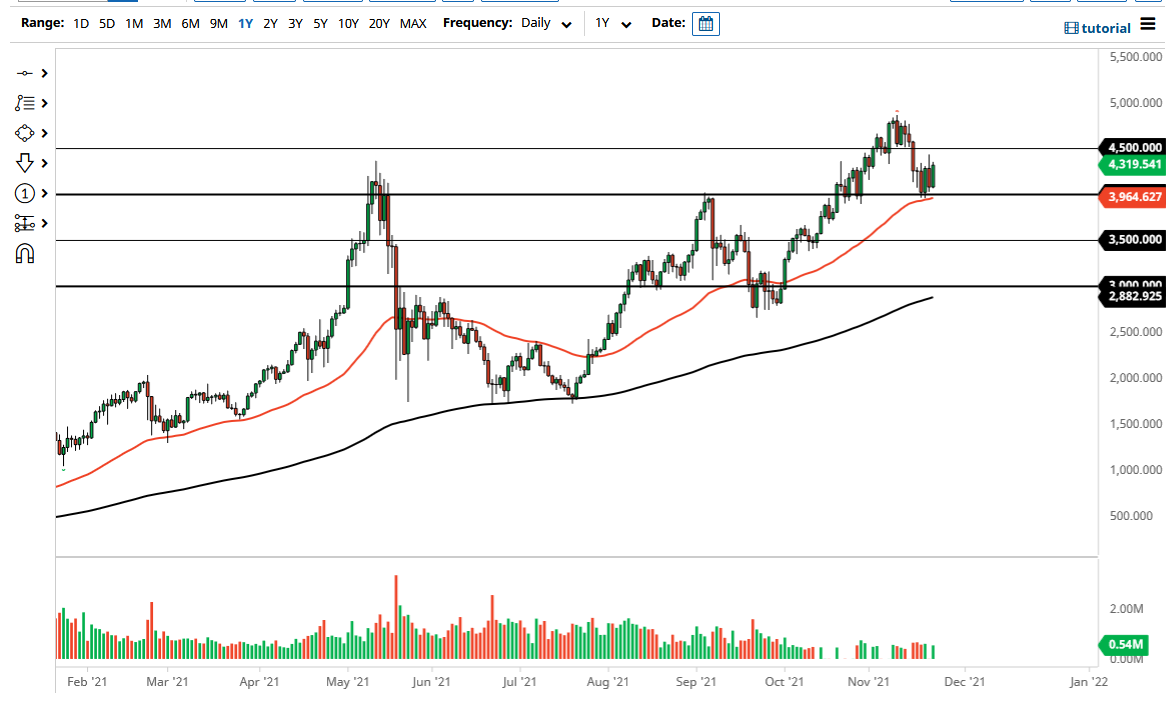

The Ethereum market rallied significantly on Tuesday as we have broken above the $4300 level. At this point, the market is likely to go looking towards the $4500 level above, which is an area where we had started selling off from. We have bounced from the 50-day EMA, and perhaps more importantly, the $4000 level. Because of this, I think it is only a matter of time before we would see the overall trend continue, and at this point in time it certainly looks as if we are making strides for that outcome. Ethereum has much further to go in the sense of catching up with Bitcoin, which the adoption rate of the network certainly is starting to favor.

I am personally long of Ethereum, and am willing to put my money where my mouth is. I even hold a certain amount of it off chain, meaning that I am in it for the longer term. That being said, if we were to break down below the $3500 level, then I might think and start over from a lower level. The action during the day on Tuesday certainly goes a long way in continuing the overall bullish narrative as central banks around the world continue to print, while crypto is a great way to avoid some of those issues. Ultimately, I think that the market is also starting to rally due to the fact that the regulators in the United States have announced a plan to define legal crypto-related banking activities next year. In other words, legal adoption of crypto is becoming a very real thing.

Ethereum is unique in the sense that it provides real utility, not just a storer of value type of argument. After all, many of the coins that we like so much as traders are sitting on top of the Ethereum blockchain, so all things being equal this is one of the better markets for a longer-term trade as far as I can see. I continue to hold onto either, but I also trade around this position, buying dips as they occur.