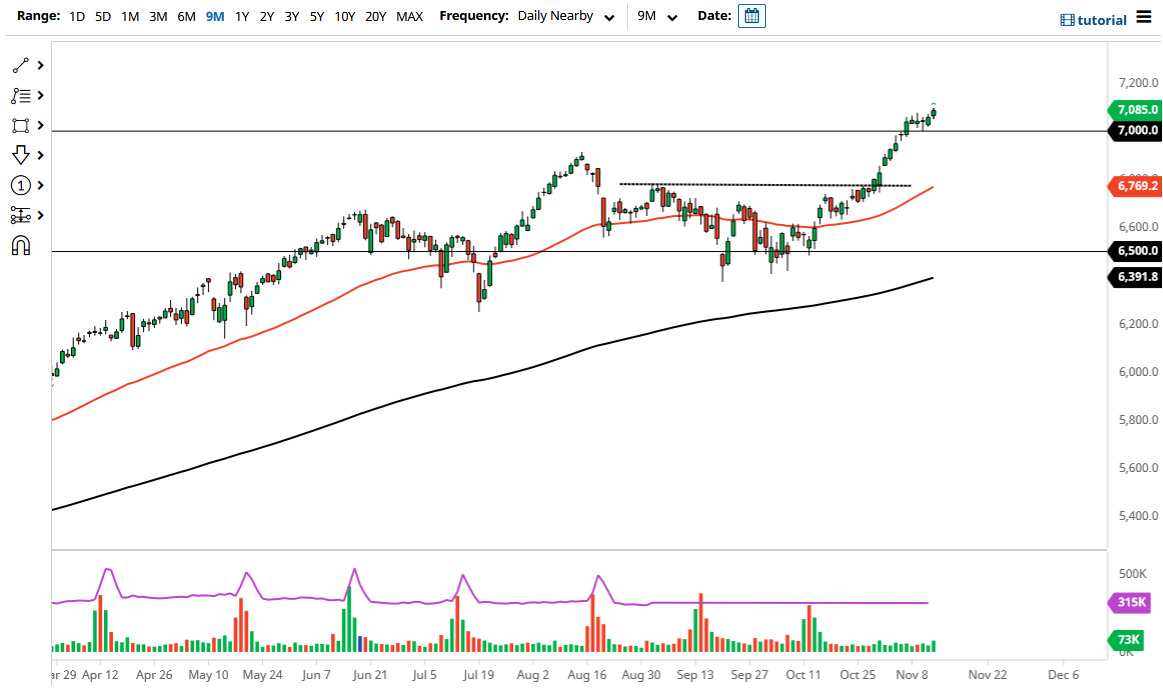

The CAC 40 Index rallied a bit on Friday, breaking above the tight consolidation range that we have been in all week. This is a good sign, as we should continue to see Paris rise after this consolidation. The market has gone back and forth over the last several days until the Friday session, digesting that massive move to the upside.

When you look at the CAC, you can see that we have recently broken out of a major rectangle that started at the 6400 level, extending to the 7000 level. In other words, it was a 400-point range, and that should extrapolate to a move towards the 7400 level. The 7000 level being broken is important not only due to that, but the fact that it had been the top of the range that we had been in before. With this, a lot of people will stand up and pay attention to what is going on. The CAC has been a strong performer for a while now, and the quick breather that we have taken over the last couple of days will have done a lot to assuage fears.

Even if we did pull back from here, it is likely that we would see plenty of buyers underneath at the 6800 level. Regardless, the fact that we closed the week above this little consolidation area for the previous four sessions does suggest that people were comfortable going home holding the contract over the weekend, which of course is a very bullish sign. With this being the case, I like the idea of buying short-term dips, but I do not know how strong a dip that will end up being anytime soon. After all, the market has continued to see upward pressure in general, and as you look at the candlesticks, you can see it has been a while since we have had a red one. With this, I believe that the 50-day EMA is starting to reach towards the 6800 level also offers a bit of a floor, and if we can continue to move forward, the 50-day EMA should start to approach that 7000 handle, which could become the new floor. In general, this is a market that looks very promising, and I do think that in the short term we will eventually go looking towards the 7200 level, but that is merely a stop on the way to our final destination.