Gold is about to collapse as the US dollar rises, with Federal Reserve Chairman Jerome Powell getting another term as head of the world's most powerful financial institution. This is another example of the rollercoaster ride that gold markets have suffered in 2021. Gold futures are down more than 2.06%, hitting $1,802.50 before the price of gold settled around $1,806 at the time of writing. Gold prices fell about 2% last week, but are still on track to post a tepid monthly gain of 0.65%. Gold is still down more than 4% YTD.

As for the price of silver, the sister commodity to gold, it is also dropping, reaching $24.36 an ounce. The white metal fell 3% last week and is heading for a decline in November of about 1%. Since the beginning of the year 2021 to date, silver prices have fallen by more than 8%.

Yesterday, US President Joe Biden announced that he would choose Jerome Powell for a second term for the US Federal Reserve. He also confirmed that he would choose Lael Brainard for the position of Vice Chairman of the Federal Reserve. "As I've said before, we can't go back to where we were before the pandemic, we need to rebuild our economy better, and I am confident President Powell and Dr. Brainard's focus will be on keeping inflation low, prices stable, and full employment making our economy," Biden said in a special statement.

The nominations will now go to the Senate for approval.

This announcement supported the stock market as investors may not now need to deal with a different approach to monetary policy. The US dollar also rose to its highest level in more than a year on Monday. The US dollar index (DXY), which measures the performance of the US currency against a basket of six major competing currencies, rose to 96.45, from an opening at 96.04. The index was one of the hottest currencies in 2021, rising about 7.25% year-to-date. The strongest bearish price for dollar-denominated commodities is because it increases the cost of purchasing them for foreign investors.

Commenting on this, Jim Wyckoff, chief analyst at Kitco.com, wrote in a daily note: "Major overseas markets today see the US Dollar Index slightly above and not much below last week's 15-month high."

The US Treasury market was strong across the board, with the benchmark 10-year bond yield rising to 1.586%. One-year yields rose to 0.175%, while 30-year yields rose 0.031% to 1.938%. The high rate environment is also detrimental to metals because it increases the opportunity cost of holding non-yielding bullion.

In other metals markets, copper futures fell to $4.377 a pound. Platinum futures fell to $1029.00 an ounce. Palladium futures fell to $2,042.00 an ounce.

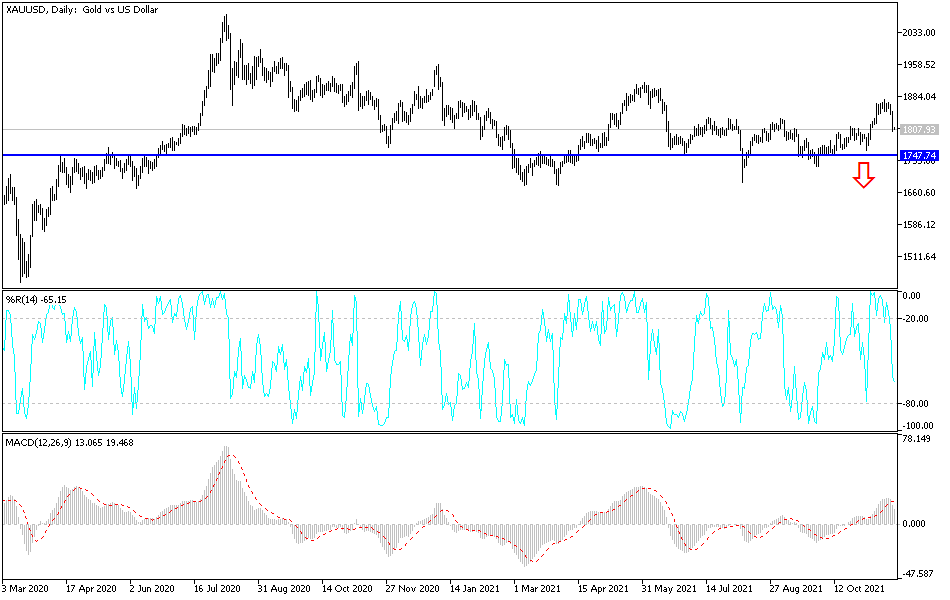

Technical Analysis

There is no doubt that a move down to the psychological support level of $1800 - the psychological resistance previously - will motivate gold traders to think about buying. I still prefer buying gold from every support level, the closest of which are $1795 and $1780. On the other hand, breaking through the resistance of $1820 will motivate the bulls to return to the upside trajectory, as the resistance will increase buying.

COVID restrictions will be an incentive to buy gold as a safe haven again.