Gold prices closed slightly higher after a four-session decline, despite the rise of the US dollar and a group of US economic reports that were mostly positive. The price of gold is currently stabilizing around $1793, and the strong sell-offs this week prompted the bears to move towards the support level of $1778, the lowest in three weeks. Today, US markets will be closed for the Thanksgiving holiday.

This week, the price of gold fell through the psychologically important resistance level of $1800 as Treasury yields soared in a holiday week. However, the rise of the dollar created headwinds for the assets pegged to the dollar. The US dollar index DXY, which measures the performance of the US dollar against a basket of six major competing currencies, rose 0.4% and is heading towards weekly gains of 0.9%, to move the index to its highest level since the summer of 2020.

A strong dollar can make currency-priced assets, such as gold, more expensive for foreign investors.

This week economic data showed US durable goods orders fell in October, weekly jobless claims reached their lowest level since 1969, international trade in goods fell 14.6% in October, and gross domestic product rose at a slightly revised annual rate of 2.1% in the third quarter.

Other data also highlighted historically high levels of US inflation, as the measure of the cost of goods and services jumped 0.6% in October, based on an index of personal consumption expenditures or personal consumption expenditures, and rose 5% over the past year from 4.4% in September. This was the highest level since December 1990. The PCE index is the Fed's preferred inflation indicator.

Investors were factoring in a more hawkish approach to 2022 from newly re-nominated Federal Reserve Chairman Jerome Powell, and the latest batch of data showing continued economic strength. Commenting on this, Jim Wyckoff, chief analyst at Kitco.com, said in a note to clients: “The bulls have faded this week and need to step up and show strength very soon to avoid serious technical damage in the near term.”

Investors are unlikely to re-enter gold into long long positions near the holiday, Jeffrey Haley, chief market analyst at OANDA, added in a note to clients. “Momentum will be muted and that means the $1835.00-$1850.00 area will cap gains this week, although I would be surprised if we even get to $1810.00 an ounce,” he said. “If US yields remain strong this week, gold will be vulnerable to further losses."

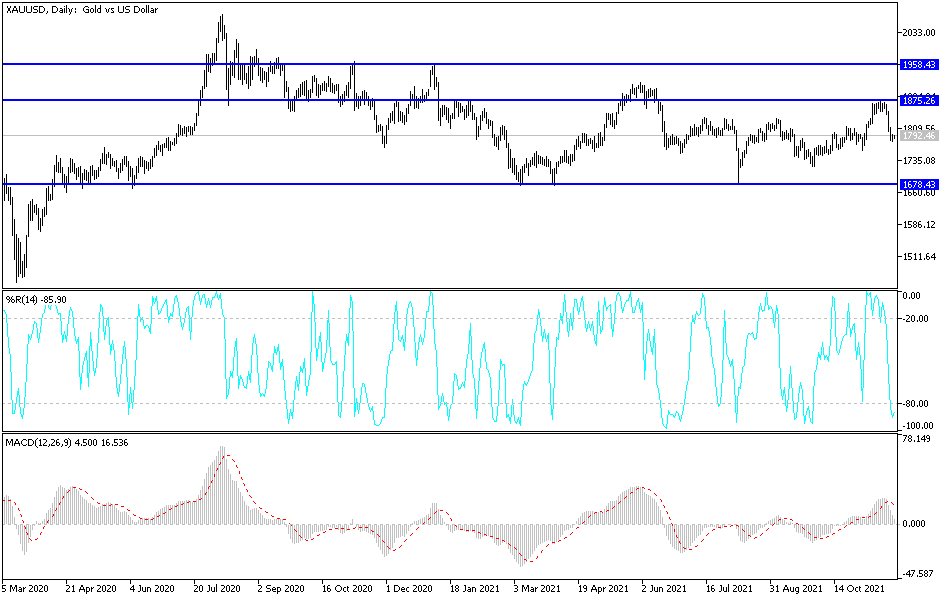

Technical Analysis

Despite the recent performance of gold, pushing below the crucial $1800 support for the bulls, gold investors are looking for new buying levels, as the factors for its gains are still valid. However, the strength of the US dollar prevents the yellow metal from benefiting from those gains. Corona waves and restrictions may impede the course of the global economic recovery and affect the desire of central banks to tighten monetary policy. I think that the most appropriate buying levels for gold are currently $1782, $1768 and $1750 dollars.

On the upside, stability above the $1800 resistance will remain important for the bulls because it stimulates buying and therefore a move higher. The closest targets for the bulls after that will be $1819, $1827 and $1845. The US holiday today may weaken the liquidity in the markets and therefore the metal may move in narrow ranges in response.