The storm of the US Federal Reserve’s announcement passed relatively peacefully in relation to the performance of the EUR/USD. Amid the announcement of what was priced in the markets some time ago, the currency pair returned to move in ranges between the support level of 1.1562 and the resistance level of 1.1616. The US central bank announced it would reduce its bond purchases, but inflation concerns remain prominent.

Federal Reserve Chairman Jerome Powell said officials can be patient about raising interest rates - after announcing they will start reducing their bond purchases - but will not hesitate to take action if inflation requires it. "We think we can be patient," he said at his press conference. This is after the FOMC said it will cut $15 billion per month starting in November.

The gradient "does not imply any direct indication in terms of our interest rate policy," Powell added, noting that the pace puts them on track to finish the process by mid-2022 but could speed up or slow down depending on the economic outlook. The Fed will reduce Treasury purchases by $10 billion and mortgage-backed securities by $5 billion, marking the beginning of the end of a program aimed at shielding the economy from COVID-19. The Federal Open Market Committee decided to keep the target range for the benchmark interest rate at zero to 0.25 percent. The decision was unanimous.

"We don't think this is the right time to raise interest rates because we want to see the labor market recover more," Powell added.

The Fed was buying $80 billion in Treasuries and $40 billion in MBS each month to help spur economic activity that was crushed in the initial pandemic shutdown and the subsequent uneven recovery.

The unemployment rate in the Eurozone fell to a seasonally adjusted 7.4 percent in September from 7.5 percent in August. The rate was in line with economists' expectations. The number of the unemployed fell 255,000 from the previous month to 12.079 million in September. Compared to last year, unemployment decreased by 1.919 million. The youth unemployment rate fell to 16.0% in September from 16.3% in August. In the same period last year, the unemployment rate was 18.8%. The unemployment rate in the 27 European Union countries was 6.7 percent in September, compared to 6.9 percent in August and 7.7 percent in September 2020.

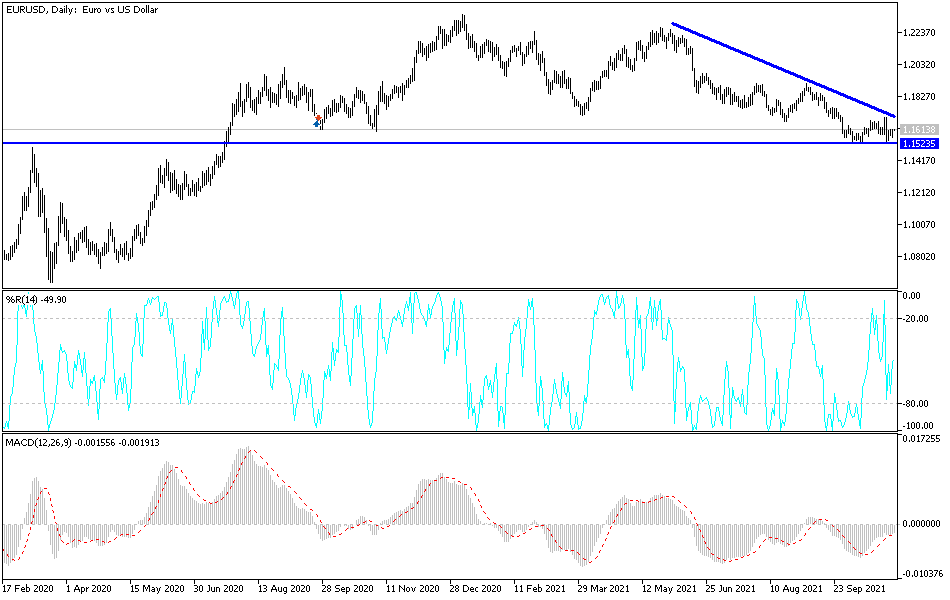

Technical Analysis

The EUR/USD currency pair is still in need of a strong impetus to get out of the current bearish channel range, as moving below the 1.1545 support will support the bearish outlook and move the currency pair towards stronger support levels, the closest of which are 1.1480 and 1.1400. These are areas where technical indicators are moving towards strong oversold levels. On the upside, and according to the performance on the daily chart, if the bulls were to breach the 1.1760 resistance, the chance of correction would be stronger, otherwise the general trend of the EUR/USD will remain bearish.

The PMI reading of services for the economies of the Eurozone will be announced, and later, statements by ECB Governor Lagarde. From the United States, jobless claims, trade balance and non-agricultural productivity will be announced.