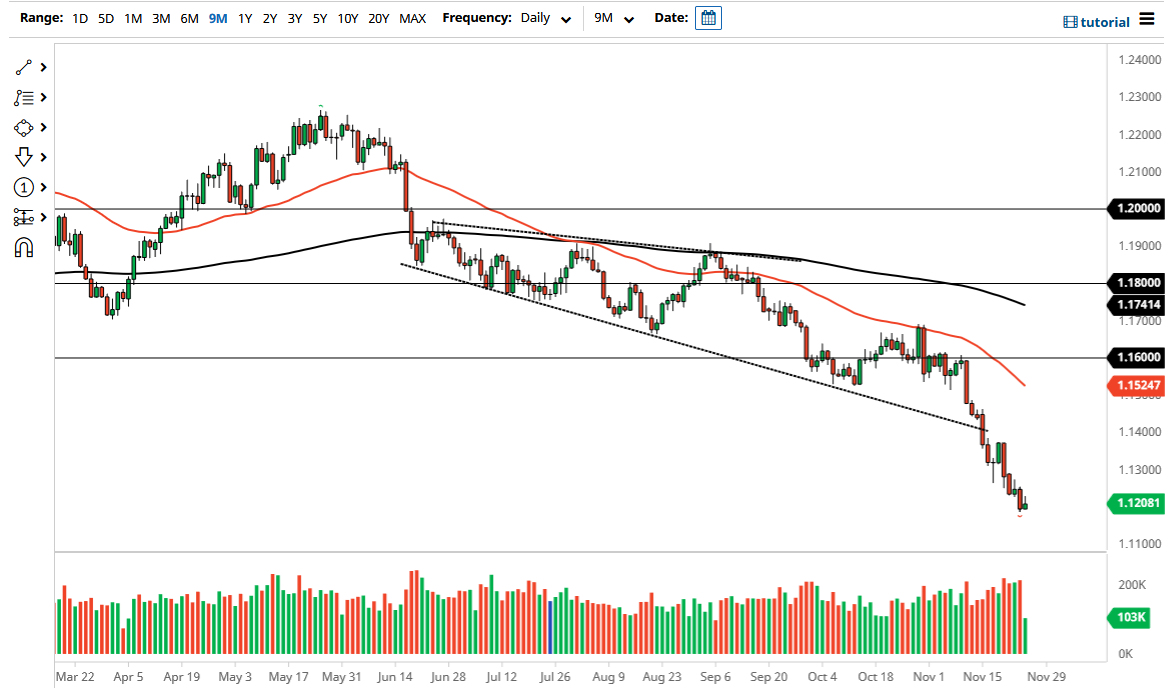

The Euro has initially tried to rally during the trading session on Thursday but gave back the gains, despite the fact that the Americans were away at Thanksgiving. With that being the case, the market has shown itself to favor the downside due to the fact that even though we did break above the 1.12 level, we could not stay above it. The market is likely to continue seeing traders jump into and shorting anytime it shows signs of exhaustion. Because of this, I think it certainly has further to go to the downside, with perhaps an eye on the 1.10 level.

Rallies at this point will continue to see plenty of resistance barriers, not the least of which would be the 1.13 level, an area that of course is a large, round, psychologically significant figure. After that, we then have the 1.14 level, which is structurally important based upon the recent selloff. Breaking above that level would be a very bullish sign, but I do not see that happening in the short term. It is possible that we will continue to see this market become a “fade the rally” type of situation, as the Euro languishes due to the European Central Bank looking to keep monetary policy rather lose.

The Federal Reserve is still looking at tapering bond purchases, so that will continue to be one of the drivers of this pair. Ultimately, I think that we could get a wicked bounce, but that bounce will be sold into. We are a bit overextended, and that is why I believe that a bounce is very likely. I do not buy this market at any point right now, so now it is simply a matter of waiting for an opportunity. The rest of this year is going to continue to be very bearish, but you cannot simply jump in with both feet because these bear market rallies can be rather nasty when they happen. Having said that, it is not as if you can simply assume that it is going to happen either, because at that point in time you are playing with fire. You cannot be a buyer under any circumstances, because if the trend was to turn around, you will have plenty of time to take advantage of it.