The US dollar recovered with the end of last week's trading, leading to the selling of gold, which moved to the $1843 support level before closing around $1846. In the same week, the price of gold jumped towards the resistance level of $1877, its highest in five months. Despite the decline, the price of gold is still gaining momentum due to increasing inflation concerns and investor fears about new infections with the Coronavirus and the return of restrictions. The price of the yellow metal recorded a weekly decline of 0.3%, but it decreased by only 2% since the beginning of the year until now after declining by 9% over the year.

As for the price of silver, the sister commodity to gold, it is trying to climb back above the $25 an ounce high. Tprice of the white metal suffered from a weekly loss of 1.7%, in addition to its decrease since the beginning of the year to date by about 6%.

New lockdowns in Europe and rising inflation problems were passed after social policy and climate change components of the "Build Back Better" plan were passed Friday morning, despite the Congressional Budget Office (CBO) warning that it would add $367 billion to the federal deficit. However, gold prices could not take full advantage of these conditions as the US dollar also rose by the end of the trading week. The US Dollar Index (DXY) rose 0.3% to 95.83, from an opening at 95.59. Accordingly, the index moved to achieve weekly gains of about 0.7%, which increases its year-to-date rise to 6.6%.

Financial markets watch inflation levels, and a strong currency is detrimental to dollar-denominated commodities because it makes them more expensive to buy for foreign investors. The US Treasury market was mostly in the red, with the 10-year yield falling to 1.534%. One-year yields fell to 0.147%, while 30-year yields fell to 1.918%. Low bonds are bullish for metals because they reduce the opportunity cost of holding non-yielding bullion.

Analysts suggest that gold markets may await new clues on how the Federal Reserve will respond to aggressively rising inflation. "Inflation is the economic wind of a massive commodity fire," Adam Koese, president of Libertas Wealth Management Group, told clients, adding, "I don't see it ending any time soon."

In other metals markets, copper futures rose to $4.3945 a pound. Platinum futures fell to $1,044.00 an ounce. Palladium futures fell to $2,083.00 an ounce.

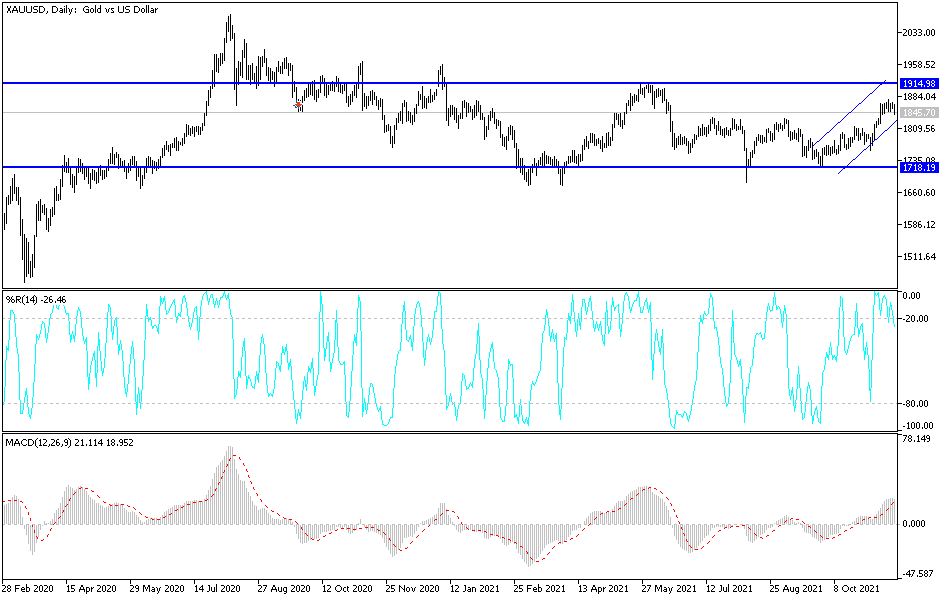

Technical Analysis

In the near term, and according to the performance on the hourly chart, it appears that the price of the yellow metal has recently completed a bearish breakdown forming a neutral channel. As a result, the XAU/USD price fell to trade near the oversold levels of the 14-hour RSI. Therefore, the bulls will target potential recovery profits at around $1,855 or higher at $1,864. On the other hand, the bears will look to extend the current decline towards $1835 or lower to $1826.

In the long term, and according to the daily chart, it appears that the price of gold is trading within the formation of an ascending channel. This indicates a significant long-term bullish momentum in market sentiment. However, the price has recently pulled back to find trend line support. Therefore, the bears will target potential channel breakout profits at around $1,813, or less at $1,780 per ounce. On the other hand, the bulls will target long-term profits at around $1,876 or higher at $1,908 an ounce.