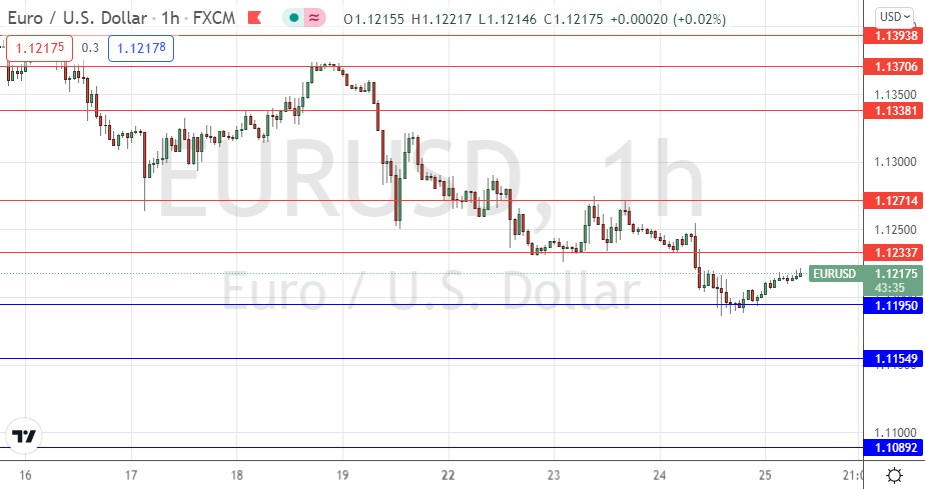

Last Thursday’s EUR/USD signal produced a losing short trade from the hourly doji candlestick which rejected the resistance level I had identified at $1.1338.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be entered between 8am and 5pm London time today only.

Short Trade Ideas

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of $1.1234 or $1.1271.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of $1.1195 or $1.1155.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that we could probably rely upon the bearish momentum provided the price stayed below $1.1338. This was a good call as after breaking above that level, the price closed firmly up on the day. However, I was wrong in my forecast for a down day. Yet developments over the past week have seen my focus on the long-term bearish trend continuing proven to be correct.

The euro has continued to be very weak ever since the ECB appeared to rule out a rate hike in 2022, while the US dollar has broken above formerly key resistance. There are no fundamental factors at work to weaken the dollar or strengthen the euro. Technically, the price has continued to fall strongly, and despite the bullish retracements this currency pair is always prone to within a trend, the bearish trend is clearly still active. The only question is where support may kick in. We may already have seen that at $1.1195 but the bullish bounce from there has been weak so I am not impressed by it. I do not see any reason to call an end to the long-term bearish move.

I maintain a bearish bias and continue to see a short trade opportunity here. The best set-up would be a firm bearish rejection of the nearest resistance level at $1.1234 which looks likely to be solid.

Trading is likely to be thin towards the end of the London session due to today’s public holiday in the USA.

There is nothing of high importance due today concerning either the EUR or the USD. It is a public holidaay in the USA.