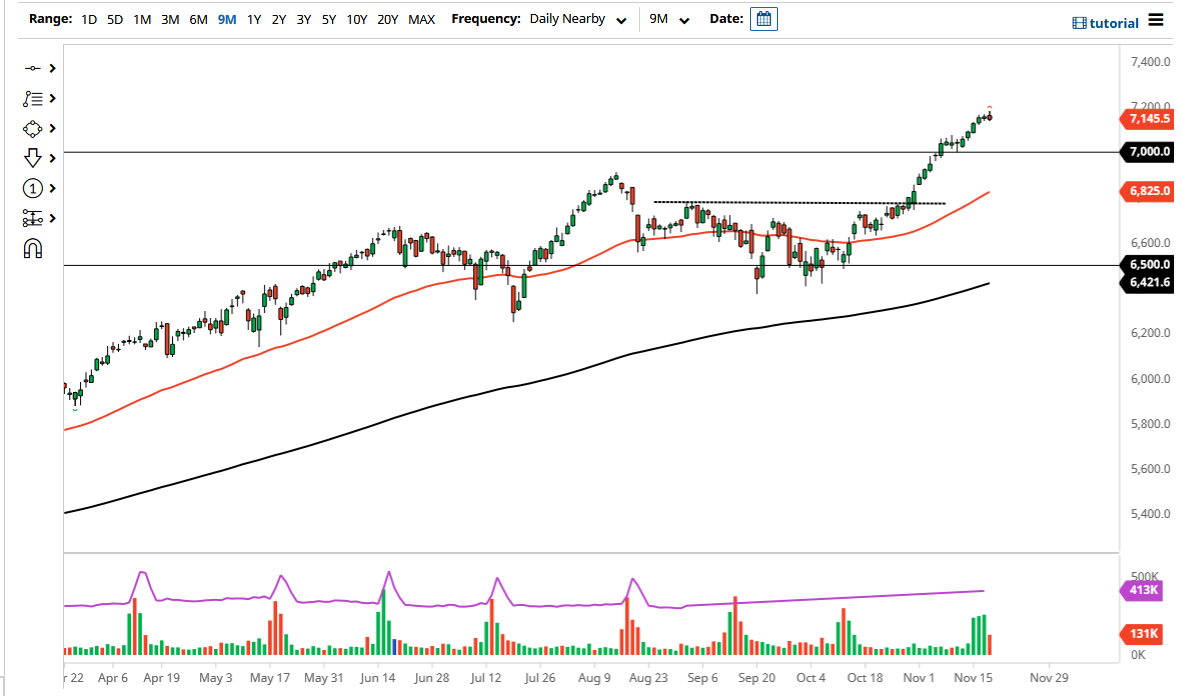

The Parisian index initially tried to rally during the trading session on Thursday but has given up gains as we approached the €7200 level. Because of this, it looks as if the market is ready for a little bit of a pullback, as we have formed a shooting star. The market is likely to find plenty of buyers underneath, especially near the €7000 level. The €7000 level of course is a large, round, psychologically significant figure but we have also seen quite a bit of support the last time we were there, as was the scene of a significant break out.

The market has been previously bouncing around between the €6500 level and the €7000 level previously, so the “measured move” is for €500. Taking the breakout from the €7000 level, it suggests that we are going to go to €7500. This makes a certain amount of sense, because stock markets around the world tend to do fairly well at the very end of the year. Furthermore, there is a lot of pressure on fund managers to catch up to their benchmarks, meaning that they will have to buy every dip along the way.

Adding even more fuel to the fire is the fact that the global economy continues to strengthen, and that suggests that we are going to continue to see equities do fairly well. With that in mind, I think that this remains to be a bit of a “buy on the dips” situation, and therefore I have no interest in shorting. If we were to break down below the €7000 level rather significantly, then I would have to step back and wait to see how this market is truly going to behave from a longer-term standpoint. With that, I believe that the market will eventually offer plenty of value the people will jump on, so it is simply a matter of being patient enough to wait for that signal over the next couple of days.

The alternate scenario is that we break above the top of the shooting star and continue to go straight up in the air. That is very possible, and as I suggested previously the target would be €7500. That would be the least likely of scenarios, but it is something that could happen and it is certainly something that you should keep in the back of your mind.