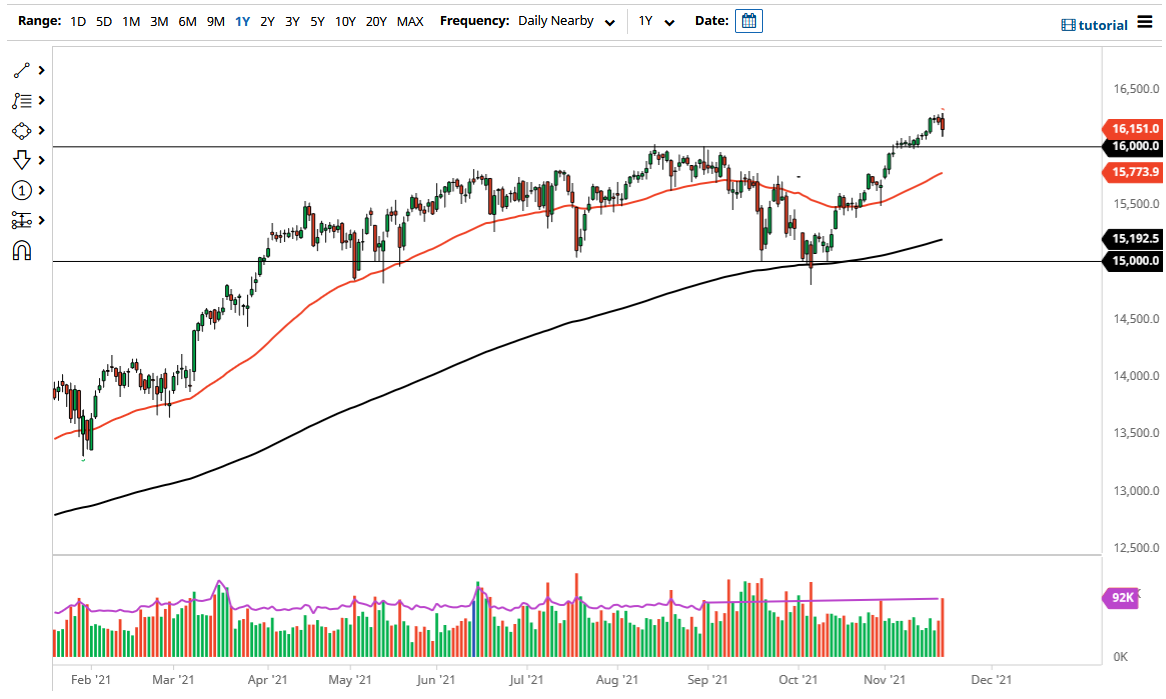

The DAX Index broke down a bit on Friday to reach down towards the €16,100 level before turning around and showing signs of life. This is a market that I think continues to see a lot of buying pressure underneath so I think it is probably only a matter of time before we continue the overall uptrend. It looks as if the €16,000 level is an area that previously had been very resistive, so I would anticipate there should be a certain amount of “market memory” in this general vicinity, offering a bit of a floor in the market.

There was a bit of a selloff due to fears of a German lockdown, as its neighbor Austria has done just that. That being said, it seems as if every time we have had a lockdown, it has been a buying opportunity as markets like to look forward. The €16,000 level being broken down below opens up the possibility of a move down to the 50-day, currently residing at the €15,773 region. Because of this, I think that we have plenty of buying pressure underneath, so I do not look at any pullback as threatening, at least not until we break down below there.

Keep in mind that Germany is a major exporting economy, so there are a lot of external factors when it comes to the DAX. The fact that the euro has fallen apart helps the idea of cheaper exports coming out of Deutschland, so that will have a certain amount of influence on this market as well. Ultimately, I believe that we will eventually take out the top of the candlestick from the Friday session and go looking towards the €16,500 level above. I anticipate that we will get there quicker than most people believe, as we have had so much in the way of momentum. This little bit of a pullback has given some people an opportunity to get involved in this market that had not been there. I have absolutely no interest in shorting the DAX, and I recognize that the seasonality for stocks tends to be rather good this time of year. Unless we get some type of major lockdown in Germany, any pullback at this point should be a buying opportunity.