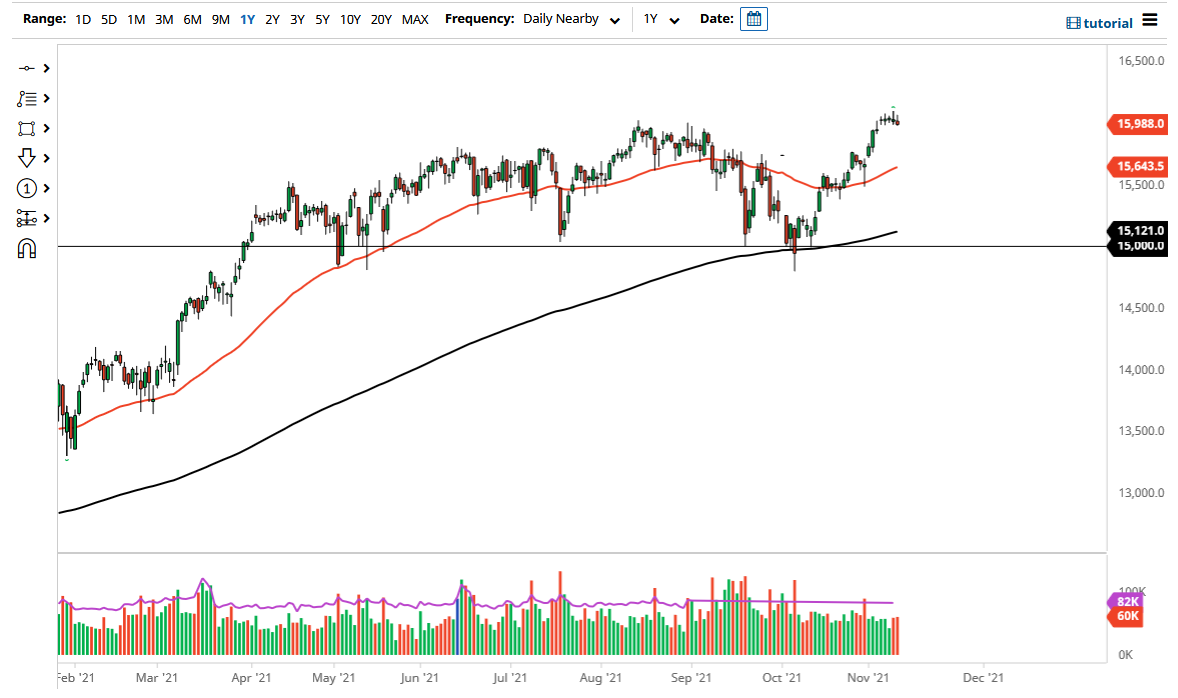

The DAX Index rallied a bit on Wednesday but gave back gains yet again as we have multiple days in a row. At this point, we are hovering around the 16,000 level and trying to - at the very least - kill a little bit of time or “chop wood”, as we had gotten here far too quickly. At this point, the €16,000 level has been a significant attraction for the market, so now if it offered support that is a very good look, because it suggests that people are still trying to push higher.

Keep in mind that the DAX is considered to be a listing of “blue-chip stocks” for the European Union. I think that if we get some type of pullback, there will be plenty of value hunters out there willing to get involved. Because of this, I am looking for value in the DAX going forward. If we pull back from here, the 50-day EMA currently sits at the €15,645 region and would make a very interesting place to get long yet again. This is not to say that we have to get that low, just that it might make a nice indication of potential value.

On the other hand, if we break above the highs of the Tuesday session, it would be another high made, and could be very bullish. Nonetheless, I do not necessarily like the idea of chasing the trade up at this point, so I do think that it is only a matter of time before we would see an opportunity to get involved, but that does not necessarily mean that we need to pay such a high price. This is a market that I think will go looking towards the €16,500 level over the longer term. That does not mean it will happen right now, but I think that is more of a longer-term call. Look for dips to offer opportunities, but until then you have to at the very least let the market go sideways in order to work off some of the excess froth that had been built up recently. You can see that we have gone basically straight up in the air since €15,000, so all of this makes sense.