After selling off due to the recovery of the US dollar, the gold price fell to the support level of $1778, but with the emergence of the new variant from South Africa, European countries re-imposed restrictions, despite the strong vaccination rate. This led to investors buying safe havens again, with gold being the most important of them. Last Friday, gold moved strongly to the resistance level of $1815 before starting the week's trading, stabilizing around the $1,795 level. Financial markets and investors are monitoring the extent of the variant's spread, strength and resistance to globally approved vaccines and countries' decisions to contain.

The price of gold fell after some concerns about the Omicron coronavirus strain eased, boosting risk appetite even as the World Health Organization urged caution. Two South African health experts, including the doctor who first sounded the alarm about Omicron, have suggested that the variant presents with mild symptoms so far. But the World Health Organization said on Sunday that it would take time to assess the severity of the new strain and that the initial infections reported were among college students, with younger patients showing milder symptoms.

Gold bullion wiped out its rally in November and almost returned to where it started the month as investors weighed the possibility of the US Federal Reserve removing policy support at a faster pace to keep inflation in check, with the potential impact of Omicron on the global economic recovery. Atlanta Fed President Rafael Bostic played down the risk of the new shape of the US economy.

The price of platinum rose by 2.4%, while the price of silver advanced by 0.7%, and the price of palladium rose by 0.9%.

Despite global concerns, the emergence of the omicron variant has not altered New Zealand's plans to ease restrictions in Auckland and move the nation into a new and more open phase of its response to the pandemic, Prime Minister Jacinda Ardern said on Monday. Bars, restaurants and gyms in Auckland can reopen from late Thursday, ending a coronavirus shutdown that began in August.

Across the country, a new "traffic light" system will put an end to lockdowns, but people will need to be fully vaccinated to ensure they can take part. On Sunday, New Zealand imposed travel restrictions from nine South African countries in response to the Omicron threat. Ardern said she does not expect any further restrictions. She added that as the new variant is studied further, New Zealand will continue to do basic things such as contact tracing, isolating infected people and requiring mask use in some settings.

On the contrary, Australian authorities on Monday announced a third case of the omicron variant COVID-19 as government leaders reconsidered plans to ease border restrictions this week. In this regard, Northern Territory Health Minister Natasha Phyllis said that a South African man in his thirties who traveled from Johannesburg to the northern Australian city of Darwin last Thursday tested positive for the new variant at Australia's safest quarantine facility in Howard Springs. On Sunday, New South Wales state authorities reported that two travelers from South Africa to Sydney had become the first case of Omicron in Australia. Both were fully vaccinated and had no symptoms and were in quarantine in Sydney. For his part, New South Wales Premier Dominic Beirut said today that there may be a third case of omicron in the most populous state in Australia.

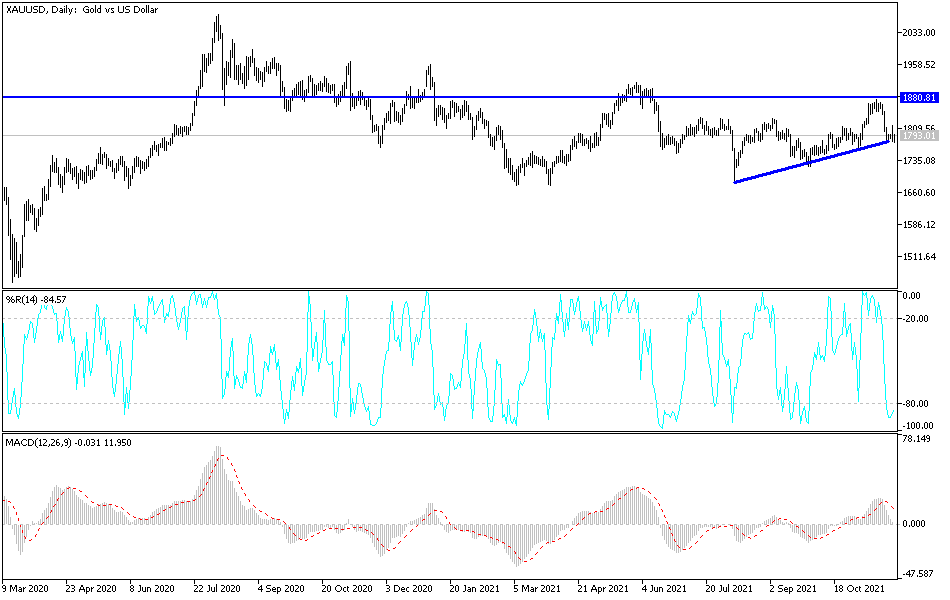

Technical Analysis

If gold moves above the psychological resistance of $1800, it will increase buying to launch strongly upwards, and the next resistance levels may be $1819, $1829 and $1845 dollars, which enables the bulls to control the performance longer term. On the downside, breaking down below the $1775 support is important for the bears to control the trend, but I still prefer buying gold from every descending level, as global concern about the new Corona variant may impede the plans of global central banks to further tighten their monetary policy, which will be a better opportunity for gold to be stronger.

This week, the gold market is expecting the testimonies of US Federal Reserve Chairman Jerome Powell and the announcement of US job numbers. This is in addition to the path of the spread of the new Corona variant.