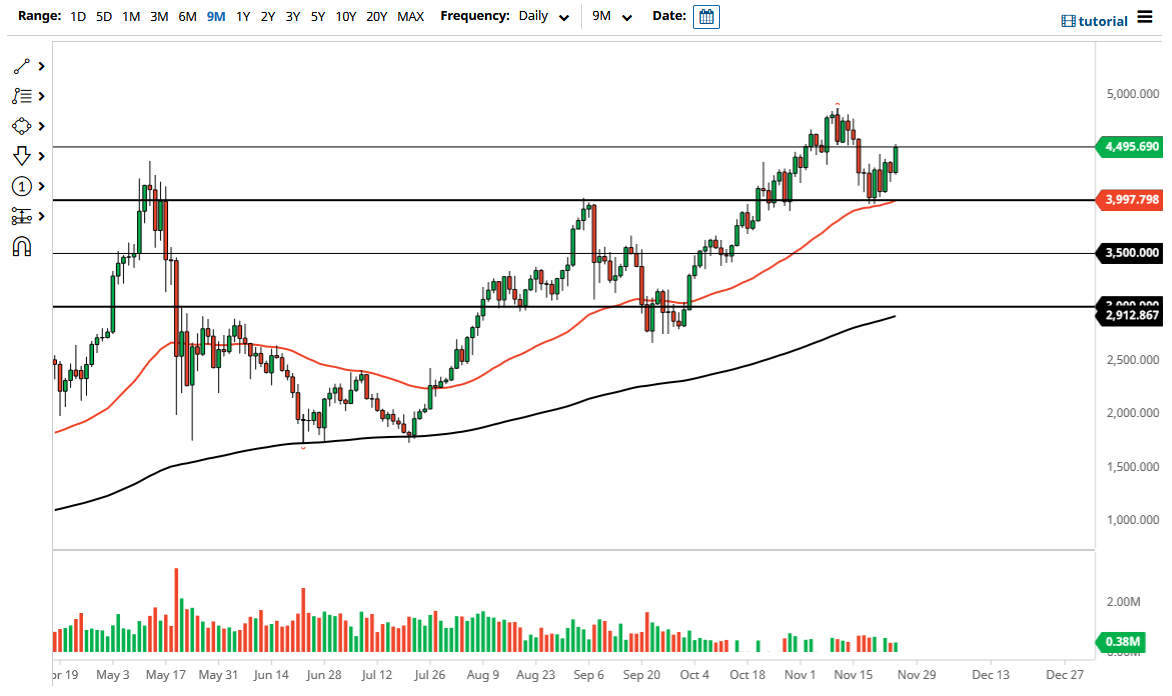

The Thanksgiving session was positive for Ethereum, as it has broken out above the recent noisy consolidation area, to threaten the $4500 level as I record. At this point in time, it is obvious that the market is trying to pick up enough momentum to continue the longer-term uptrend. The market has shown itself to be rather resilient, and as a result it should not be a huge surprise to see that Ethereum is now attracting more money. It is interesting that the market has found itself to be bullish, just as the Bitcoin market has taken off. In fact, all of crypto was rather positive during the day, with such alt coins as Shiba Inu taking off.

The candlestick is trying to close towards the top of the range, and that in and of itself is a rather bullish sign. Because of this, I think it is more than likely only a matter of time before we start to see buyers come in on short-term dips, because this is a market that had gotten a little bit of ahead of itself previously, and now has recently consolidated in order to make it a much more attractive place to put money to work. The $4500 level being attacked is a significant short-term barrier, but it certainly looks as if we have the momentum to finally break through there.

It is worth noting that most pundits believe that Ethereum is going to rally into the end of the year, which of course suggests that there is a little bit of “self-fulfilling prophecy” going on here. Regardless, I still believe that the market is likely to go looking towards the $5000 level given enough time, and that is my intermediate target. It should be noted that I am a longer-term holder of Ethereum, so therefore I am more likely than not to find reasons to add to a position.

Currently, the 50 day EMA sits just below the $4000 level, and it should be noted that the market is very sensitive to the indicator. In other words, I believe that the $4000 level will now offer a bit of a “floor in the market”, especially as it has already shown itself to be supportive to begin with. As Ethereum 2.0 becomes closer to a reality, more and more Ethereum demand will make itself known. Remember, a huge portion of Ethereum is currently locked up, decreasing the float.