The US dollar has taken a strong position ahead of the FOMC announcement today, which will negatively affect gold, which fell to the support level of $1780 as of this writing. The US Federal Reserve, which will reveal its policy decision later today, is widely expected to announce plans to gradually begin reducing its $120 billion monthly bond purchases by mid-November or December. The language of the Fed's statement will likely be in focus as traders look for clues about the interest rate outlook amid concerns about rising inflation.

The Bank of England meeting takes place on Thursday, with think tanks divided over the direction the interest rate decision will take.

Earlier this week, the Reserve Bank of Australia kept its benchmark interest rate at a record low 0.1% for the 12th consecutive month but dropped one of its key stimulus measures, known as "yield curve control," suggesting borrowing costs may have risen faster than expected.

Wall Street has focused on the steady stream of corporate profits over the past few weeks. The results helped drive gains for the major indicators after a volatile summer when COVID-19 cases surged. That wave has since subsided, but rising inflation as the economy recovers remains a major concern.

Investors are awaiting the latest comments from the Federal Reserve as it presses ahead with its plans to ease the extraordinary support measures put in place at the start of the pandemic to support markets and the economy.

US Federal Reserve Chairman Jerome Powell has indicated that the Fed will announce after today's policy meeting that it will start reducing monthly bond purchases of $120 billion as soon as this month. These purchases are intended to keep long-term loan rates low to encourage borrowing and spending.

The recovery of the labor market has been a major focus of the US central bank. The job market has been improving, but has mostly lagged behind the rest of the economic recovery as people are reluctant to return to work despite the abundance of job opportunities. Investors will get another update on Friday when the Labor Department releases the US jobs report for October.

The central bank's plan to cut its bond purchases also comes as businesses and consumers struggle with rising prices for raw materials and finished goods. Supply chain problems reduce companies' financial resources and push companies to raise prices.

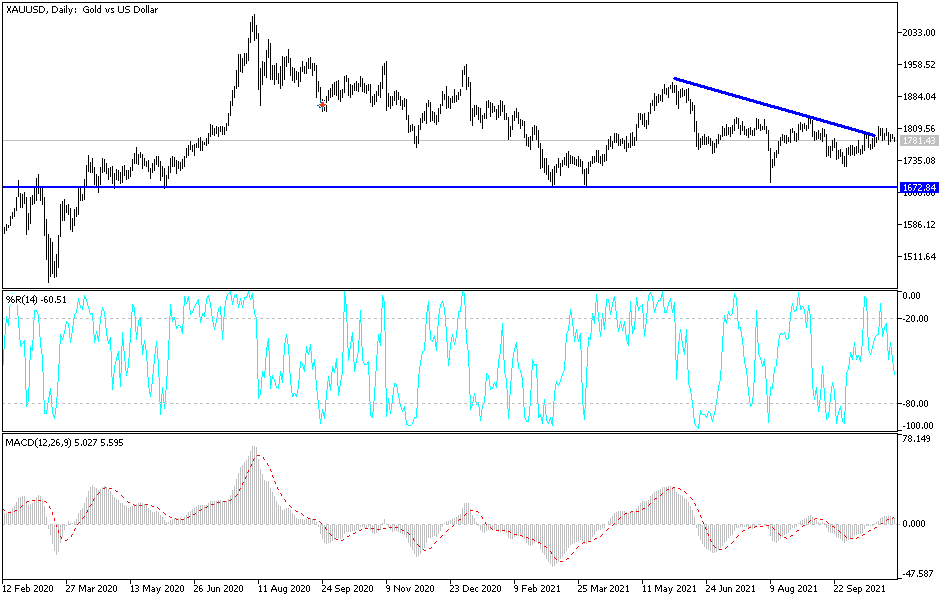

Technical Analysis

Despite the recent performance, the price of gold is still in a relatively neutral position, and the tendency will be more bullish if it returns to the vicinity of the psychological resistance of $1800 again. On the downside, if the bears move towards the $1775 support again, then the support level of $1745 is not ruled out, or less than that if the current strength of the US dollar continues and risk appetite increases. You must be careful and make trades before the announcement of the US Federal Reserve, which may cause a strong fluctuation in performance that may be reflected in your trades before the announcement. Learn about the event and reaction and then hunt for your bargains.