The gold markets broke down significantly on Friday, crashing rather hard early in the day. By slicing through the 50-day EMA, it did catch a lot of people off guard, and it is also worth noting that we broke out of a consolidation range over the last 48 hours. After all, the shooting star from the Thursday session signified the upper part of the range, while the hammer from the Wednesday session signified the lower. Now that we have broken down below the lower area, it is likely that we will continue to break down over the longer term.

Pay close attention to the interest rates in the United States, because as the 10-year continues to rise, that does work against the value of gold in general. This does not necessarily mean that we see a major meltdown, but it certainly means that there could be a significant amount of selling pressure over time we rally. Looking at short-term charts, if we see a certain amount of exhaustion, I would be short of this market, just as I would if we break down below the lows of the Friday trading session.

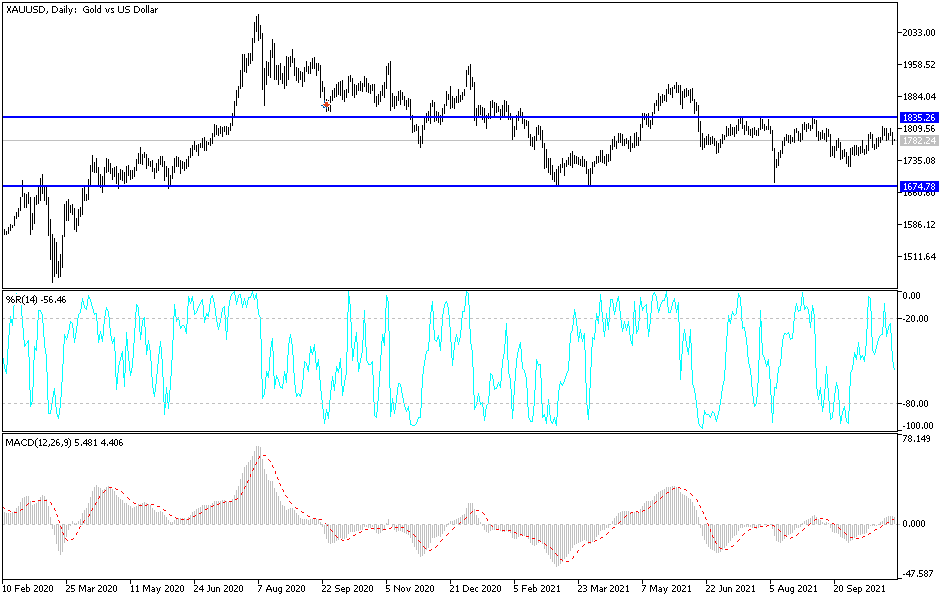

To the upside, you can see that the area right around $1810 has been massive resistance, and if we can break above there then it is likely that we could go looking towards the $1835 level. The $1835 level is a major barrier that has been tested multiple times, so if we were to somehow turn around and break above there, the market is likely to go much higher, perhaps reaching as high as $1900. Obviously, we need to see some type of catalyst or momentum jumping into the market in order to make that happen, and at this point it is difficult to imagine what that would be. However, you need to keep in the back of your mind that it is of course a possibility. However, it looks as if the downtrend line continues to show signs of resiliency, and I think it is easier to short this market than anything else. Pay attention to the US Dollar Index and interest rates coming out the 10-year note, because they do tend to have a bit of a negative correlation to this market.