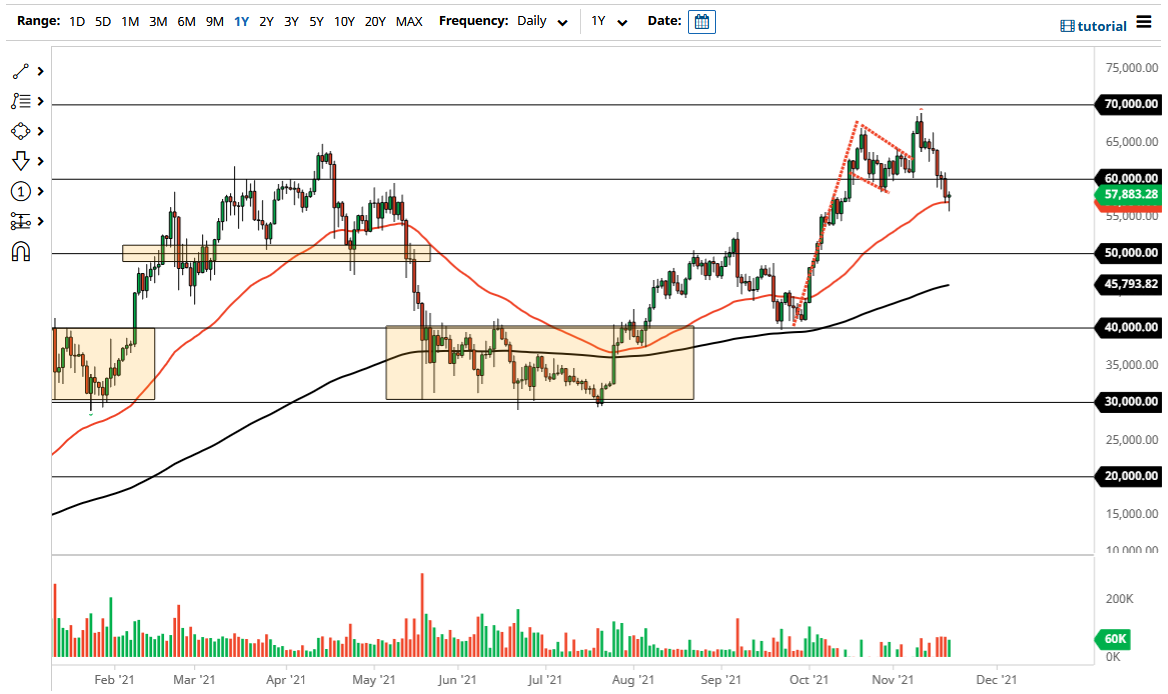

Bitcoin initially fell on Friday, piercing the 50-day EMA. The 50-day EMA is an indicator that a lot of crypto traders pay close attention to, so it is certainly worth mentioning that it has offered support. Furthermore, the market seem to be paying close attention to the cluster just below that had previously formed and the $58,000 level. If we can break above the top of the candlestick for the trading session on Friday, that is a classic technical analysis signal to start buying again.

Regardless, I think at this point it is obvious that you should not short Bitcoin. Even though we get the occasional brutal selloff, it just is not worth the risk. Bitcoin has much further to go to the upside, so it is likely that you need to pay close attention to these pullbacks as an opportunity. This does not mean that you go in and start levering yourself up, but perhaps building up a bigger position over the longer term.

Even if we break down below the bottom of the candlestick during the session on Friday, then the $50,000 level will almost certainly attract a lot of attention. Keep in mind that Bitcoin does tend to pay close attention to every $10,000 level, so that gives even more credence to that area. Furthermore, it had previously been resistance, and the 200-day EMA seems to be racing towards that area as well. With that in mind, I do believe that it is likely to be the “floor in the market” as things stand right now. This is not to say that we cannot have some type of significant breakdown, it is just that it is very likely that the downside is limited.

Central banks around the world continue to show signs of dovishness, with perhaps the one exception being the Federal Reserve. That being said, even though they are doing bond buyback tapering, the reality is that they are still relatively dovish from a historical standpoint. In other words, loose money continues to be a major issue and Bitcoin is being used as a way to get around that issue globally. The limited supply argument seems to be working out quite well for the coin in general, so I believe we will go higher over the longer term.