For the third consecutive day, gold showed strong bearish momentum, which pushed it to the $1782 support level, a 3-week low, before settling around $1796 as of this writing. The strength of the US dollar negatively affected the price of gold and the strength of the US currency increased amid expectations that the Federal Reserve will start raising interest rates starting in the middle of 2022. After US President Joe Biden nominated Fed Chairman Jerome Powell for another term, the markets are preparing for a more hawkish monetary policy in the near future.

In the same performance, silver futures contracts ended trading lower at $23.435 an ounce, while copper futures settled at $4.4235 a pound.

Fed Chairman Powell has been supportive of taking measures to help combat high inflation. His candidacy provided a little more legitimacy to market pricing in terms of policy tightening next year. Traders were also betting on a rate hike from the European Central Bank next year after ECB policymaker Francois Villeroy de Gallo said on Monday that the central bank was "serious" about ending its emergency bond purchase program in March and might not need to expand the scope of regular asset purchases to cover the shortfall.

Separately, board member Isabel Schnabel said today that inflation risks are skewed to the upside and that plans to end pandemic emergency bond purchases remain in place.

New COVID infections in South Korea exceeded 4,000 cases in one day for the first time since the beginning of the epidemic as the spread of the disease continued to be led by the country's delta variable after it eased social distancing in recent weeks to improve its economy. Most of the 4,116 new cases reported on Wednesday came from the capital, Seoul, and the surrounding metropolitan area, the Korea Disease Control and Prevention Agency said, where an increase in hospitalizations has created concerns about a possible shortage of intensive care units.

The death toll in the country has now reached 3,363, after 35 patients died of the virus in the past 24 hours. And 586 patients in serious or critical condition also achieved a new high.

South Korea is the latest country to see a spike in infections and hospitalizations after easing social distancing measures amid high vaccination rates. Cases in the United States also rose ahead of Thanksgiving weekend, while Austria went into a major lockdown on Monday as the wave of the virus spread across Europe.

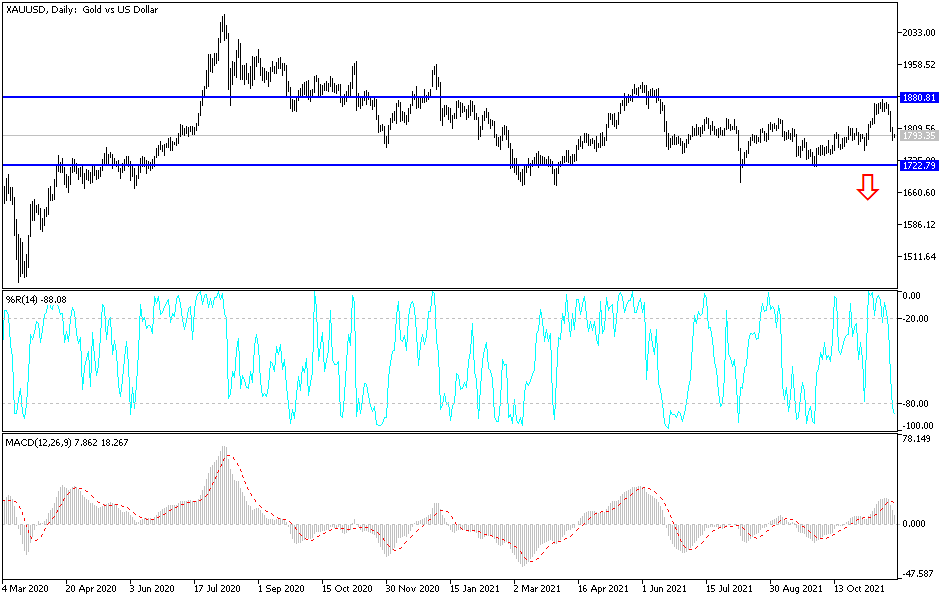

Technical Analysis

According to the performance on the daily chart, the bulls’ control over the price of gold will not return without moving above the psychological resistance of $1800, because it may stimulate buying and push gold towards stronger resistance levels, the closest of which are $1819, $1827 and $1845. It is enough to push the gold price out of its current descending channel. On the downside, the closest support levels for gold are currently $1785, $1770 and $1755. I still prefer buying gold from every bearish level.

The price of gold today may be subject to strong fluctuation in response to US economic data, including the growth rate of the gross domestic product, orders for durable goods, reading the number of weekly jobless claims, reading the personal consumption expenditures price index, the preferred measure of the Federal Reserve to measure US inflation, and the content of the minutes of the last meeting of the US Federal Reserve.