Gold tried to return to $1800 the psychological resistance to compensate for sharp losses that brought it all the way to the support level of $1772. The gold price is stabilizing around the $1795 level as of this writing, and it may remain in a cautious waiting mode and move in narrow ranges until the US Federal Reserve's announcement tomorrow. The price of gold retreated from a weekly loss of 0.8%, but the yellow metal posted a gain of 1.3% in October.

In the same performance, silver, the sister commodity to gold, reached $24.11. The price of the white metal fell more than 2% last week, but rose about 6% last month. Since the beginning of the year 2021 to date, silver prices have fallen by more than 9%.

All global financial markets, from the metals market to the stock arena, are awaiting the Federal Reserve's announcement this week. The US central bank will hold its two-day FOMC policy meeting on Tuesday. The consensus is that the Eccles Building will begin scaling back its $120 billion per month bond-buying program. And if the Eccles building reduces quantitative easing (QE) efforts, it may reduce inflation fears, which will be bearish for metal prices.

For his part, US Federal Reserve Chairman Jerome Powell indicated that the Fed will announce after the policy meeting on Wednesday that it will start reducing monthly bond purchases of $120 billion as soon as this month. These purchases are intended to keep long-term loan rates low to encourage borrowing and spending.

Commenting on this, Ricardo Evangelista, chief analyst at ActivTrades, said in a note to clients: “Inflation remains a concern for US central bank officials, with persistent supply chain issues and high energy prices making a prolonged rise in consumer prices more likely than previously thought.” .

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major rival currencies, was relatively flat at the start of the week's trading, despite jumping 0.3% last week and 0.3% in October. Since the beginning of the year, the DXY has increased by 4.6%. Overall, a stronger US currency gain is bad for dollar-denominated commodities because it makes it more expensive for foreign investors to buy.

The US bond market was mostly in the green yesterday, with the 10-year yield rising 0.028% to 1.584%. One-year bond yields settled at 0.127%, while 30-year yields jumped 0.042% to 1.983%. Higher Treasury yields are also bearish for the metals market because it raises the opportunity cost of holding non-yielding bullion.

For other metals, copper futures fell to $4.3595 a pound. Platinum futures rose to $1063.00 an ounce. Palladium futures rose to $2,066.00 an ounce.

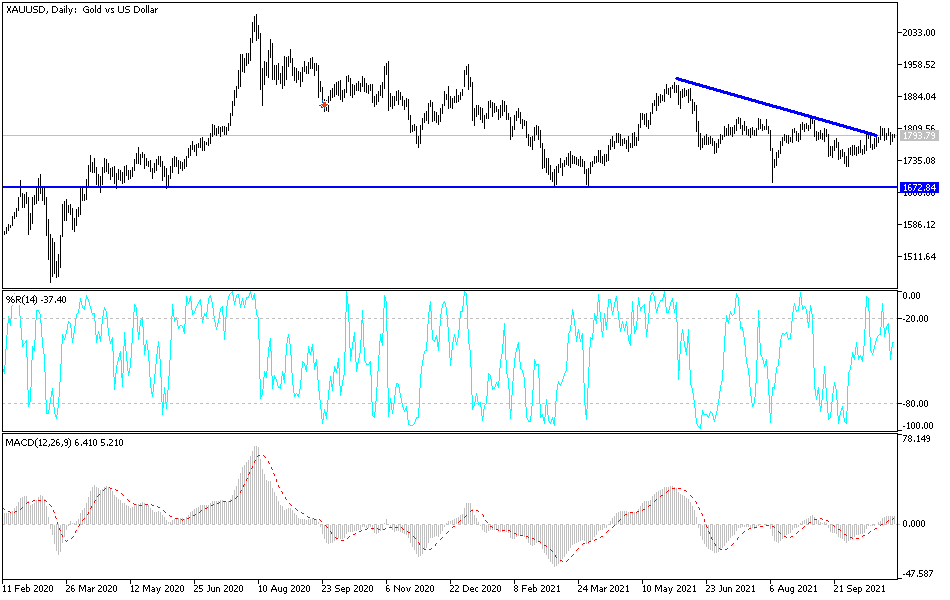

Technical Analysis

Despite the recent performance, gold still has the opportunity to correct upwards, as it is close to testing the $1800 psychological resistance, which is vital for the bullish trend and may increase buying to move strongly upwards. Nevertheless, it must be taken into account that the continued strength of the US dollar amid expectations of tightening the Fed's policy may prevent gold from further progress. Accordingly, the $1770 support will remain crucial for the bears to regain control again.