For two trading sessions in a row, the EUR/USD tried to stop its losses which extended to the 1.1186 support level, the lowest in 16 months, but the rebound gains did not exceed the 1.1330 level, instead settling around the 1.1270 level today. There is cautious anticipation in the markets of the testimony of Federal Reserve Chairman Powell, and whether he would have a comment on the new variant of the Corona virus, and if it would prevent the bank from tightening its monetary policy.

The euro gained more than 100 pips before the weekend, as the crisis in global markets encouraged investors and traders to liquidate positions in riskier currencies, increasing demand for the euro and other funding currencies in the process. Just like the yen and the Swiss franc, the euro has been widely sold off lately by investors seeking to fund bets on higher returns or simply more attractive currencies including currencies such as the Canadian dollar and the Australian dollar, although these positions were quickly taken over. They last sold out on Friday.

The rise of the euro and the dollar and the underlying sell-off in global markets were stimulated by the discovery of a new variant of the Corona virus in Africa, which prompted a number of governments to impose travel restrictions or adopt stricter entry requirements for international travelers. However, the rebound in the EUR/USD is that if global markets are to rebound this week, the single European currency could at least struggle for more momentum and maybe even reverse its gains on Friday, which is possible given how that happens. Not much is known about the new disease.

The concern has been in some parts that the new, highly mutated strain of the COVID-19 coronavirus will prove to be more contagious and as harmful to some of those who contract it as other dominant strains. It is likely that that is all some countries' governments need to see or hear before reimposing economically devastating restrictions on business and social contact, although there is no evidence so far to suggest the new strain became more effective on Monday.

The risk of a new and problematic strain of the virus entering the cycle has emerged at a critical time for the euro as many governments on the continent have already resorted to re-imposing harmful containment measures in various forms due to the continued spread of previous strains.

“The simultaneous rise in virus cases and inflation is complicating the ECB’s deliberations on PEPP at the upcoming monetary policy meeting,” says Mark Kos Babic, analyst at Barclays. “Our view remains that the ECB will maintain its accommodative monetary policy stance. very much in 2022.”

Technical Analysis

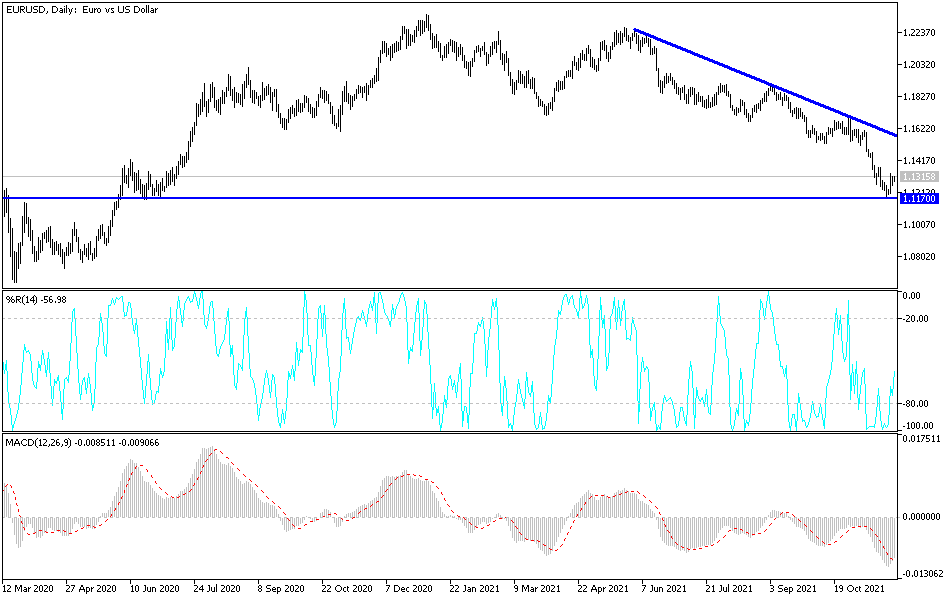

On today's chart, the general trend of the EUR/USD currency pair is still bearish, and stability below the 1.1300 support will motivate the bears to launch further towards stronger bearish levels, the closest of which are currently 1.1245, 1.1180 and 1.1045. These levels are sufficient to push the technical indicators towards strong oversold levels. Continuing factors of the euro's weakness will not prevent the pair from further collapse. On the upside, the bulls will not have a chance to break the current trend without moving towards the 1.1620 resistance. I still prefer to sell the currency pair from every bullish level as the factors of euro weakness will not improve quickly.

The inflation reading in the Eurozone will be announced. Then the announcement of the US consumer confidence reading and the testimony of US Federal Reserve Governor Jerome Powell will be released.