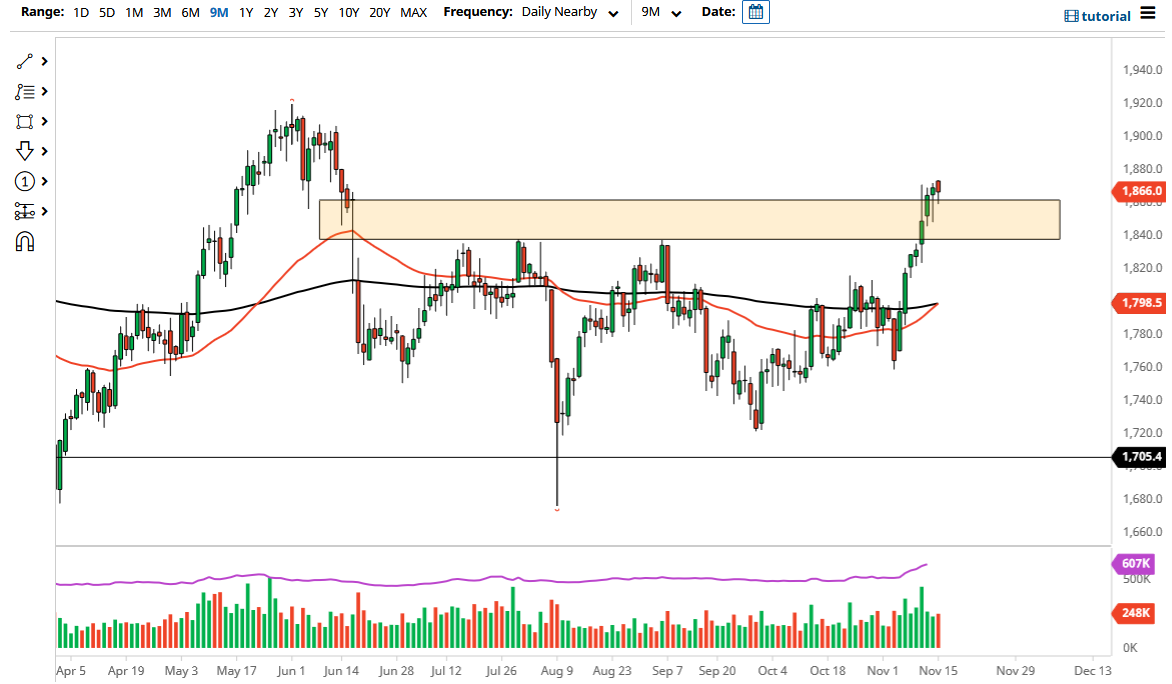

The gold markets have fallen a bit on Monday reaching down towards the $1860 level. This area had been resistance previously, so at this point it will be interesting to see whether or not we have buyers coming in to pick up value. I think gold continues to look as if it wants to go higher, perhaps reaching towards the $1900 level above. In the meantime, I would anticipate that the market probably needs to digest some of these gains for a while, so do not be overly surprised to see more sideways action than anything else.

In fact, as long as we can stay above the previous figure that I was paying attention to in the form of $1835, I think this is a market that continues to find plenty of value hunters. If we were to break down below there, then it is possible that we could get a move to much lower levels, but I would obviously pay close attention to the US dollar, as it does tend to have a longer-term negative correlation to the gold market. Beyond that, you also have to look at the interest rates in the 10-year notes, because if they start to skyrocket, that could work against the value of gold as well. Both of those could be thought of as potential “warning signs” for the gold markets.

If we were to break down below the $1830 level, then I think it is very likely we will go looking towards the $1800 level. While that would be a significant pullback, it is also worth noting that the 50-day EMA is turning around to go higher to break above the 200-day EMA, which forms the technical signal known as a “golden cross”, which a lot of buyers will pay close attention to. In that scenario, gold in theory becomes a bit of a “buy-and-hold situation.”

I would anticipate a lot of choppiness, but I also do not believe that you should jump into this market with a big position, because it is very likely that we need to digest a bit of the froth that currently is making out most of this market. That being said, typically when you see a very impulsive move like this, it is rare that we do not at least get some type of follow-through.