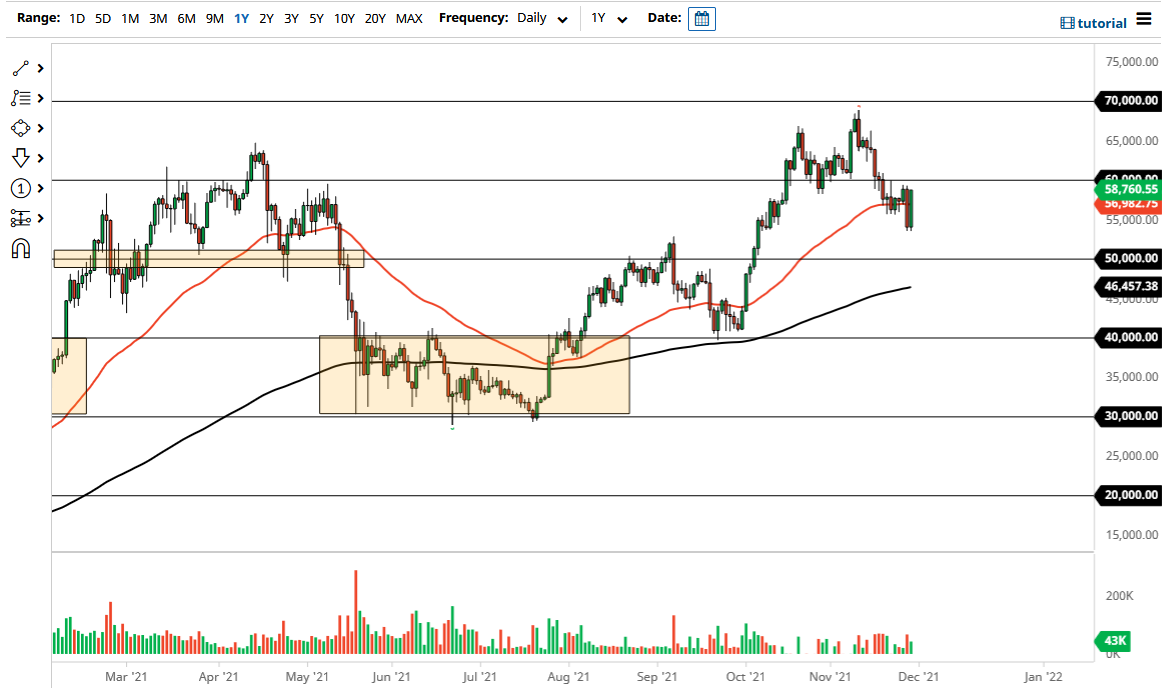

Bitcoin rallied a bit on Monday to wipe out the losses that we just had. Ultimately, it looks like the $55,000 level has offered enough support and interest to have traders come back into this position, because Bitcoin has much further to go and almost everybody out there knows this. The $60,000 level could offer a little bit of resistance, as it is a large, round, psychologically significant figure, as well as an area where we had recently seen a lot of support. “Market memory” comes into the picture and it should have people looking at this as potential resistance.

The 50-day EMA slices right through the last couple of candlesticks, which shows it as a potential area of interest as well. The fact that we turned around so drastically suggests that we have plenty of buyers on the dips, which has been the case for quite some time. If we do break above the $60,000 level, then I think the market will go looking towards the $69,000 level. Obviously, the $70,000 level is where most people are paying attention to, so I do not know that the highs themselves will be a big deal.

You also notice that the 200-day EMA is sitting above the $46,000 level and racing towards the $50,000 level. I think there is a bit of confluence there waiting to happen, and 50,000 could now be the new floor in the market going forward. Ultimately, this is a market that I think has attracted enough attention that we will continue to see plenty of buyers, especially as it is at roughly the 50% Fibonacci retracement level from the most recent shot higher. Given enough time, I think we will see fresh all-time highs and continue to drive towards the $80,000 level. In fact, at one point, I had a target of $85,000 to the upside, but that was somewhat knocked out as the bullish flag had been invalidated. At this point, I think it is only a matter of time before we get there, so maybe $85,000 is not high enough? I have no interest in shorting Bitcoin, especially after the move that we just had over the last couple of sessions. This shows real resiliency, something that you must pay close attention to.