The bullish performance of gold continues despite the strength of the US dollar. Gold's gains topped $1870 at the beginning of this week’s trading, before the gold price settled around $1865 as of this writing. The US dollar stabilized against the major currencies after giving up some of its gains in the last session on the back of weak consumer confidence data. Gold futures gained nearly 3% last week.

Gold prices have risen for seven consecutive sessions amid mounting inflation fears after data showed that US consumer prices posted their biggest jump in more than 30 years last month and fueled speculation that the US central bank could start raising interest rates by mid-2022.

A report from the New York Federal Reserve yesterday showed that manufacturing activity in New York grew strongly in the month of November. The New York Fed said its general business conditions index jumped to 30.9 in November from 19.8 in October, with a positive reading pointing to growth. Economists had expected the index to rise to 21.6. Meanwhile, the report said companies were less optimistic about the six-month outlook than they were last month, with the index of future business conditions slipping to 36.9 in November from 52.0 in October.

On the other hand, despite the American dispute with China, US and Japanese officials agreed to start talks aimed at settling a dispute over US tariffs on Japanese steel and aluminum imports. Japanese officials said that the agreement came in a meeting between the visiting US Secretary of Commerce Gina Raimondo and the Japanese Minister of Economy, Trade and Industry Koichi Hagiuda.

Japan hopes to persuade Washington to raise the tariffs it imposed during the administration of President Donald Trump.

The United States recently resolved a similar dispute with the European Union in a deal officials said addressed excess capacity that could distort the steel market. It reconstructed a rift across the Atlantic Ocean and aims to create a framework to reduce the carbon intensity of global warming steel and aluminum production. Trump ordered additional tariffs, 25% on steel imports and 10% on aluminum, in March 2018, stressing that they would protect American jobs and national security.

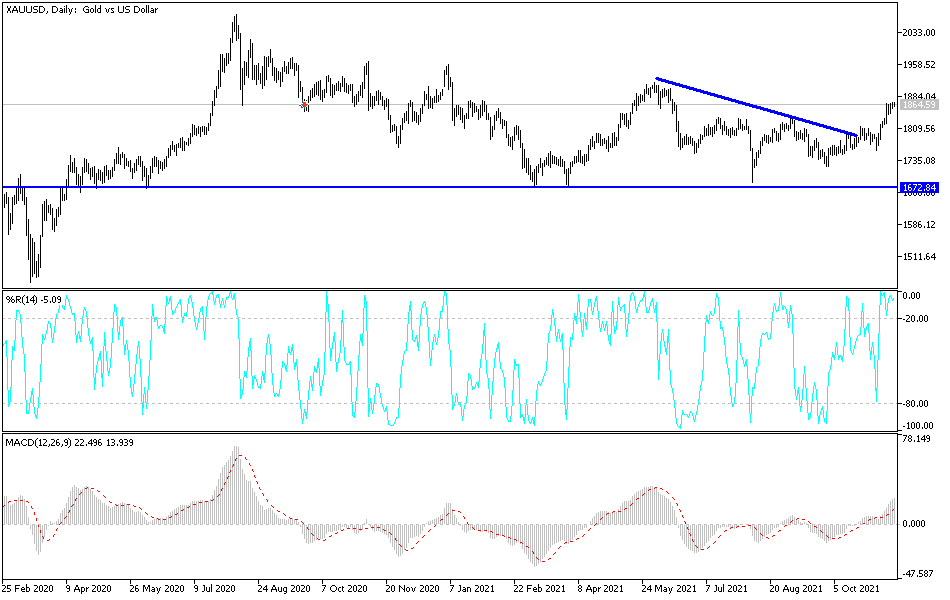

Technical analysis

There is no change in my technical view of the price of gold. The stability of the gold price above the psychological resistance of $1800 will continue to support the continuation of the bullish trend, which will not change without breaking down below that level. The continued fears of the markets and investors towards COVID, which may disrupt global economic recovery, in addition to the strength of the dollar, are all factors that will affect gold in the coming days, not to mention the path of the policies of global central banks.

The closest targets for the bulls are currently $1878 and $1900. It is enough to push the technical indicators towards strong overbought levels, which warns us that profit taking can occur at any time. The US dollar, as well as the price of gold, will be affected today by the announcement of US retail sales figures.