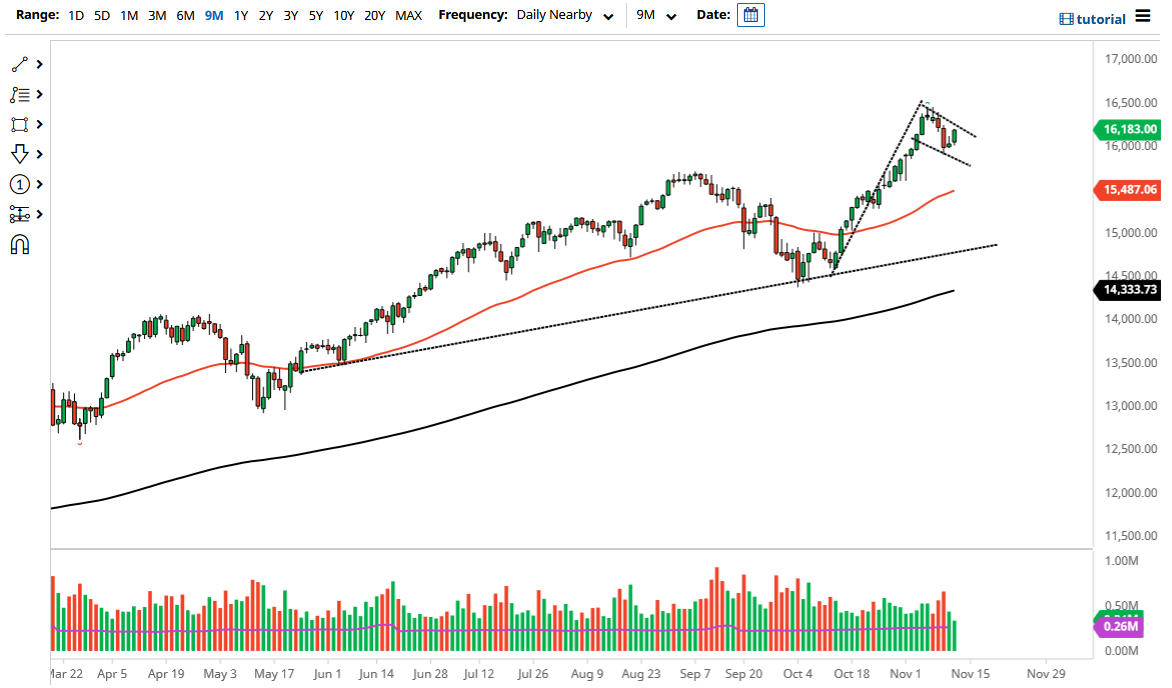

The NASDAQ 100 rallied significantly on Friday and closed towards the top of the range as it shows a proclivity to continue going higher. Furthermore, the Thursday candlestick ended up forming a bit of an inverted hammer, and we break the top of it, suggesting that a lot of stops have been run through. The NASDAQ 100 will more than likely continue to outperform many of the other indices in the United States, so I do not necessarily believe that it is one that you can short anytime soon. The bullish flag that we have been forming looks like it is still very much intact, and it is probably only a matter of time before we break out.

The 50-day EMA is sitting just below the 15,500 level, and seems to be curling a little bit higher. The 50-day EMA will have a certain amount of support attached to it due to the psychology, and therefore I think it is only a matter of time before any dip would be bought into. The NASDAQ 100 is only moved by a handful of stocks, such as Tesla, Microsoft, and Apple. In other words, pay attention to all the ones everybody talks about, because if they start to recover, then it makes sense that the NASDAQ 100 would as well.

The “measured move” of the flag suggests that we can go looking towards the 18,000 level, but that does not necessarily mean that we have to do it in the short term. Ultimately, this is a market that I think will continue to find plenty of value hunters every time we dip, and that is exactly how I plan on playing this market. As far as the trend is concerned, I do not think that it is a negative trend until we break down below the 15,000 level at the very least, if not the 14,500 level. Looking at the start, it is very likely that we will continue to see plenty of value hunting out there, so with this being the case I think it is a situation where a little bit of patience probably goes a long way, just as we had seen during the day on Friday.