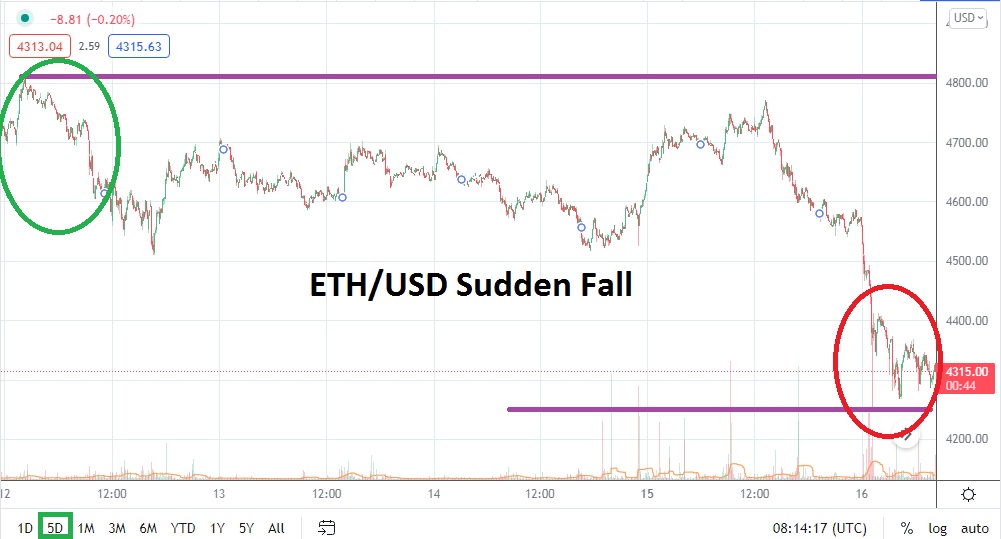

As of this writing, ETH/USD has fallen to lows not seen since the 1st of November. However, the drop from nearly 4755.00 via yesterday’s high to this morning’s value of about 4305.00 as of this writing was quick. The price velocity of the plunge will get the attention of speculators, even if they are accustomed to extremely fast conditions and typically do not get nervous.

Reasons behind the sudden selloff in the broad cryptocurrency market may have something to do with the massive ‘infrastructure bill’ being signed into law in the States. The legislative bill includes a mandate that would allow the U.S. government to supervise digital assets with greater tax efforts, but this may prove to be noise. The actually reason for the sudden decline in values in ETH/USD and other major cryptos may effectively prove to be a profit-taking mode undertaken by speculators.

ETH/USD is currently near the 4300.00 mark and if this vicinity starts to prove is has adequate support below, the notice that the selloff may turn out to be a buying opportunity may entice speculators. Cautious traders should keep their eyes on lower values, if support levels with a deeper reach are tested near the 4200.00 level in the short term, this could set off alarm bells that the decline has further room to explore.

While ETH/USD has certainly been within the whirlwind of a substantial bullish run higher, the value of 4235.00 was a fairly solid resting ground when ETH/USD made its high water values in May of 2021. A sustained test of this value downward could spark more speculative sellers who decide to cash out winning positions if they seek to register their profits before they potentially vanish.

Speculators need to use their risk-taking tactics astutely today because it appears Ethereum will see a solid amount of volatility in the short term. Bullish speculators who remain optimistic may see the sell off as a technical reaction to recent record highs, and a signal ETH/USD needs to consolidate within a lower value tier near term. However, cautious traders who want to be buyers and wager on upside action to develop are encouraged to keep their eyes on the 4250.00 level, if this fails to hold back a selling tide more bearish activity could ensue.

Ethereum Short-Term Outlook

Current Resistance: 4421.00

Current Support: 4250.00

High Target: 4574.00

Low Target: 3920.00