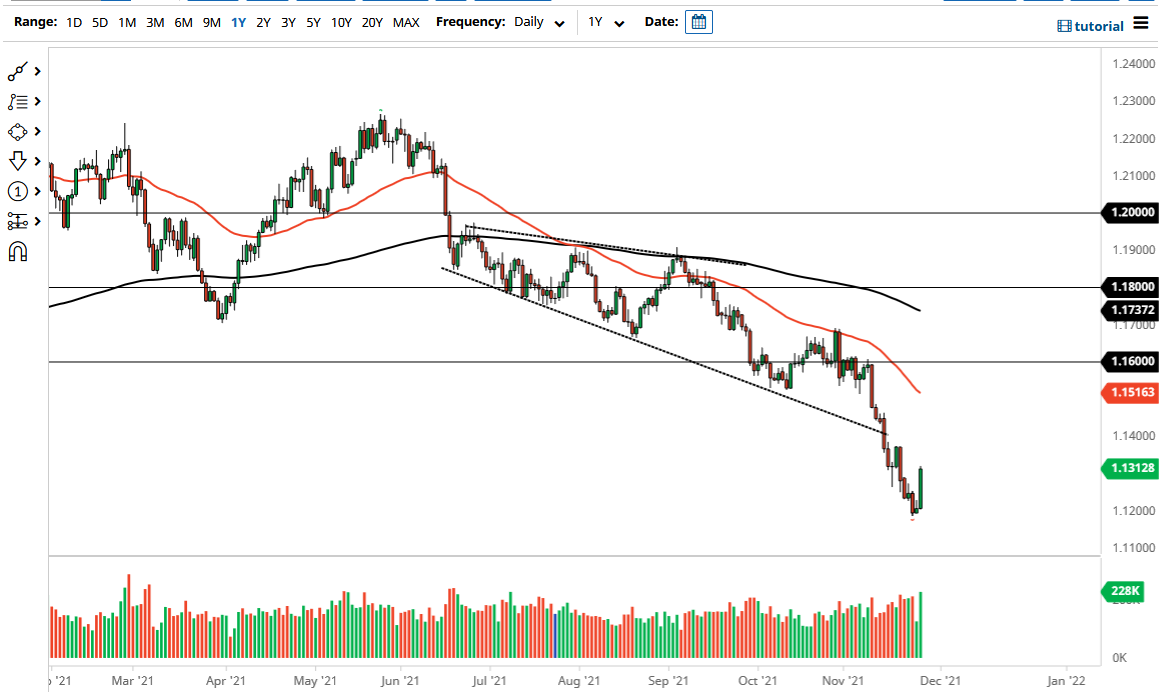

The euro rallied significantly on Friday, breaking above the 1.13 level. The market has seen a significant amount of momentum, but I still believe it is only a matter of time before we find sellers, especially if we get near the 1.14 level. That being said though, the market is likely to see a lot of noisy behavior, but if we break above the 1.14 handle, then we could open up a move towards the 50-day EMA. One thing is for sure: this is a “shot across the bow” for the greenback.

I find it interesting that the euro gained the way it did during the day on Friday, considering that a lot of what had been going on was a reaction to the coronavirus variant coming out of South Africa. In other words, you would think that safety currencies such as the US dollar would have been picked up hand over fist. But they were not, and I find it interesting that we ended up here. At this point, I think that we have a scenario where we are trying to see whether or not we are going to continue to see momentum. Typically, when you see a candlestick like this, it does not happen in a vacuum, meaning that there should be more buyers.

If we can break above the 50-day EMA, then I think we will change the complete trend. It is worth noting that we had bounced from a major support level, but as things stand right now, I still think it is probably only a matter of time before sellers come in and try to push us lower. I still think we could go looking towards 1.10 level, but anything above the 50-day EMA has me thinking that this market could have a bit more staying power. Regardless, the US dollar had been overbought so I think all of this has been necessary, the nonsense on Friday was just the excuse to have this happen. The 1.12 level underneath it looks to be very supportive, so a breach of that level obviously could open up the floodgates to massivee selling pressure at this point in time, making momentum a major driver.