For the third day in a row, gold futures contracts continue to rise, especially with the breach of the psychological resistance of $1800. We mentioned before that this level is crucial for a bullish outlook and to move to stronger levels. The price of gold is stable around $1820 as of this writing. The yellow metal held its gains despite the strong US jobs report for the month of October. In general, gold prices benefit from a weaker US dollar and lower Treasury yields. With monetary policy clearly moving forward, can the metallic commodity maintain its upward trajectory?

The price of gold recorded a weekly gain of about 2%, to reduce its loss since the beginning of the year 2021 to date to less than 5%.

Silver, the sister commodity to gold, crossed the $24 mark on Friday. Silver futures rose to $24.12 an ounce. Accordingly, the price of the white metal achieved a weekly gain of 0.65%, but it is still down about 9% so far this year.

In October, the US economy added 531,000 jobs, beating the median estimate of 450,000 jobs. The country's unemployment rate also fell to 4.6%. But market analysts say gold prices have likely picked up due to the weak labor force participation rate, which has remained steady below 62%. Market watchers also note that investors are focusing on inflation data. During this week, the Consumer Price Index (CPI) and Producer Price Index (PPI) will be released. The market expects a PPI of 8.7% and a CPI of 5.8% - both above September's readings.

Currently, investors are expecting gold prices to trade in the $1,770 and $1,800 range.

Peter Cardillo, chief market economist at Spartan Capital Securities, said in a note. “However, with the Fed now on its way to paving the way for monetary tightening next year, the gold market is likely to remain boring at best.”

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major currencies, fell to 94.25, from the opening of 94.34. A weak currency is beneficial for dollar-denominated commodities because it makes them cheaper to buy for foreign investors. Another factor affecting the gold market was the US Treasury market mostly in the red, with the benchmark 10-year yield dropping to 1.457%. One-year bond yields fell to 0.145%, while 30-year yields fell to 1.89%. Low yields are considered bullish for the metals market because it reduces the opportunity cost of holding non-yielding bullion.

Relative to the prices of other metals, copper futures rose to $4,343 a pound. Platinum futures rose to $4,344 per pound. Palladium futures fell to $2,032.00 an ounce.

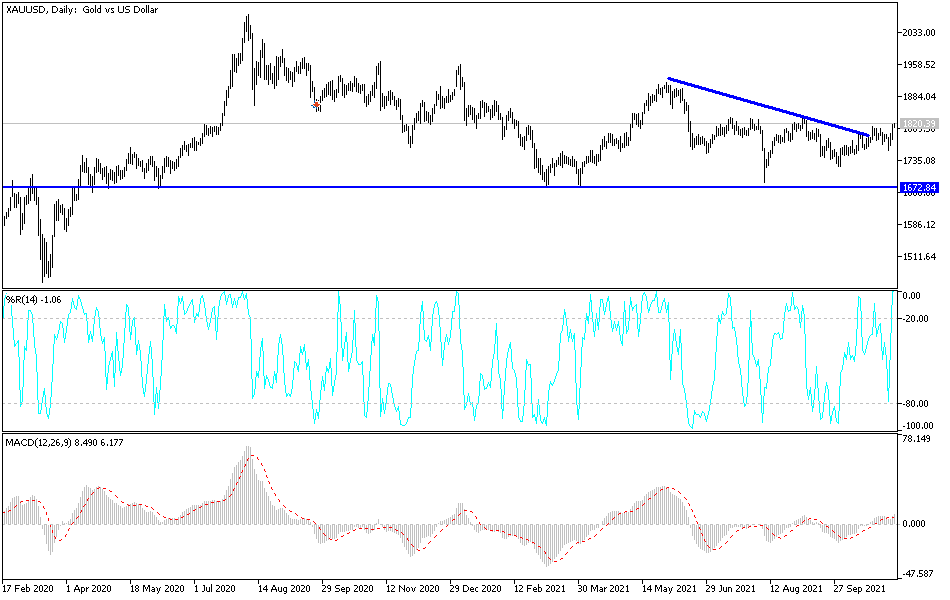

Technical Analysis

The price of gold is proceeding according to what we expected, as stability is above the psychological resistance of $1800, which still supports the dominance of the bulls. Gold is moving towards the levels that we expected before: first $1819, then $1827 and then $1845. This may happen if pressure continues on the US dollar and investors’ fears increase about the upcoming waves of the epidemic, which threaten the path of global economic recovery. The situation in China is not reassuring, especially with the winter season coming.

On the downside, there will be no change in the general trend of the bullish gold price without moving towards the support level of $1775 again. The US dollar, as well as the price of gold, will be affected by the statements of US Federal Reserve Chairman Jerome Powell later today, as well as statements by a number of bank officials.