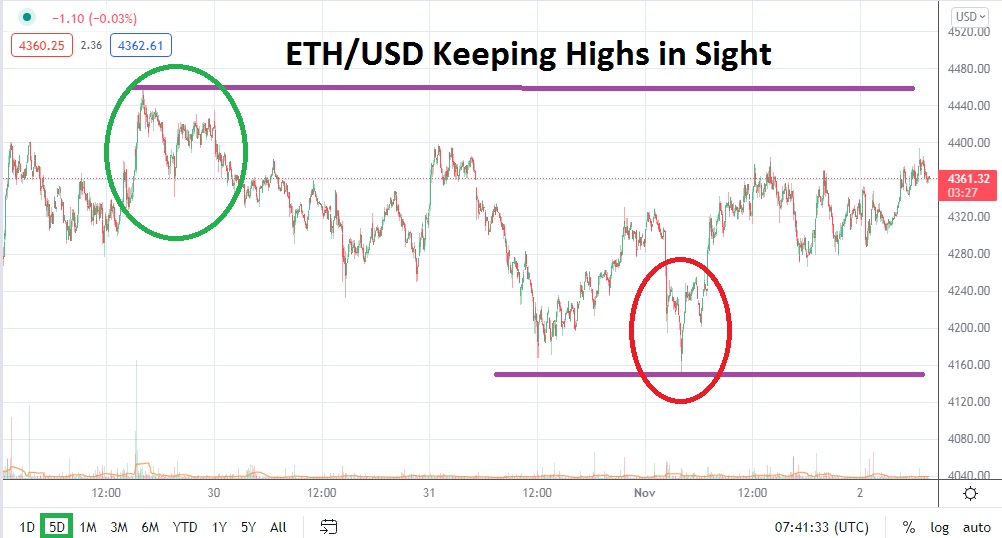

ETH/USD is within sight of the 4400.00 level, but remains a healthy distance away from the juncture in early trading this morning. That could change in a moment’s notice with one strong buying surge as all experienced cryptocurrency traders know. The record levels of 4460.00 are clearly being thought about and speculators are likely anticipating a rush towards these all-time highs sooner rather than later.

However,the past handful of trading days has seen a rather tough consolidated price range practiced by ETH/USD. Intriguingly for bullish speculators is the notion that a major reversal lower has not been demonstrated during this time span. After creating a record high on the 29th of October of 4460.00, yesterday’s low of 4150.00 may have scared off some trend followers, but a move higher quickly was ignited.

Let there be no doubt that ETH/USD has NOT suddenly found a formula which has eliminated bearish moves. Ethereum can certainly move lower and at some point it will, that is the nature of cryptocurrencies and all financial assets actually. The trend in ETH/USD though remains strong and technical traders are likely looking at charts, listening to proponents, paying attention to news about an Ethereum blockchain update and feeling rather positive.

Current resistance near the 4395.00 mark may seem like a stone’s throw away and it could legitimately be hit in a blink of an eye. But trading could also remain consolidated and contrarian speculators may be tempted to wager on downside momentum being demonstrated first which tests support ratios.

Traders who do prefer to sell ETH/USD on the notion that negative movement needs to be displayed before the next leg up should practice extreme caution and have their risk management working. Aiming for 4325.00 to 4300.00 may be legitimate, but the amount of leverage used is important and if these support levels are not hit then ETH/USD could be off to new highs quickly.

Buying ETH/USD near current support around the 3340.00 to 3325.00 areas could prove to be worthwhile. Traders who are aggressive and are buyers should also keep in mind that they might not capture an entire bullish run upwards, meaning they should not be overly ambitious and if profits materialize it could prove wise to cash the winning positions in before they vanish.

Ethereum Short-Term Outlook

Current Resistance: 4395.00

Current Support: 4287.00

High Target: 4495.00

Low Target: 4199.00