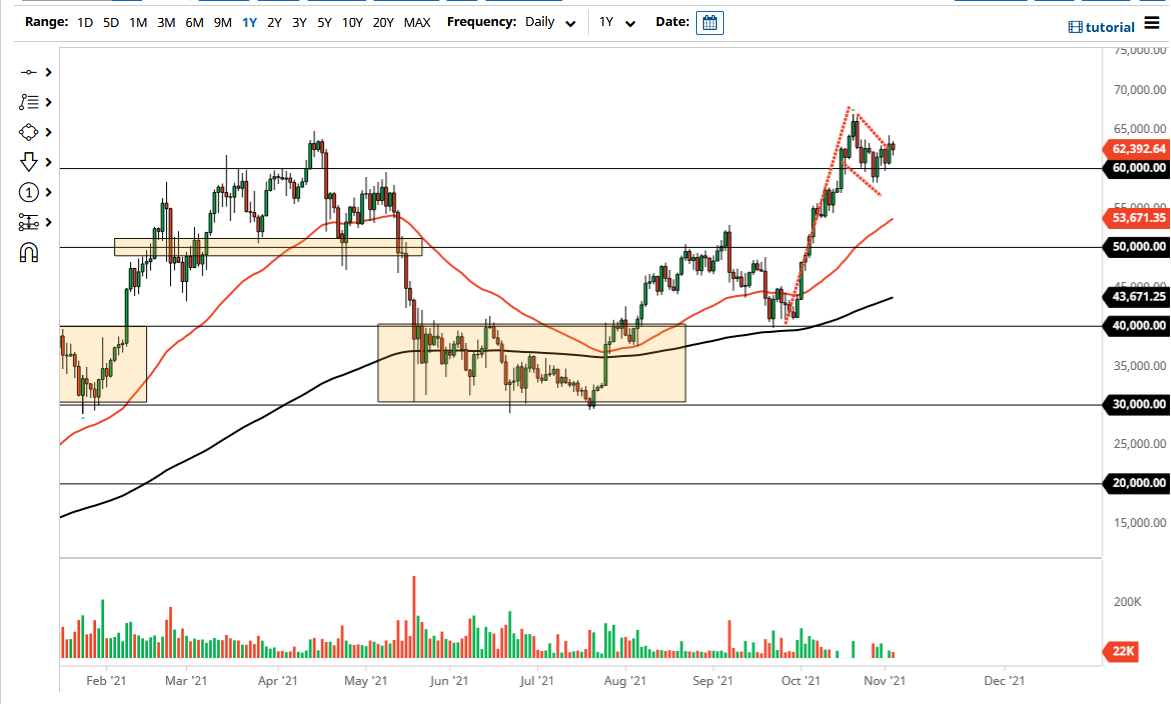

The Bitcoin market initially pulled back on Wednesday but recovered a bit to show signs of life again. By doing so, it looks as if we are trying to break out of a bullish flag, so if we can clear the highs of the session on Tuesday, then it is likely that we could go looking towards the highs again, perhaps even much higher than that. After all, the bullish flag measures for a move towards $85,000, and the way that Bitcoin has been behaving, that is not a stretch of the imagination.

At this point, the $60,000 level should offer a significant amount of support, as we have bounced from there previously. Furthermore, the Bitcoin market likes a lot of these $10,000 increments for support and resistance, so it is interesting that we have taken off from there. Even if we were to break down below that level, then I think your “floor in the market” is near the $50,000 level. The $50,000 level was previous resistance, so I think we will see a lot of support in that area. The 50-day EMA is above there anyway, so I would be very surprised to see this market break down below there.

To the upside, I would recognize that we would see a lot of issues at the $65,000 level, and then possibly even the $70,000 level. That being said, every time we pull back, I think you will probably have a value opportunity as this market is in a very strong uptrend and has shown absolutely no possibility of changing it anytime soon. Furthermore, the US dollar could soften a bit, which would of course lift this market as well. While I am not Bitcoin maximalist, I do recognize a strong uptrend when I see it, and this is most certainly a perfect example of that. With this, I think that the market will continue to see plenty of momentum, but it may take a while to get to where we are going, depending on whether or not we continue to see more inflow into the ETF market which has a lot to do with what happened more recently. But it is more likely than not just yet another reason to expect that Bitcoin will continue to be one of the best places to put your money over the longer term.