For the second day in a row, gold is stabilizing around $1870 after recent sell-offs that pushed the price of gold to $1850 in this week's trading. Global inflation fears continue to support the yellow metal. Meanwhile, the US Dollar Index has retreated slightly from its highest level since July of 2020, providing additional support to gold prices.

Gold prices rose after falling 0.7% as strong US economic data provided a boost to the US dollar and somewhat dampened demand for safe haven currencies. Economists and analysts see inflation concerns and the realization that inflation is not really under control and not just in the financial markets when it becomes a problem that major retailers tackle, as the market looks for more clarity. Accordingly, gold has responded by moving higher and creating higher levels of support over the past month or so.

In US economic news, US homebuilders began building homes at a seasonally adjusted annual rate of 1.52 million in October, down 0.7% from the previous month, the US Census Bureau reported. Commenting on this, Jeff Wright, chief investment officer at Wolfpack Capital, said the decline was "partly due to higher inflation in materials used to build homes." "Inflation is all around us and gold is benefiting." And “inflation is all around us and gold is benefiting.”

This week, data on Tuesday showed that US retail sales jumped 1.7% in October, marking the biggest gain since March. However, inflation also appeared in the retail sales figures, supporting the price of gold, which is seen as a hedge against inflation. In the same vein, analysts at Sevens Report Research wrote in their news release on Wednesday: "The recent rise in inflation expectations supports the rise in gold as real interest rates continue to decline. However, if inflation peaks in the coming months as most central bankers continue to forecast, real rates are likely to fall to lower levels and prospects for new record highs for gold will fade. For those riding the latest rallies in gold, the trend remains bullish and dips to $1800 are likely to be good buying opportunities for a lower long time frame.”

Investors will look to a round of speakers from the Federal Reserve this week for further guidance on the health of the US economy, the pace of the current reduction in monthly purchases of Treasuries and mortgage-backed securities, and the timing and pace of US interest rate increases, which could also affect global asset prices like gold.

In this regard, John Williams, President of the Federal Reserve Bank of New York, said, according to a report by Reuters, that the markets need to strengthen to prepare for the next big shock. Other speakers Thursday include Daley, Atlanta Fed President Raphael Bostic and Chicago Fed President Charles Evans.

Commenting on this, Naim Aslam, chief market analyst at AvaTrade wrote, “What we want to hear from them is a coherent message regarding monetary policy. So far, the Fed Chairman has said there is no rush to increase the interest rate and market players are not expecting any interest rate until the third quarter of next year.”

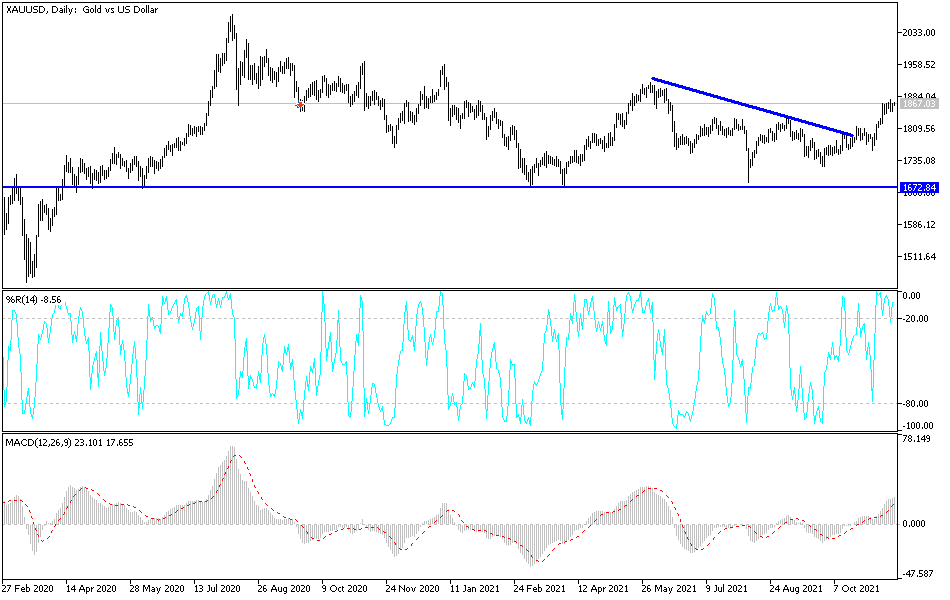

Technical Analysis

The general trend of the gold price is still bullish. The recent gains for gold pushed the technical indicators towards strong overbought levels, but its continued gains may support a move towards the next psychological resistance of $1900 in case it settles again above the $1875. Fears of corona waves, the energy crisis and supply chains, which may disrupt the global economic recovery, and the US/Chinese conflict are important factors for gold bulls. In contrast, the global central banks’ coordinated action to tighten policy and raise interest rates to stop inflation will stop gold’s gains.

So far, I still prefer buying gold from every bearish level, with the closest bearish targets at $1848 and $1830.