Bitcoin fell apart on Friday, as markets around the world got hammered due to the news coming out of South Africa. It appears that there is a new variant of the coronavirus that health officials are concerned about, so anything that was risk-related got sold off during the day. Quite frankly, this is probably a buying opportunity, but you need to pay attention to the fact that this market could drop another couple thousand dollars in the blink of an eye.

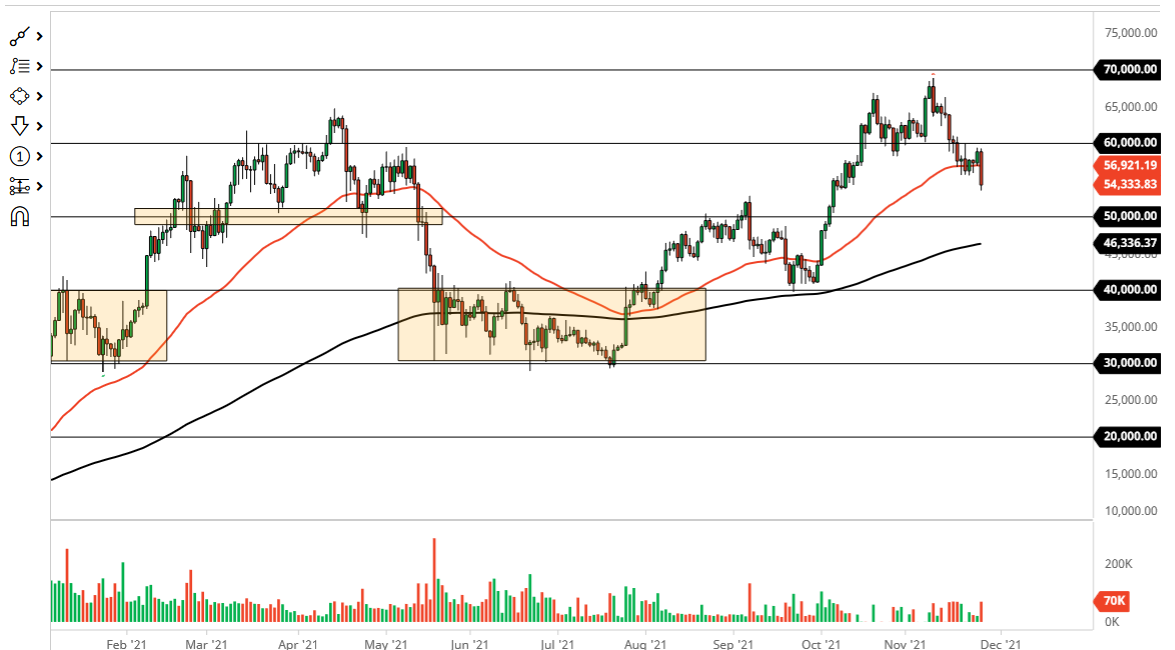

Underneath, I believe that the $50,000 level offers a bit of a “floor in the market”, and always have thought that. At this point, any dip towards that area will more than likely be bought into, as the $50,000 level is not only structurally important, but it is also psychologically important. Furthermore, the 200-day EMA is reaching towards that area, so that obviously would have a lot of influence on this as well. Because of this, I do not shy away from this market but rather look at it as an opportunity to continue to add to a bigger position.

It is obvious now that the $60,000 level is a barrier that will continue to attract a lot of attention in and of itself, and if we can break above there then I think Bitcoin will continue to take off to the upside. That being said, a lot of the selling probably was due to the fact that large firms would have to raise cash in order to cover other positions that they were in. It is a bit of a wrecking ball when something like this happens, because anything with positive gains continues to get sold off in order to make up for the losers elsewhere. For the retail trader, this should be thought of as a buying opportunity and I will be looking at the first signs of support as a signal to start bidding this thing back up. I think given enough time, we will probably go to the all-time highs, but we may have some work to do over the next couple of days. For what it is worth, the new version of coronavirus has not been proven to be vaccine resistant, so is very likely this will be a short-term selloff due to the lack of liquidity on Friday after the Thanksgiving holiday.