The EUR/USD continued its biggest decline since late September last week, breaking through a major support level while reaching another near 1.1425 under pressure, but extending the decline further to the support level 1.1356, the lowest in 16 months. The pair then settled around the 1.1380 level as of this writing. The sharp drop came despite many analysts warning of continued downside risks for the EUR. The rapid developments in European infections with the Coronavirus provided the bears with a new impetus, in addition to the economical contrasts between the Eurozone and the United States of America.

“EU periphery currencies are feeling pressure on this, from the Swedish krona to Central and Eastern European currencies, some of which have reached cycle lows against the single currency,” John Hardy, a foreign exchange analyst at Saxo Bank, said in a research note on Friday. "We've had a lot of risk setbacks lately, but focus on growth concerns in Europe about the natural gas catastrophe and perhaps now even on Covid, like SEK is in the firing line, given that it's often seen as a high-powered beta proxy for the EU."

Signs of a continental return toward containment measures in the past put another question mark on the Eurozone's economic outlook for the winter months and just as the dollar benefits from investors' growing conviction that the US Federal Reserve may raise interest rates in the US next year, which severely affected the EUR/USD rate last week.

While the market is likely to remain alert to the coronavirus situation in continental Europe, other factors will also be important to the price movement in the EUR/USD rate including the preliminary estimate of third-quarter GDP growth from Eurostat on Tuesday. The consensus expects GDP to reveal a solid 2% q/q growth rate for the last quarter. Perhaps most important for the single European currency is cutting investors' appetite for the dollar after it was announced that inflation in the US in October exceeded 6% last week.

This has sent financial markets rushing full pricing in a 0.25% increase in the federal funds rate range for both the third and final quarters of 2022, and then some for 2023. The euro is among the major currencies most vulnerable to a rise in US interest rates, due partly because markets are realizing that the European Central Bank (ECB) is likely to follow the Fed and other central banks when it eventually normalizes its monetary policies.

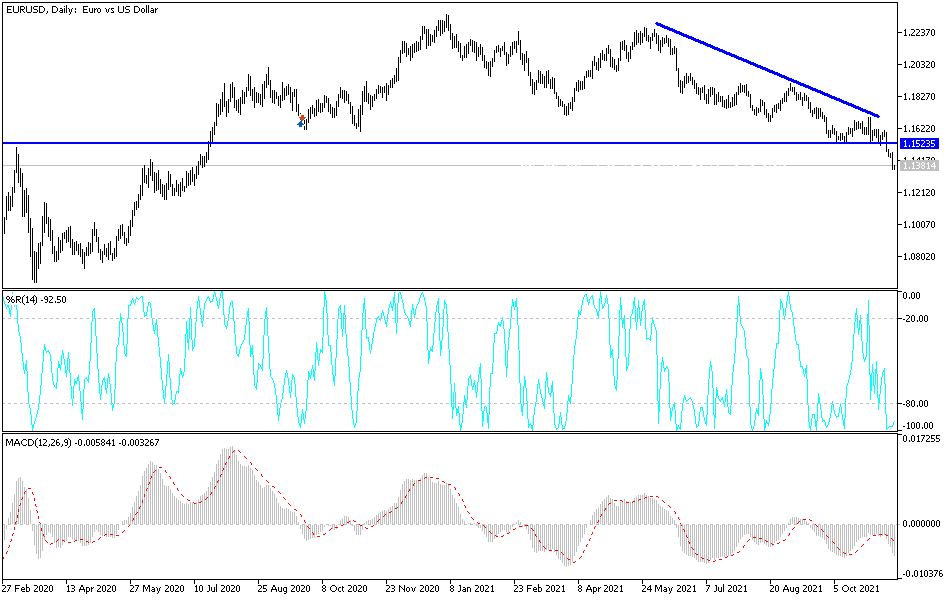

Technical anaylsis

The bears’ control over the performance of the EUR/USD currency pair is getting stronger on the daily chart. The technical indicators have moved towards oversold levels, and despite that, the euro still lacks motivating factors to stop its losses, which confirms the continuation of the bearish trend long term, awaiting a change in risk sentiment. The closest bear targets are currently 1.1350, 1.1300 and 1.1235. On the upside, and on the same time frame, the bulls need to break the resistance levels at 1.1525, 1.1630 and 1.1700 to trigger a trend shift, otherwise it will remain bearish.

The euro will react to the announcement of the GDP growth rate and the rate of change in employment in the Eurozone. The US dollar will react to the announcement of US retail sales figures and the industrial production rate.