I expected that gold may decline with the announcement of the US Federal Reserve, and indeed gold fell to $1758. A week before the announcement, we recommended considering buying gold at $1759. Before the bank's announcement, there were data that showed a sharp jump in US private sector employment in October, which weighed on gold prices.

Markets are also looking forward to the BoE policy announcement due on Thursday.

Federal Reserve Chairman Jerome Powell said officials can be patient about raising interest rates - after announcing they will start reducing their bond purchases - but will not hesitate to take action if inflation requires it. "We think we can be patient," he said at his press conference. He said this after the FOMC said it will cut $15 billion per month starting in November.

Powell added by saying that the scaling "does not imply any direct indication in terms of our interest rate policy," noting that the pace puts them on track to finish the process by mid-2022 but could speed up or slow down depending on the economic outlook. The Fed will reduce Treasury purchases by $10 billion and mortgage-backed securities by $5 billion, marking the beginning of the end of a program aimed at shielding the economy from COVID-19. The FOMC decided to keep the target range for the benchmark interest rate at zero to 0.25 percent. The decision was unanimous.

"We don't think this is the right time to raise rates because we want to see the labor market recover more," Powell said.

The Fed was buying $80 billion in Treasuries and $40 billion in MBS each month to help spur economic activity that was crushed in the initial pandemic shutdown and the subsequent uneven recovery.

A report from the payroll processor ADP showed that private sector employment in the US increased more than expected in October. The ADP said private sector employment jumped by 571,000 jobs in October after rising by a revised 523,000 jobs in September. Economists had expected employment in the private sector to increase by 400,000 jobs compared to the addition of 568,000 jobs originally reported for the previous month.

US jobs data for October, including non-farm payrolls, will be released on Friday.

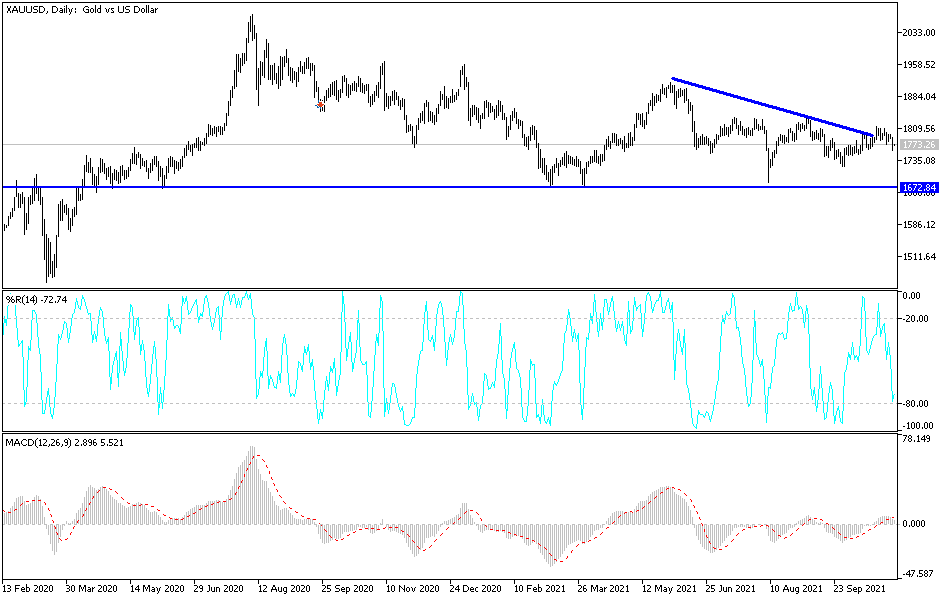

Technical Analysis

There is no doubt that the recent decline in the price of gold raises the question about the appetite of gold investors to think of buying the metal. The question now is: from which levels can this be done? On the daily chart below, the most important levels are highlighted in the areas of $1745, $1730 and $1710. On the upside, the psychological resistance of $1800 will remain vital for the bulls to control the trend, which may happen if the price returns to the vicinity of the $1785 resistance.

The price of gold today will be affected by risk appetite, the US dollar and the reaction to the Bank of England's announcement of its monetary policy decisions. I still prefer buying gold from every bearish level. COVID and what is happening in China will be catalysts for buying the yellow metal as a safe haven.