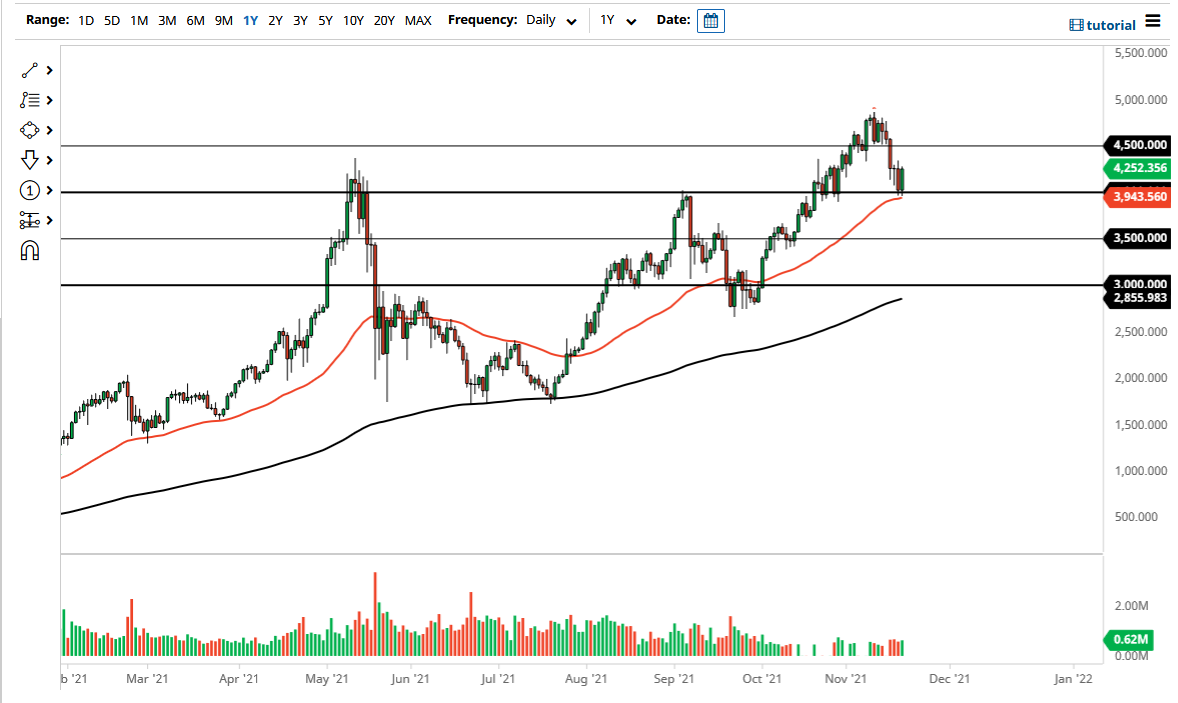

The Ethereum market rallied quite significantly on Friday, as the $4000 level has offered enough support to turn things back around. This is a good sign, because not only do we have a large, round, psychologically significant figure hanging about this area, but we also have the 50-day EMA. The 50-day EMA is followed closely by traders as well, so it all ties together quite nicely after a decent correction. The crypto markets themselves all look as if they are ready to take off to the upside again, with Ethereum and Bitcoin both leading the way. I do think that eventually Ethereum will go looking towards the $5000 level above, which we fell just short of in the last rally.

If we were to break down below the 50-day EMA, it could open up a deeper correction towards the $3500 level, but right now it does not look like it is a likely outcome. This is a market that has been very noisy over the last couple of weeks, but this pullback has been exactly what the doctor ordered when it comes to sustaining the overall uptrend. The markets had previously seen the $4000 level as a major barrier, so now that we are back down in this general vicinity and have found buyers, it shows the proclivity of “market memory” to influence the behavior of traders in general.

Regardless, I still believe that Ethereum has a long way to go, and most experts believe that we could increase tenfold from here, but when it comes to trading Ethereum, you have to be okay with the idea of significant pullbacks occasionally. Those pullbacks can cause some issues psychologically for certain traders, so you need to think of it more as an investment. As far as short-term trading is concerned, Ethereum is definitely difficult to deal with. However, if you have a non-levered position in your wallet sitting somewhere, you are not as stressed as you would be trading a highly levered CFD. In that sense, Ethereum is very much like silver, where it is easier to have less leverage and simply look at it as a longer-term trade. That is exactly how I focus on Ethereum, which is now my number one holding in my crypto portfolio.