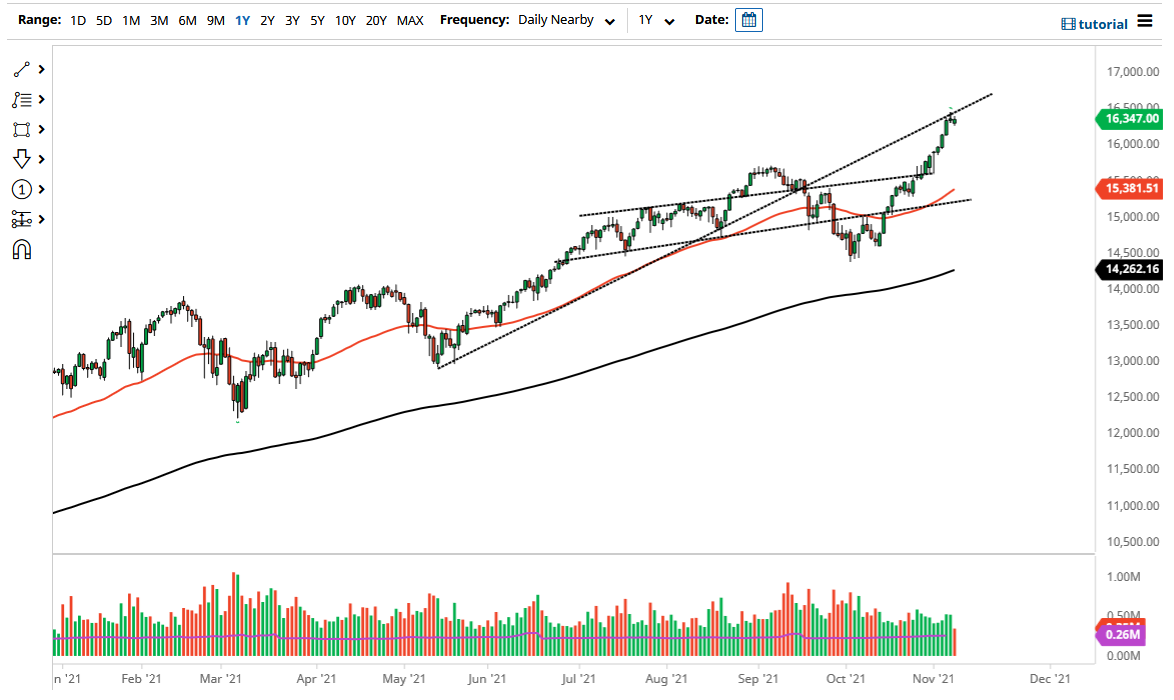

The NASDAQ 100 pulled back just a bit on Monday after forming the shooting star during the day on Friday. Quite frankly, this is a market that has been a bit overdone for a while, so a pullback makes sense. At this point, the 16,000 level should be an area where we could see a little bit of psychology come back into the market. That being said, the 15,650 level could offer quite a bit of support due to the fact that it was previous resistance, so a certain amount of “market memory” could come into the picture.

After that, the 15,380 level features the 50-day EMA which is starting to rise quite drastically, and I think it is likely that we will eventually see buyers coming into pick up bits and pieces of value along the way. At this point, I think what we are seeing is an opportunity for the market to pull back, only to find more value hunters out there. The market continues to see a lot of over-extension, and it is in desperate need of some type of pullback in order to continue the uptrend. The higher we go, the more dangerous this market becomes.

The overall attitude of the market is one that is bullish, but I would like to see about a 50% pullback. The market would cheer that on, but at this point there is a lot of “FOMO” creeping into the market as well. In fact, you can make an argument that it has been the main driver of the markets over the last week or so. When you look at this chart, you can see that there is only one red candlestick over the last three weeks or so, which is beyond ridiculous. Chasing the trade at this level is a great way to lose a lot of money, and that is something that I have no interest in doing. Because of this, I think a lot of people are in the same boat as I am, simply waiting for an opportunity to pick up the market “on the cheap.” With this, a simple approach of being patient with the market probably pays off the most drastically over the longer term.