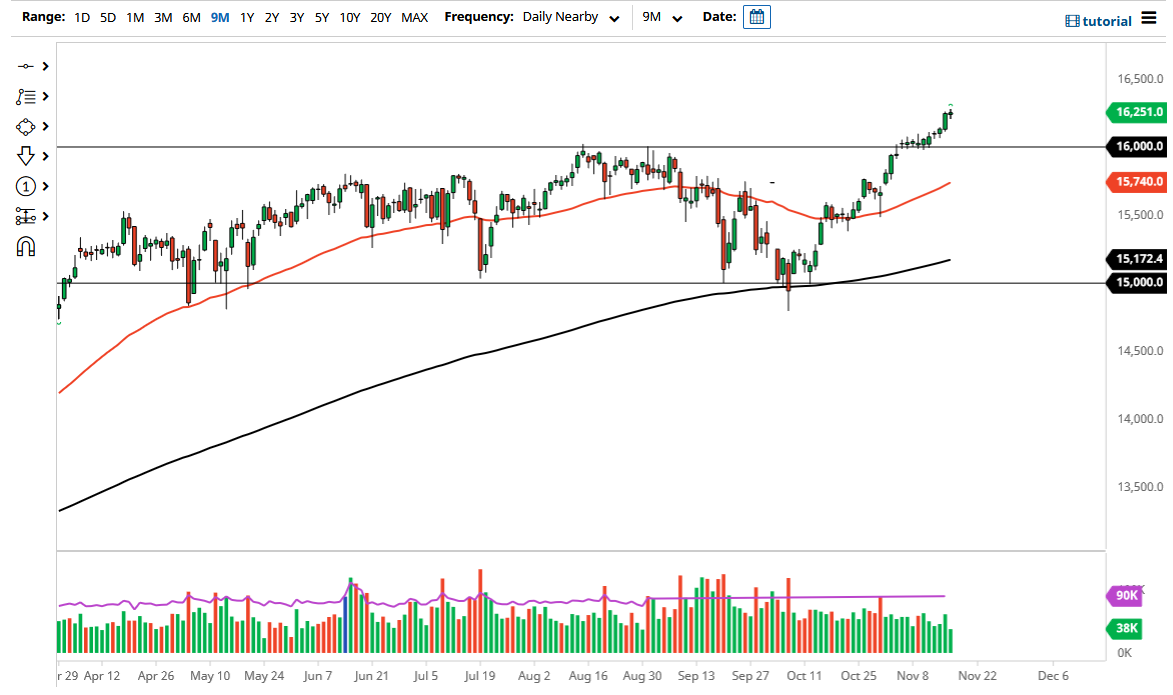

The DAX went back and forth on Wednesday as the market seems to be hovering around the €16,250 level. This is a market that has recently seen a huge push higher, gaining €250 in the last four days or so. We had recently broken above the €16,000 level, only to go sideways for a while before finally taking off. With that in mind, I think it is a market that you need look at through the prism of finding value, meaning that I would be a buyer on dips.

The neutral candlestick on Wednesday is a good sign that we could get a little bit of a pullback. I think a pullback will become a buying opportunity, as long as we stay above the €16,000 level which should now be support based upon market memory. Ultimately, that is a scenario where the previous resistance should not be supportive, as anybody who has been trapped short of the DAX will be more than happy to get out of the market. As long as we can stay above that area it is a very good sign. The 50-day EMA is reaching towards the 15,750 level and going higher. At this point, it should eventually crossed the €16,000 region, offering a bit of a reason to continue finding buyers.

To the upside, if we break above the highs of the session on Wednesday, then it is very likely that we could go looking towards the €16,500 level, which is an area that would cause a little bit of noise, due to the psychology of every €500 or so, so it makes sense that we would have a bit of a pause in that area. That being said, I think it is only a temporary thing and based upon the “measured move” of the previous consolidation area, then we could go looking towards the €17,000 level as it is a market that just broke out of a €1000 range. The market continues to find plenty of reasons to go higher, and with the euro losing so much strength over the last couple of days, it makes German exports cheaper, which is a huge driver of the DAX as it is such an export-driven market.