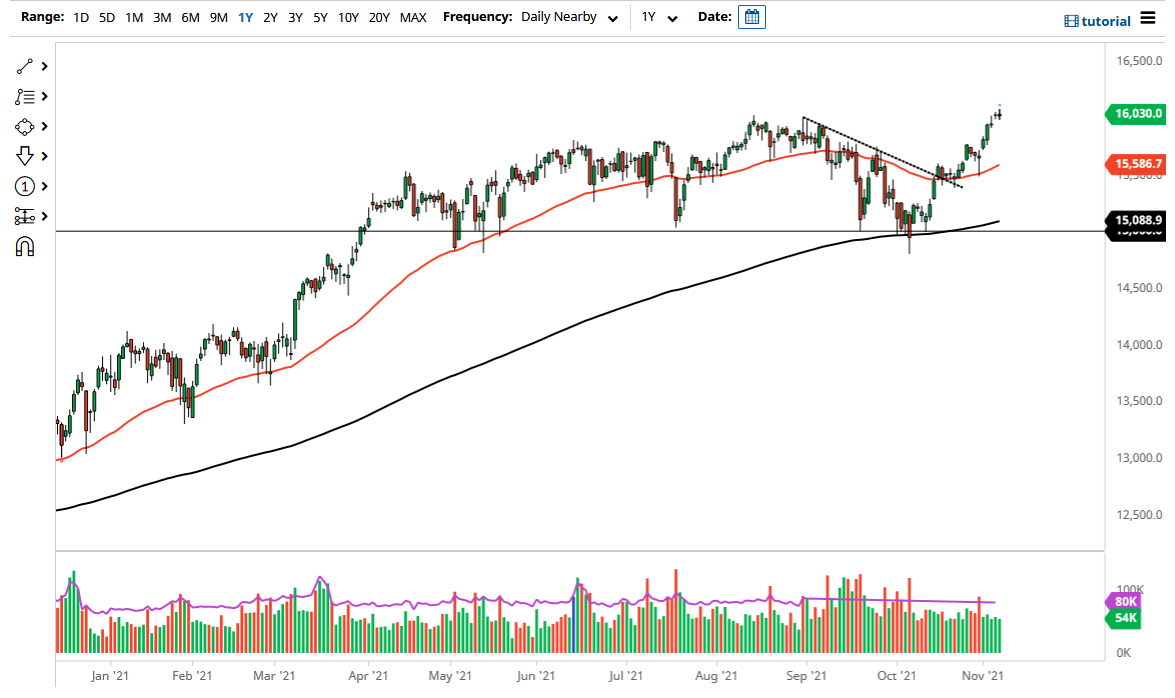

The DAX went back and forth on Friday as the markets are digesting a string of recent gains. That being said, there is more than likely going to be further upside, although we may need to pull back in order to offer enough value that people will jump on it. The American jobs number was very strong, so that does suggest that perhaps we are going to continue to see the global economy pick up, and demand for industrial corporations will continue to flourish.

When I look at this chart, it is obvious that the market is in an uptrend, and therefore I have no interest in shorting, but I could be convinced to wait for a pullback. This market has been so bullish for so long that I think it needs to take a bit of a breather. Now that we have cleared the €16,000 level, it may be more likely that we will not pull back, but maybe just grind away to the side in order to work off some of this froth. At this point in time, I do believe that the market is likely to see a lot of noisy behavior, but beyond that I would not expect much.

If we were to pull back at this point, then I think it is likely that the €16,000 level will offer the first level of support, followed by the €15,750 level. The 50-day EMA is racing towards that area and reaching towards it, so I do think that it is probably only a matter of time before that would come into the picture to offer a bit of support as well. You will notice that I have no interest in shorting this market, because Germany is one of the better-performing indices in the European Union. As long as we are going to continue to have money flowing into the markets, Germany will be one of the first places it goes. Furthermore, we also have inflation numbers in the European Union picking up, which means that the economy in the EU may be trying to emulate what we are seeing in the United States. The DAX looks as if it is poised to continue going much higher into the end of the year, but waiting for a decent price is probably the best thing you can do.