Europe's face-off with COVID infections will continue to hurt the Eurozone economy, which is facing other crises like in energy and global supply chains. The price of the EUR/USD currency pair remained under downward pressure and was unable to correct after its recent losses, which reached the 1.1250 support at the end of last week’s trading and closed around the 1.1282 level. The performance is bearish ahead of an important and exciting trading week.

Lockdowns in major European economies were brought back to the table after Austria's decision to reimpose a full lockdown, news that rocked the euro and other major currencies ahead of the weekend. With Covid cases rising across Europe, there is growing expectation among market participants that another major country will follow Austria's precedent, with Germany looking particularly vulnerable to such a decision. In this regard, Austrian Chancellor Alexander Schallenberg said in a press conference on Friday that the country will return to a state of complete lockdown from Monday.

The decision comes amid a spike in cases in a country where 65% of the population is fully vaccinated against COVID-19.

Commenting on this, Raffi Boyadjian, Senior Investment Analyst at XM says: “Austria’s announcement that it was entering a complete lockdown may have affected the mood... It comes hours after Germany announced new restrictions on people not immune as virus cases increase in many parts of Europe “.

The national lockdown is set to last for three weeks but will be reviewed after 10 days.

The developments are significant as they point to a sharp slowdown in economic activity in the Eurozone over the coming weeks, making another "lost" Christmas the time that is the traditional driver of increased service sector activity. The Forex market response is "textbook" in terms of offering the safe-haven combination of yen, franc and US dollar. We would normally expect the GBP/EUR exchange rate to incur significant losses, but with the single European currency in the Eurozone being at the center of the storm, it is understandable that the pair holds its recent gains near the 1.19 level. In this regard, says Matthias van der Geogt, analyst at KBC Markets: “Forex trading has developed according to an old-school scenario away from risk.” And “especially since the statements of German Health Minister Jens Spahn pushed the euro off the cliff.”

As German Health Minister Jens Spahn said on Friday - when 52,970 cases of coronavirus were reported including 201 deaths - the country was now in a "national emergency". "We are now in a situation - even if it results in a news alert - where we can't rule out anything," Spahn added. “Further acceleration in cases across Europe over the coming weeks is likely to raise expectations for further underperformance of the eurozone economy compared to the United States, and impose downward pressure,” says Matthew Hornbach, global macroeconomic analyst at Morgan Stanley.

At the end of last week, European Central Bank President Christine Lagarde said the ECB should not rush into premature tightening when faced with transient or supply-driven inflation shocks. And at the 31st European Banking Conference in Frankfurt in 2021, she said premature tightening of policy would only exacerbate pressure on household income.

At the same time, such a measure will not address the root causes of inflation, because energy prices are set globally and supply bottlenecks cannot be addressed by the monetary policy of the European Central Bank. A supply shock will tend to increase inflation and reduce production. In this case, Lagarde noted, tighter monetary policy would only exacerbate the deflationary effect on the economy. Moreover, the banker noted that monetary policy is affecting the economy with lag events. "Therefore, when inflation pressure is expected to abate - as it is today - it makes no sense to respond by tightening policy," Lagarde said. She added that monetary policy today must remain patient and persistent, while being alert to any potential destabilizing dynamics.

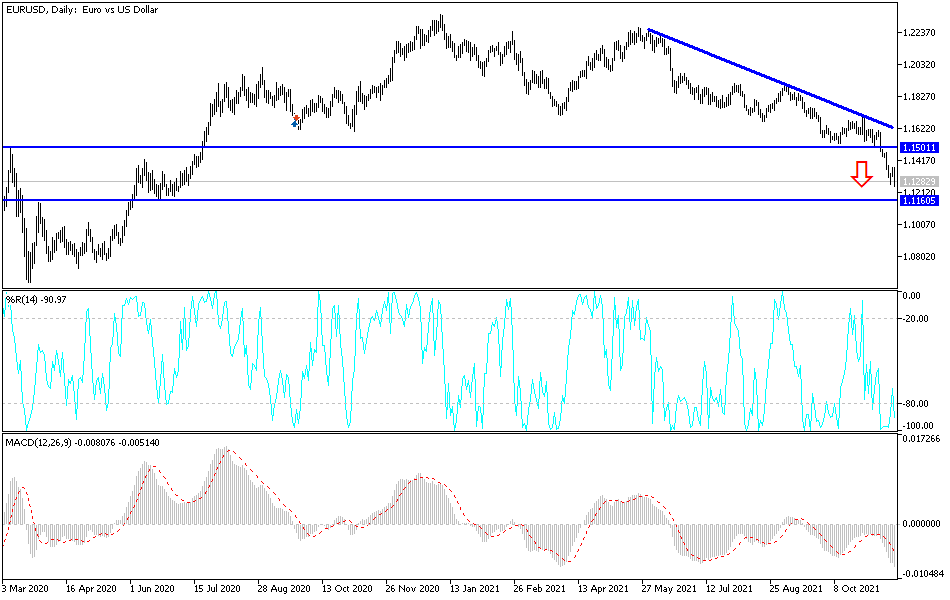

Technical Analysis

On the daily chart, the general trend of the EUR/USD pair is still bearish and stabilizing below the 1.1300 support, as it is now increasing the bears’ control for more movement. The closest bearish targets are 1.1210, 1.1150 and 1.1000. On the upside, the bulls should move towards the resistance levels 1.1520 and 1.1600 to make a breakout, otherwise the trend will remain bearish and any gains for the euro will remain a target for selling as long as the above mentioned weakness factors remain.

Today, the Eurozone Consumer Confidence will be released, followed by the US Existing Home Sales figures.