The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

Big Picture 28th November 2021

Last week’s Forex market moved in line with the long-term bullish USD trend until the end of the week, when news of the spread of the new omicron variant of the coronavirus and the prospect of the world closing its borders again sent stocks and several commodities tumbling and caused strong movements in currencies which were changes from prevailing trends.

In the Forex market, the Japanese yen and the euro ended the week as the strongest major currencies week while the Canadian, Australian, and New Zealand dollars were the weakest. If the impact of the omicron variant is as bad as feared, which may be born out by testing over the coming days, this situation is likely to persist.

I wrote in my previous piece two weeks ago that the best trades for the week were likely to be short EUR/USD, and long USD/TRY and wheat. This was a great and exceptionally profitable call as the EUR/USD currency pair fell by 2.08%, USD/TRY rose by 12.35%, while wheat rose slightly by 0.88%. This produced an average profit of 5.10%.

Fundamental Analysis & Market Sentiment

The headline takeaways from last week were:

A coronavirus variant of concern, named the omicron variant, was identified in South Africa and has also been confirmed to be present in some other countries. The variant is heavily mutated, and it is believed that it may have a strong capacity to evade current vaccines. Some countries have already begin closing their borders to non-nationals and enforcing isolation on all new arrivals. As the import of this news broke on Friday, markets made some sharp turns.

U.S. FOMC Meeting Minutes revealed little except that some members wanted to taper faster, but had little effect upon the market, as did Preliminary GDP data which showed the US economy growing at an annualized rate of 2.1%, very slightly below expectations.

The Reserve Bank of New Zealand hiked rates by 0.25% to a rate of 0.75%, but the market saw this as a “dovish hike” because some analysts had expected a 0.50% hike.

WTI Crude Oil fell to a near 3-month low price, dropping by more than 12% on Friday alone.

The South African rand has fallen to 1-year lows, with the already bearish trend accelerating as countries closed their border to South Africa due to the omicron coronavirus variant.

The US stock market made its largest 1-day fall in many months last Friday.

The coming week is likely to see a lot of volatility, with direction likely to be determined mostly by how dangerous the omicron variant is believed to be as more tests are performed on it. Apart from that, the coming week’s major scheduled economic releases will be:

US Non-Farm Payrolls data.

Australian and Canadian GDP data.

British CPI (inflation).

US services and manufacturing data.

Last week saw the global number of confirmed new coronavirus cases rise for the fifth consecutive week after having fallen for two months before that. The situation was already not looking good in Europe before the omicron variant was discovered a few days ago. Approximately 54% of the global population has now received at least one vaccination. Pharmaceutical industry analysts now expect a large majority of the world’s population will receive a vaccine by mid-2022.

The omicron variant has been confirmed as present in South Africa, the UK, Israel, the Czech Republic, the Netherlands, Italy, and Germany.

The strongest growths in new confirmed coronavirus cases overall right now are happening in Andorra, Austria, Belgium, Bolivia, Czech Republic, Denmark, France, Germany, Hungary, Italy, Jordan, South Korea, Laos, Mauritius, Malta, Monaco, Netherlands, New Zealand, Norway, Poland, Portugal, Slovakia, Switzerland, Slovenia, Trinidad, the UK, and Vietnam.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bullish candlestick last week, again making its highest weekly closing price in over one year. The price is above its levels from 3 and 6 months ago, which shows that a long-term bullish trend in the greenback is present. However, Friday’s news sent the greenback falling, and the Index clearly rejected probably resistance overhead at 12238 as shown in the price chart below, so the bullish USD trend may have come to an end, at least for a while. The short-term momentum is certainly bearish.

The best strategy in the Forex market over the coming week will probably be to look for trades driven by other, weaker currencies, and using either USD or ideally JPY as the long counterparty, or maybe a mixture of both.

USD/ZAR

Unless it is quickly discovered that the omicron variant should not be as problematic as feared, it is hard to see how the closing of doors to South Africa is going to have anything other than a negative effect on the Rand over the coming days.

The Japanese yen is stronger than the USD so short ZAR/JPY will probably be a better trade if your Forex broker offers access to it.

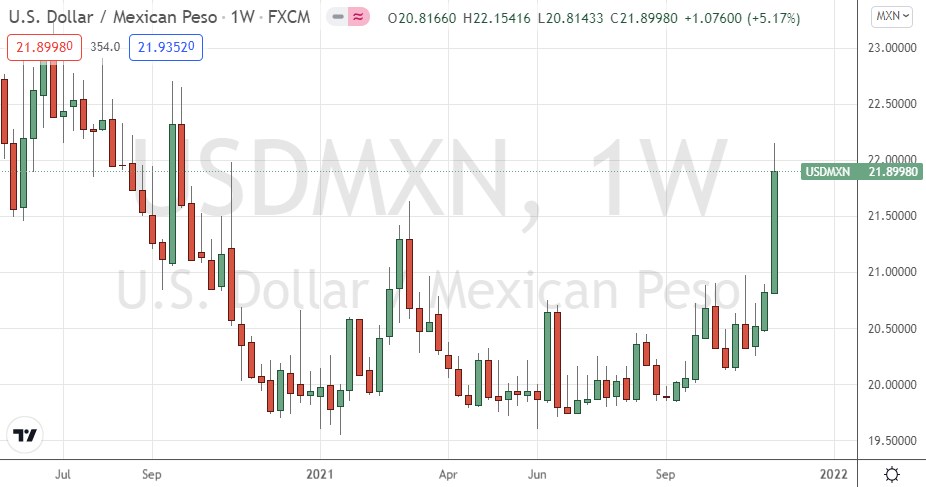

USD/MXN

This exotic currency pair has been in a bullish trend over the past few weeks, due mostly to USD strength. The news of the origin of a potentially dangerous coronavirus variant emerging in South Africa at the end of last week caused many countries to shut their doors on South African and other African travel, and strongly hit the price of Crude Oil on fears of lesser demand, of which Mexico is a major exporter, causing the Mexican peso to nosedive and send this pair sharply higher to a new 1-year high price on strongly above-average volatility.

Unless it is quickly discovered that the omicron variant should not be as problematic as feared, it is hard to see how Crude Oil and henceforth the Mexican peso will not make a further sharp fall over the course of this week.

The Japanese yen is stronger than the USD so short MXN/JPY will probably be a better trade if your Forex broker offers access to it.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be long of USD/ZAR and USD/MXN. If you have access to the JPY crosses in ZAR and MXN, these are likely to be better options provided you are short of ZAR and MXN.